Sustainable Finance solution to accelerate Asia Pacific’s transition

ESGpedia Nexus streamlines Sustainability-Linked Financing, portfolio and risk management, and tracks sustainable finance targets all in one platform. Award-winning solution trusted by over 10 leading financial institutions across Asia.

SFF FinTech Excellence Awards 2025 – Sustainable Innovator Award

MAS Global FinTech Innovation Challenge Awards 2020

Hitachi Green Finance Challenge 2024

Scaling Sustainable Finance

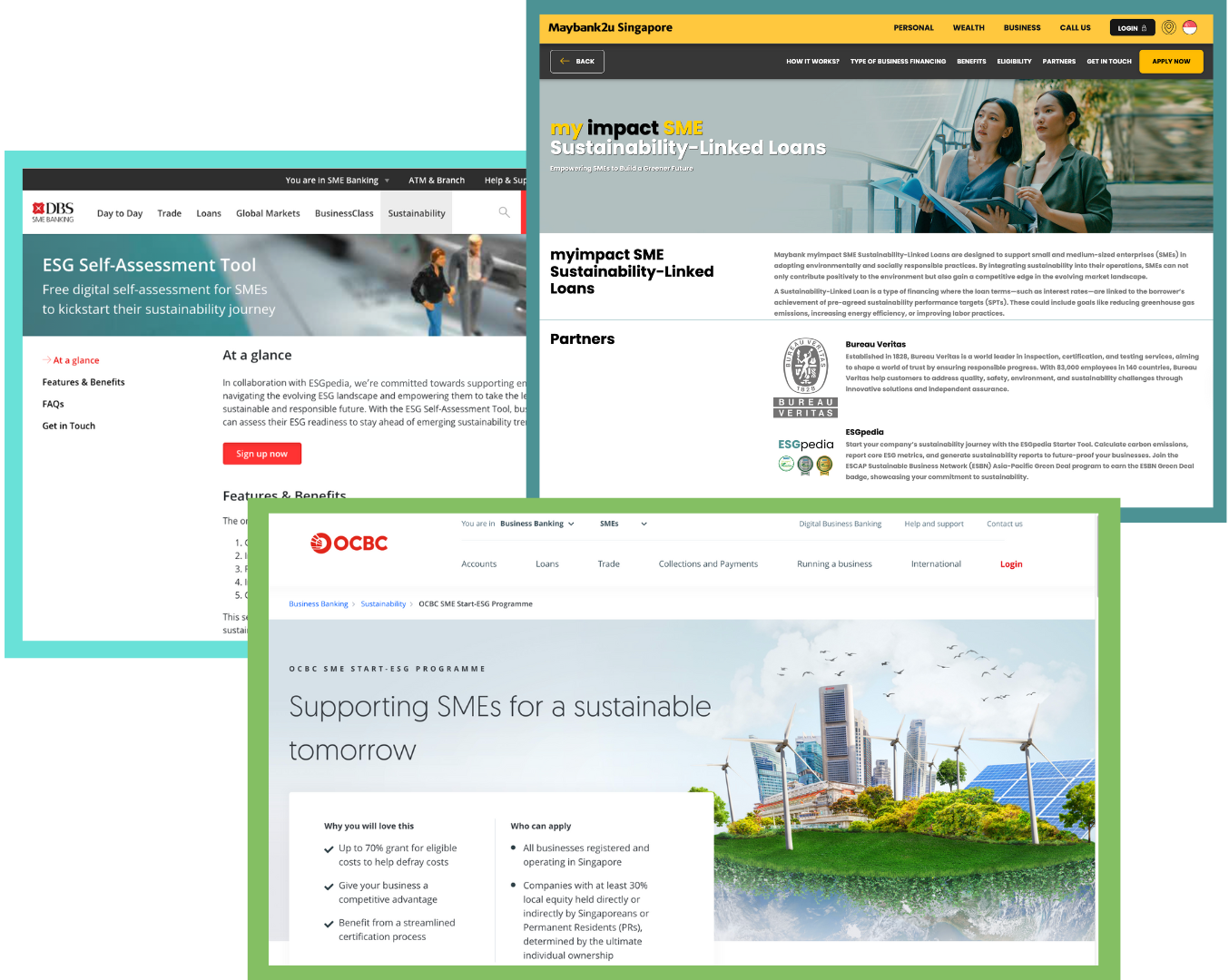

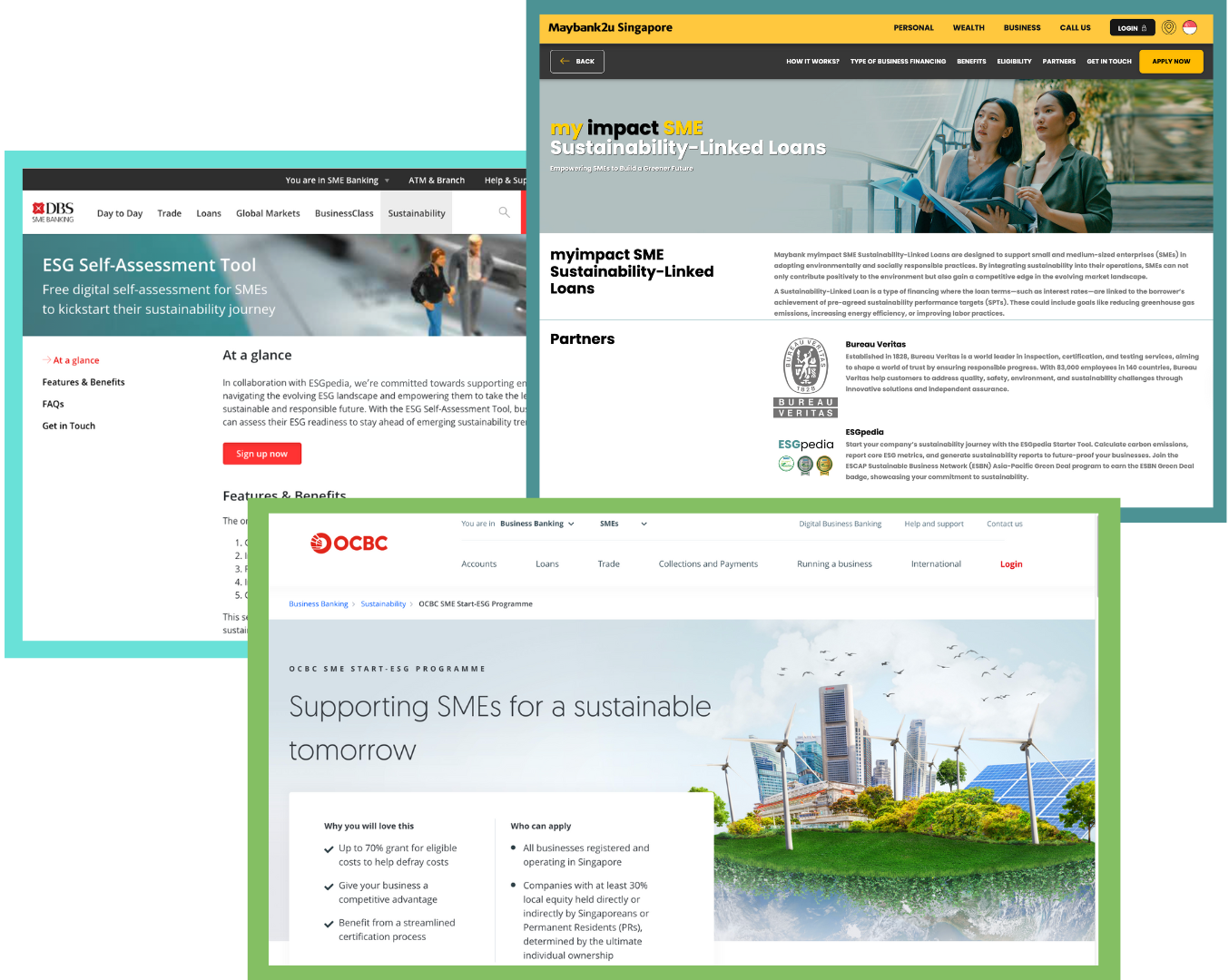

ESGpedia supports banks’ programmes to enable companies on Sustainability-Linked Financing

Read Article

$150 million

Sustainability-Linked

Loans Issued

250+

Sustainability-Linked

Loans Supported

10 countries

10 Financial Institutions

Product and strategyCIMB Bank

Global Commercial Banking,OCBC Bank

Services MaybankMaybank Singapore

Finance Association(MSFA)

What are the benefits of adopting a Sustainable Finance solution?

Secure preferential rates for sustainability-linked financing from local and regional banks

Help companies advance on their ESG strategies and credibly showcase their commitment

Streamlined emissions data collection and verification on

ESGpedia to obtain SLLs from banks

Making Sustainability-Linked Financing accessible and scalable

Co-Branded Portals to enable portfolio/ client ecosystem engagement

Advance on your organisation’s sustainability strategy and enhance brand loyalty by streamlining and actively engaging your portfolio/client ecosystem, from data collection, to monitoring, analysing, and taking action

Showcase your brand logo and messaging, and incentivise your ecosystem by offering benefits such as preferential financing rates

Customise assessment content and workflows towards your sustainability requirements

- Customise digital assessment content towards sustainability requirements, to better assess companies’ sustainability standing for financing decisions

- Better manage risks and monitor their portfolios against ESG Taxonomies by embedding ESG criteria into risk assessments.

- Accelerate the bank’s go-to-market and improve accessibility to sustainability-linked financing, by allowing financial institutions to launch their programmeswithout the need to build own digital infrastructure

Track and Monitor Sustainable Performance Targets (SPTs) and Decarbonisation Goals

Streamline monitoring of SPTs linked to Sustainability-Linked Loans, by tracking portfolio companies’ year-on-year GHG emissions and progress targets

End-to-end ESG solutions

Comprehensive

Carbon Calculator

Comprehensive

ESG Reporting

Supply Chain

Management