Published 17 Dec 2024 –

2024 has been a pivotal year for Sustainability Reporting, with numerous regions across the world advancing regulations on sustainability reporting and major milestones such as the COP29 Azerbaijan held in November, which resulted in a breakthrough agreement for climate finance.

Extreme-weather events and climate disasters in 2024 served as a climate reality check, highlighting the urgent need for companies to build resilience and manage climate risk.

Countries and businesses alike are integrating ESG strategies into their plans to achieve net zero emissions, ramping up on corporate social responsibility, and increasing efforts to reach sustainability goals by engaging technology providers like ESG reporting platforms.

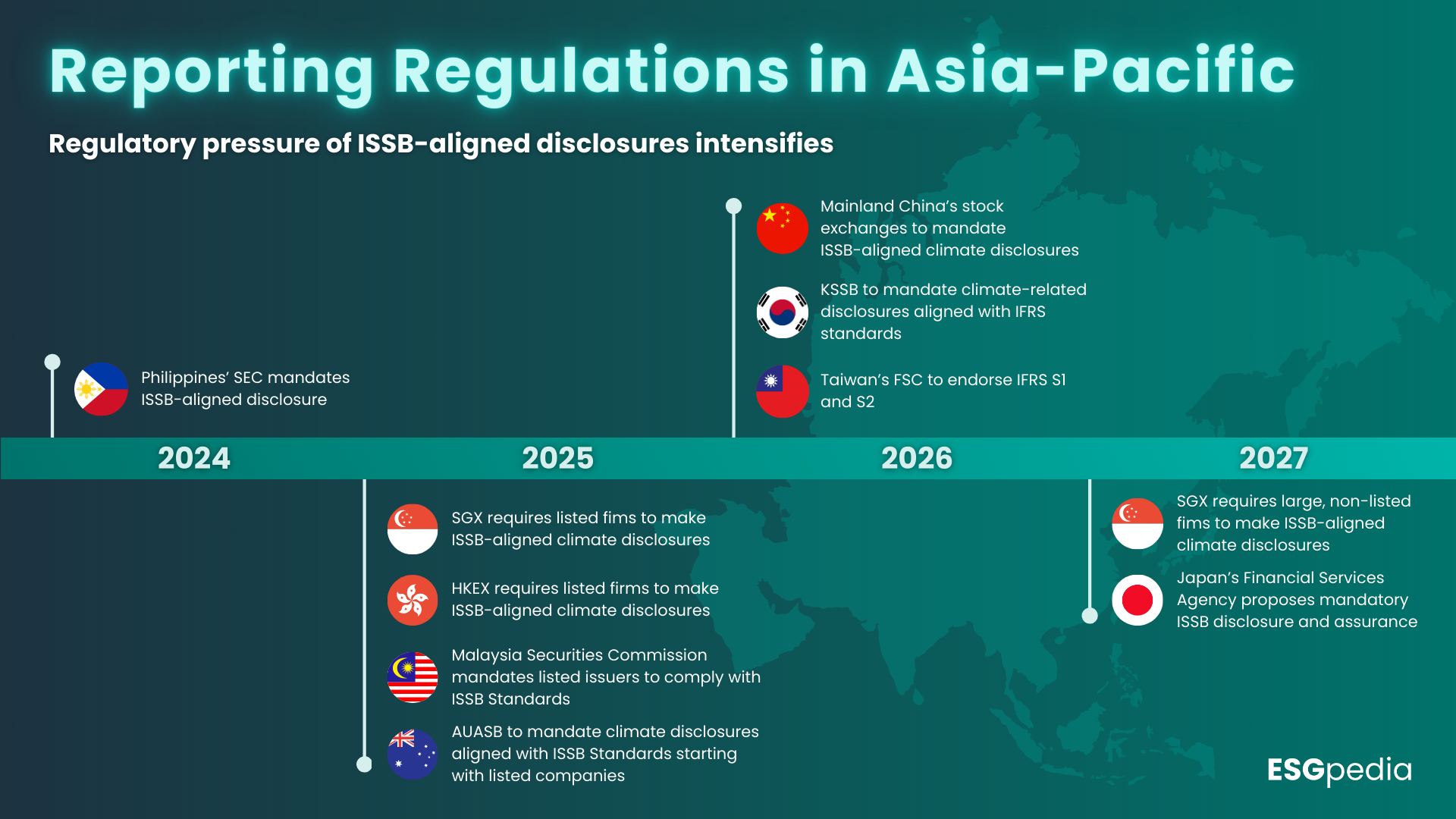

Enhanced Sustainability Reporting Standards across Asia-Pacific region

Along with the increase in adoption of the International Financial Reporting Standards (IFRS) Foundation’s International Sustainability Standards Board (ISSB) disclosures across Asia Pacific, ESGpedia has likewise expanded across the region in 2024 to empower companies in reporting in accordance with such international and local sustainability reporting standards.

Apart from establishing new partnerships with regional organisations and empowering companies to report in accordance with global frameworks such as Global Reporting Initiative (GRI) and ISSB Standards, ESGpedia has integrated local frameworks and localised emission factors to assist businesses in reporting accurately and consistently, in alignment with local compliance.

Read about our partnerships across Asia-Pacific:

Partnering with regional organisations to enable reporting with ESG data:

- Sustainable Finance Institute Asia (SFIA) partners with ESGpedia as the official technology platform partner in driving regional disclosure efforts through the Single Accesspoint for ESG Data (SAFE) Initiative

- ESCAP Sustainable Business Network (ESBN) Asia-Pacific Green Deal Platform saw steady growth and adoption in 2024

- Singapore-Australia $20 million Go-Green Co-Innovation Programme sees ESGpedia combine technologies with FootprintLab, to improve climate disclosure and sustainable supply chain management for businesses

Enhanced ESG Reporting Platform empowering businesses to stay ahead of Sustainability Standards

Our ESG reporting platform saw continuous upgrades throughout the year, expanding our coverage and depth in terms of Scope 1, 2, and 3 greenhouse gas (GHG) calculations and comprehensive sustainability reporting.

Sustainability Reporting Standards and Frameworks for ESG Reporting

ESGpedia is GRI-licensed and enables businesses across the Asia Pacific region to report in accordance with international frameworks and standards such as the International Sustainability Standards Board (ISSB), Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and more.

Localised templates, frameworks, and tools released by our regional neighbours were also integrated onto our platform to ensure inclusivity and empower businesses to report more accurately – including:

- Sustainable Practices and Reporting Kickoff (SPARK) template in collaboration with Global Reporting Initiative (GRI) ASEAN and the Philippines Department of Trade and Industry (DTI), to enable ESG reporting for Filipino SMEs

- Digital Carbon and Emissions Recording (CERT) Tool hosted on ESGpedia, as part of the LowCarbonSG Programme by Global Compact Network Singapore (GCNS)

- Sustainability Reporting (SuRe) Form launched by the Securities and Exchange Commission (SEC) in the Philippines, integrated onto the ESGpedia platform

- Simplified ESG Disclosure Guide (SEDG) for SMEs in supply chains, to facilitate ESG reporting among Malaysian SMEs, integrated onto the ESGpedia platform

- And more to come!

In addition to Environmental metrices, core Social and Governance metrices, aligned with international standards such as the Sustainable Development Goals, are available for businesses to use and scale according to their needs. After establishing these core ESG metrices and reporting, businesses can then swiftly generate GHG/ESG/Sustainability reports to showcase to stakeholders and baseline their emissions.

GHG Carbon Calculator

To empower companies in ensuring full compliance with regulatory requirements such as SGX’s ISSB-aligned standards starting FY2025, our carbon calculator has been enhanced to ensure data accuracy and credibility.

ESGpedia’s carbon calculator, built in accordance with the GHG Protocol and validated under ISO14064-1 methodologies, covers the full range of GHG emissions, from direct emissions covering Scope 1 and 2, to all 15 Scope 3 categories such as purchased goods and services, business travel, use of products, and so on.

Get in touch for a demo on our extensive carbon calculator.

Emission Factors and ESG Data Registry

ESGpedia’s ESG reporting platform also serves as a registry of ESG data and hyper-localised Emission Factors, and is updated consistently to ensure GHG accounting accuracy and data transparency for businesses across the region.

The integration of localised emission factors such as the Singapore Emissions Factor Registry (SEFR) onto the ESGpedia platform has enabled Singapore-based companies such as Se-cure Waste Management (SWM) to generate their first Sustainability Report baselining its GHG emissions, leveraging SEFR data on ESGpedia.

Interested in our full suite of ESG solutions? Contact us here.

ESGpedia Use Cases across various industries and the Asia-Pacific region

Following increasing sustainability criteria within the business landscape, we expanded our capabilities to cover different industries and areas of expertise such as the built environment, financial institutions, Meetings, Incentives, Conferences, and Exhibitions (MICE) events, and supply chain engagement.

Supplier Engagement – Sustainable Supply Chain Management

2024 saw the rise in greening supply chains, with many jurisdictions’ ESG regulations requiring companies to report their Scope 3 emissions from FY2025 onwards.

Our work continued to focus on supporting corporates with supply chain engagement in various industries, onboarding suppliers and kickstarting their sustainability journeys to enable them to calculate Scope 1 and 2 emissions.

ESGpedia is delighted to be the Carbon Accounting and Reporting Partner of City Development Limited’s SME Supplier Queen Bee Programme, in collaboration with Global Green Connect and DBS Bank, supported by Enterprise Singapore.

Learn more about our Supplier Engagement Module today.

The Built Environment – Embodied Carbon and Project-level ESG Reports

The built environment is no stranger to the green transition, with authorities raising the bar for businesses by requiring companies to demonstrate sustainability credentials of their goods and services when bidding for government tenders.

Contractors and developers can address rising sustainability criteria in tenders and build competitive edge by leveraging our platform’s full suite of digital solutions. Contractors can generate ESG reports and attain green certifications. Developers can generate embodied carbon reports which include project-level data, and streamline management of contractors’ ESG data with dashboard and analytics.

Financial Institutions – Enhancing Client-Enabling Bank Initiatives and Sustainability-Linked Financing Programmes

This year, we embarked on strategic partnerships with various local and regional financial institutions to streamline the process of obtaining sustainable finance products such as green loans and sustainability-linked loans (SLLs).

Co-Branded Portals – Enabling Portfolio/Client Ecosystem Engagement

Co-branded portals allow financial institutions to actively engage with their client/portfolio ecosystems from data collection, to monitoring, analysing, and taking action, while facilitating sustainable financing objectives and advancing on the banks’ ESG strategies.Check out some of our existing co-branded portals with DBS, CIMB, Maybank, OCBC, and Public Bank.

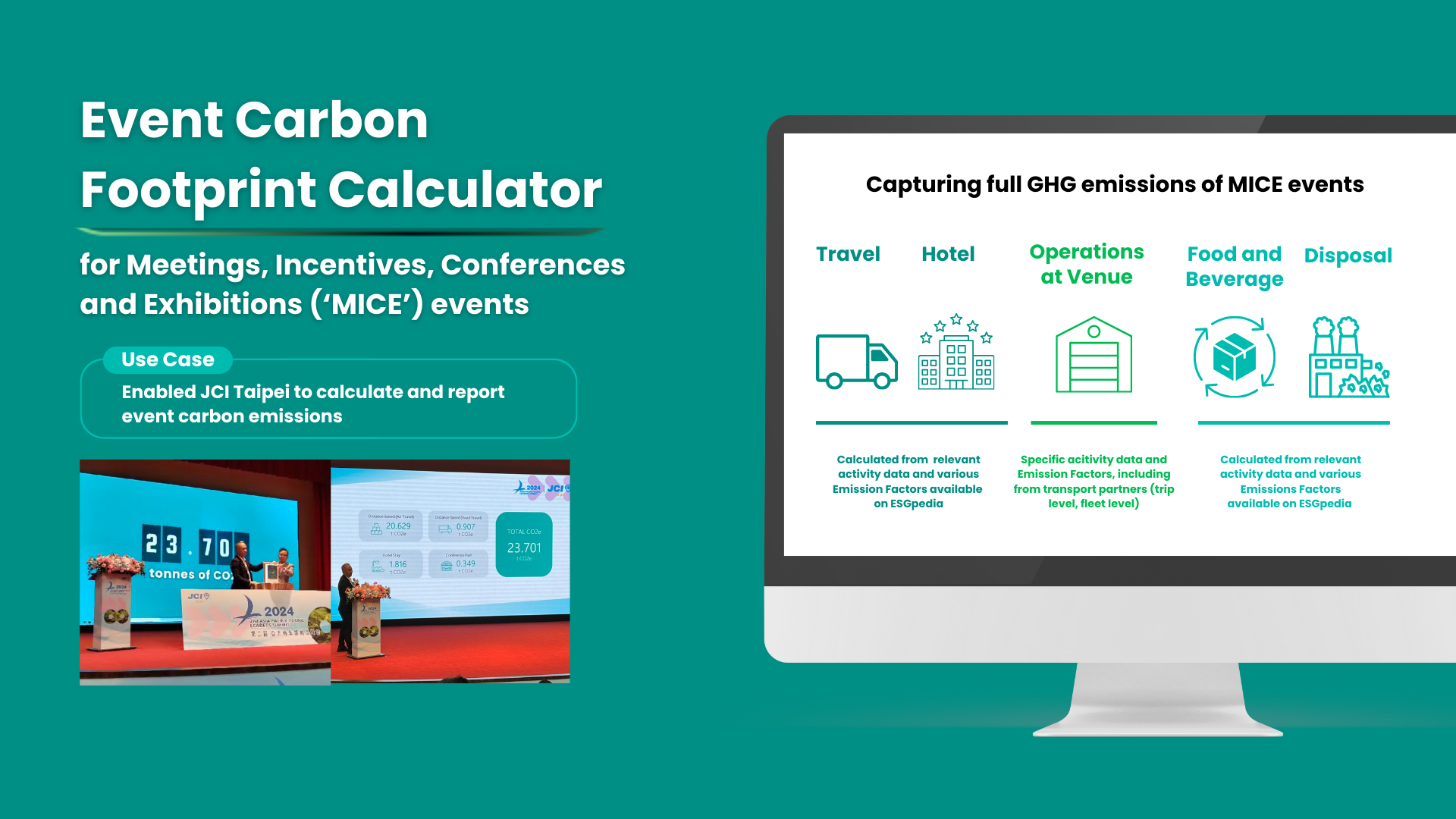

MICE Events – Event Carbon Footprint Calculator

With the government starting to assess sustainability criteria of MICE tenders starting FY2025, ESGpedia has expanded our capabilities to cover the calculation of GHG emissions and reporting for MICE Events.

In a recent pioneering use case, ESGpedia has enabled JCI Taipei to fully account for their GHG emissions and generate an event carbon emissions report. Get in touch to calculate your event emissions.

United Nations ESBN Asia-Pacific Green Deal for Businesses on ESGpedia – Real-World Results and Use Cases One-Year On

In April 2024, the team was invited to lead a segment on the Roundtable session at the 80th Commission of the United Nations ESCAP (UNESCAP), co-organised by ESCAP Sustainability Business Network (ESBN) and the United Nations Global Compact Network Malaysia & Brunei.

We had the honour of showcasing the ESBN Asia-Pacific Green Deal program and its meaningful impact on businesses’ sustainability journeys with use cases on sustainable financing and greening supply chains across Asia, since its inception in May 2023.

Read more on the 80th Commission of the United Nations ESCAP here.

Media Features

We are grateful to have received many media invitations for interviews and coverage across Asia, to share about navigating ESG regulations and data insights from our ESG reporting platform.

Check out some of our media features:

- Bloomberg – A Rush for Greener Offices in Asia is Leaving Hong Kong Behind

- Asian Banking & Finance – Maybank rolls out green financial advisory service to SEA SMEs

- Business Mirror – SG firm offers help to local SMEs in ESG reporting

- Yahoo Finance – Sustainable Finance Institute Asia partners with ESGpedia as the official technology platform partner in driving regional disclosure efforts through the Single Accesspoint for ESG Data (SAFE) Initiative

- South China Morning Post (SCMP) – Climate reporting: ESG start-ups jump in to help SMEs calculate supply-chain emissions to meet tighter requirements

- The Asset – ESGpedia to transform UN GCNS’ Digital CERT

Events and Partnerships

The team was busy with exhibitions, workshops, and speaking engagements in the various Asia Pacific markets throughout the entire year. We are grateful for these opportunities to share our expertise and solutions with business leaders across the region.

Apart from yearly exhibitions at which we showcased our full suite of ESG solutions to various crowds, such as Asia Tech 2024, Singapore Fintech Festival 2024, and BEX Asia 2024, we were honoured to host joint workshops with both local and regional partners.

These workshops include webinars, in-person workshops, and sharing sessions, during which we were able to connect with businesses to understand their challenges and streamline curated ESG solutions for them.

Check out some of our co-hosted events:

- United Nations Global Compact Network

- Singapore – SME Series 2024

- Philippines – Sustainability Workshop to empower Filipino businesses in navigating ESG regulations and report to the SuRe Form

- GRI ASEAN and Philippines Department of Trade and Industry (DTI) – workshop on the Sustainability Practices and Reporting Kick-off (SPARK) training programme for Filipino MSMEs

- Mind the Gap: How does IFRS S1 and S2 affect Listed Companies?

- Green Logistics Workshop with Green Freight Asia

Follow our newsroom or connect with us on LinkedIn for more updates!

Preparing for ESG in 2025

Given the rise in sustainability reporting standards and criteria, we anticipate ESG to continue making its way up the priority list of both businesses and countries.

Through our full suite of ESG solutions across GHG accounting, ESG reporting, supply chain sustainability, and sustainable financing, ESGpedia fills gaps in ESG data and compliance, increasing credibility and transparency in disclosures and helping businesses achieve ESG excellence, regardless of ESG maturity.

Through the ESGpedia Marketplace, take your ESG strategies a step further with other decarbonisation solutions, including sustainability-linked finance, ESG assurance, certification, advisory, and more.

Gain access to 70% funding support for ESGpedia services through the IMDA Advanced Digital Solutions (ADS) Scheme.

Interested in engaging an ESG reporting platform? Speak to us today to kickstart and accelerate your ESG reporting journey.