Published 18 January 2024 –

Asia plays a key role as supply chain to the world due to the historic availability of low-cost labour, a strong manufacturing base, proximity to major markets in Europe and North America, and government policies supportive of trade and investment.

While the importance of Asia in global supply chains is expected to continue, shifts are now slowly but surely happening within Asia, away from markets like China and towards places like Vietnam, the Philippines, and Indonesia (Vietnam was chosen by Apple for its supply chain diversification out of China recently).

A combination of continued economic growth, a rising middle class, and increasing demand for goods and services via supply chains in Asean is making the region an important strategic player in the global push to net zero.

A majority of the world’s electronics are manufactured in Asia, with China still being the leading producer but Asean countries now stepping up to take on more of this market share, along with huge swathes of the world’s apparel and automotive manufacturing, just to name a few key sectors.

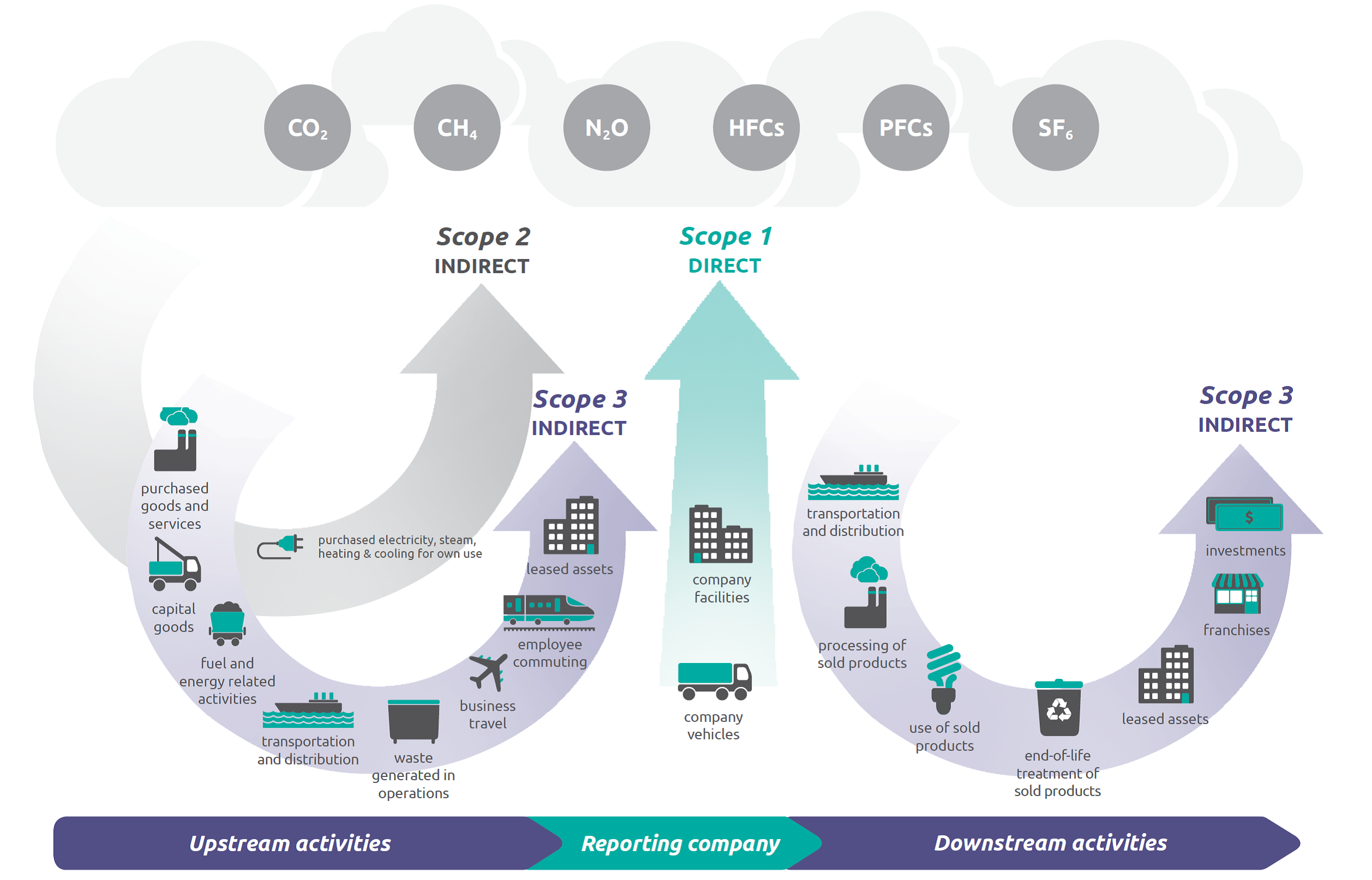

For any conversation on global supply chain decarbonisation, it is important to understand the different types of emissions we measure as part of carbon mitigation efforts.

Scope 3 emissions are indirect emissions that occur in the supply chain of a company but which are not directly produced by the company itself, yet account for a significant portion of overall emissions.

By comparison, Scope 1 emissions are directly controlled or owned by an organisation (think fuel combustion in boilers, furnaces, and vehicles) and Scope 2 emissions are indirectly controlled through the purchase of things like electricity, steam, heat, and cooling.

Reducing this third type of emissions can be a daunting task, especially for smaller companies that have limited resources compared to larger listed firms, but despite the complexities and challenges it remains an essential part of any net zero plan.

Incentives are already here, but are you getting ahead?

Fortunately, capital markets and regulators around the world are increasing incentives as a way to encourage Scope 3 decarbonisation of supply chains, both in the form of financial (price discounts or rebates for suppliers that meet emissions reduction targets) as well as non-financial (preferential treatment in procurement or access to training and resources).

We are now far enough into the net zero transition, with some progress and updates from COP28, to know conclusively that such incentives do play a significant role in accelerating the global decarbonisation efforts.

According to a piece in The Economist which made the case for why business decarbonisation is nearly impossible without supply chain buy-in, Scope 3 emissions are estimated to account for fully 99.98 per cent on average for companies in the financial services sector, closely followed by capital goods, transport, and real estate.

As businesses increasingly set ambitious net zero targets, yet at the same time struggle to achieve them, a clue may lie in the relatively low attention that has to date been paid to this third scope of emissions that sit at the heart of supply chains.

For firms ready to take the step towards more thoroughly tracking and reducing their supply chain emissions, there are a number of actions they can take today.

We encourage setting clear expectations for suppliers on emissions reduction and communicating those actively, providing financial and technical support to suppliers to help them decarbonise (this more so for the banks and regulators), and encouraging suppliers to adopt new technology platforms such as ESGpedia to track and reduce emissions.

Given the stark warnings from the Intergovernmental Panel on Climate Change that we need to urgently reduce global emissions by 50 per cent by 2030 if we are to avoid the worst effects of climate change, major effort is required collectively across the global business supply chain.

Here in Asia, Vietnam is a good example of an exciting growth market that has caught the attention of companies like Apple, where we just signed a progressive partnership with Bamboo Capital Group to support corporate sustainability and ESG reporting.

MOU signing ceremony between STACS ESGpedia and Bamboo Capital Group on 22 August 2023 to support corporate sustainability and ESG reporting for businesses in Vietnam

Greening Asia Supply Chains

With an estimated 785,000 SMEs in Vietnam, accounting for more than 98 per cent of the total number of businesses, SMEs have a pivotal role to play in going green as key suppliers to global business.

As part of the decarbonisation of complex global supply chains that see goods travel over long distances, SMEs in places like Vietnam and the Philippines will have to ramp up decarbonisation efforts in order to become more transparent, meet rapidly evolving regulatory regimes, and remain attractive to the comparatively demanding ESG jurisdictions of the EU and US.

The good news is that preferential financial products provided by financial institutions increasingly include sustainable supply chain financing to finance companies as part of their broader net zero transition planning.

What is key would be supply chain transparency so that suppliers (SMEs) are able to prove their ESG commitment, large corporates will be able to choose sustainable suppliers, and financial institutions will be able to scale sustainable financing effectively, with quelled fears on the legitimacy of ESG claims.

Free and simplified ESG reporting tool to foster transparent and sustainable supply chains

To meet the growing needs for businesses and their supply chains in Asia to start reporting and accounting for their carbon emissions, STACS’s ESGpedia Nexus provides a free ESG Starter tool and reporting portal. This allows businesses to measure their greenhouse gas (GHG) emissions, report according to international and country-specific frameworks, manage their ESG profile, and gain access to an ESG marketplace to take actions towards decarbonisation.

Calculating Scope 3 Carbon Emissions in accordance with GHG Protocol and ISO14064 methodologies

For businesses and large corproates that are looking to decarbonise their supply chains, an understanding of your Scope 3 emissions would be the fundamental first step. ESGpedia Nexus has an in-built calculator in accordance with international standards including the GHG Protocol and ISO14064, that allows businesses to calculate their Scope 3 emissions by completing a guided and digitalised assessment.

Request for a demo today and enjoy exclusive rates as an early adopter.

Fuss-free Scope 1 and 2 carbon calculation tool for suppliers

Watch how other businesses in Asia are using the free ESG reporting tool to amplify their commitment to sustainability.

For SMEs that are suppliers to large corporates, it is pivotal to have an understanding of your Scope 1 and 2 carbon emissions, so as to remain competitive and prove your ESG commitment.

ESGpedia Nexus provides a free ESG Starter Tool consisting of the ESBN Asia-Pacific Green Deal digital assessment, which allows SMEs to simply input operational data such as water and electricity bills, to attain an automatic calculation of their GHG emissions under the standard GHG Protocol. By completing the assessment, SMEs will also be awarded the ESBN Green Deal badge to demonstrate their commitment to sustainability to customers, investors, and financiers.

Create a free ESG profile now to calculate your Scope 1 and Scope 2 emissions.

Streamlining ESG reporting in accordance with international frameworks

Corporates play a pivotal role in fostering sustainable supply chains by encouraging their existing suppliers in their supply chain to complete the digital assessment to attain a Green, Silver or Gold badge, in order to measure and manage their supply chain carbon emissions.

Businesses that are more mature in their sustainability journey can utilise ESGpedia to report in accordance with international and country-specific frameworks such as GRI, TCFD, IFRS, SuRe, SEDG, and more.

By coming together, Asia’s business community can step up to the decarbonisation challenge of its supply chains and show the world that it is a viable, trustworthy, and sustainable choice for the next 50 years.

Gain key insights into the top 6 esg trends in 2024 and uncover how ESG reporting can drive more sustainable supply chains in Asia.