Data-Driven Sustainability for Asia

ESGpedia is your one-stop digital platform of ESG data and solutions for corporates, SMEs, and financial institutions across the Asia Pacific region to attain ESG goals

Partners

One-stop Digital Platform to Empower Sustainability in Asia

ESG solutions for businesses’ end-to-end ESG needs

to frameworks

Achieve ESG excellence,

Achieve ESG excellence,increase competitiveness

Manage all projects in

Manage all projects inone platform

5 million

Sustainability

Data Points

909,000

ESG Certificates

(& growing)

119,000+

ESG Credentials

(& growing)

521,000+

companies’

sustainability data

156,000+

company profiles with full corporate data overlaid and standardized

Focus on your core business, leave ESG to us

Digital Data

Management

Streamline data management across all assets and sources

- Simplify collection of data

- Handle ESG data at scale, saving time and minimising human error

- Transform operational data into ESG metrics and GHG calculations

Calculate and Track

GHG Emissions

Attain relevant data for calculation of GHG emissions

- Industry-specific project-level carbon emissions (e.g. Construction, MICE, Product footprint)

Comprehensive ESG

Reporting

Create a comprehensive ESG Report, aligned with global standards

- Streamline complicated ESG reporting processes

- Win more business deals & project tenders

Full Value Chain

Sustainability and Analytics

Get end-to-end visibility of ESG data, aggregated from an entire ecosystem

- Green your supply chains & advance in sustainable procurement

- Build actionable roadmap to decarbonise, expand opportunities for sustainable finance with preferred interest rates

Simplify ESG Processes. Power Business Success.

Less excel sheets, more impact.

90.8%

Effort Reduction

4.5 months

Duration Saved

250+

Sustainability-Linked

Loans Supported

75%

Productivity Gain

End-to-end ESG Solutions for Businesses

Address rising mandatory sustainability regulations:

Kickstart your ESG journey and gain a competitive edge:

Enhance sustainable financing and empower your ecosystem:

Gain competitive advantage, amplified by ESGpedia’s Unique Network

Ensure regulatory compliance

Specialised in engaging Asia ecosystems and supply chains

Access benefits through our network effect. Get connected with our Marketplace for integrated actionable ESG strategies, including Assurance, Certifications, Financing, Green Procurement, Advisory, Carbon Offsets, and more.

Built for compliance, credibility, and accuracy, ESGpedia covers comprehensive ESG reporting frameworks, including both international and local standards. Calculate GHG emissions in accordance with the GHG Protocol and ISO14064 methodology.

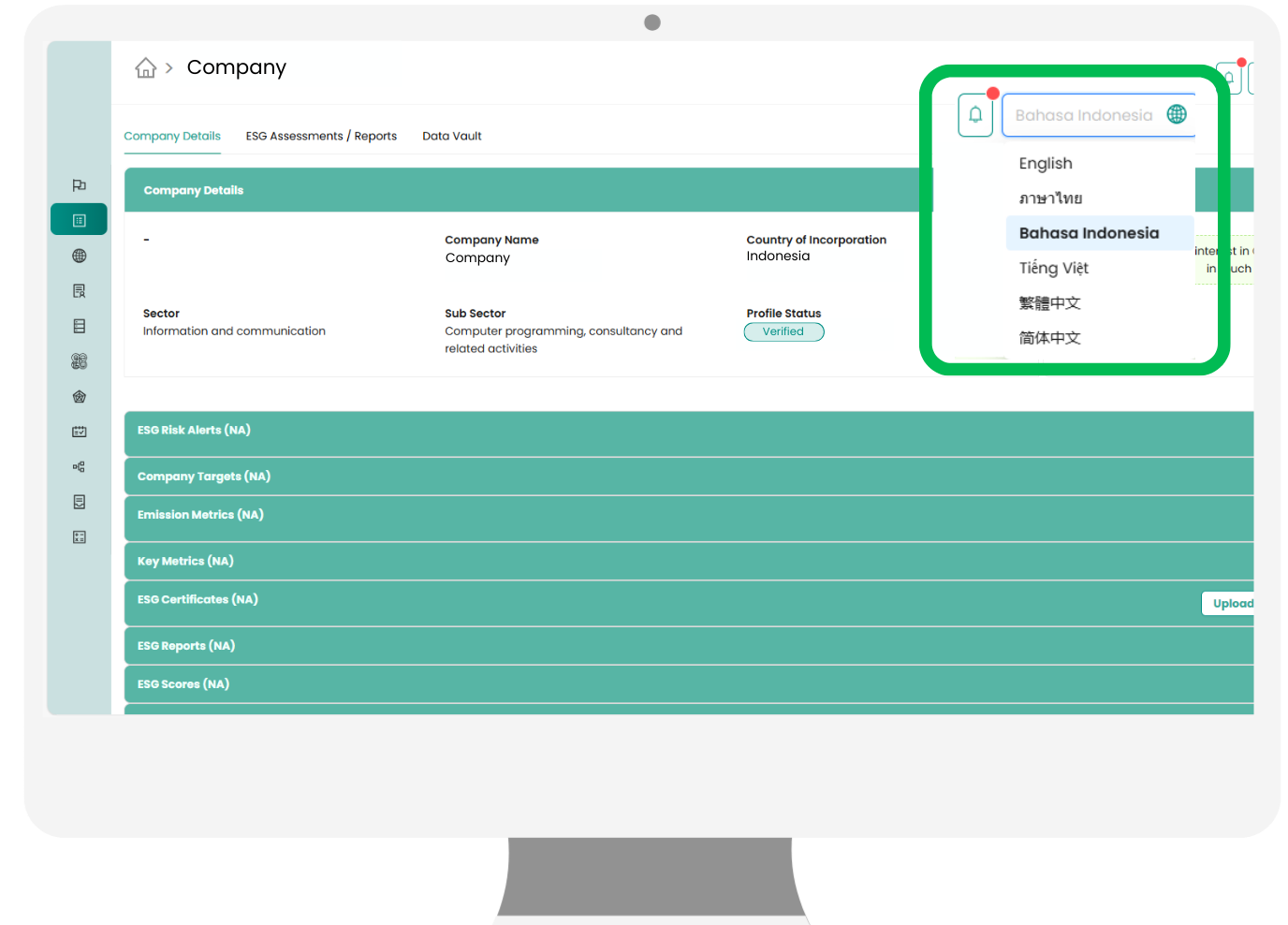

Companies, SMEs, and suppliers can access the platform in their preferred language for a seamless experience. Over 200,000 emission factors hyper-localised to all APAC countries, covering 1000 product categories and various sectors.

Asia’s Leading ESG Solution

Carbon calculator built in accordance with GHG Protocol and ISO14064

Localised to Asia-Pacific countries supporting local and international frameworks

ESBN Green Deal program included at no additional cost

Achieving Corporate Sustainability with ESGpedia

Live Industry Use Cases

Sustainability-Linked Financing