Published 24 May 2024 –

Sustainability Reporting Standards and Landscape

The Asia-Pacific region has witnessed a surge in adoption of ESG regulations in recent years, causing businesses to be cognizant of the growing importance of sustainable business practices and sustainability reporting standards. The release of the International Financial Reporting Standards’ (IFRS) inaugural ISSB standards in June of last year has placed renewed attention on the ESG regulatory landscape that hasn’t gone unnoticed.

In the APAC region, several nations have released local sustainability reporting standards that complements global initiatives like the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD). In the Asia-Pacific region, these ESG frameworks are commonly used, albeit on different scales.

This article aims to provide an overview of the ESG regulatory and sustainability reporting landscape across each Asia-Pacific country, in 2024 and beyond.

European Union ESG Regulations causing major trickle-down effects for Businesses in Asia Pacific

Recent international ESG regulations from Europe have significant trickle-down implications for businesses across the Asia-Pacific region. A prime example is the European Union’s Carbon Border Adjustment Mechanism (CBAM), which aims to level the playing field between EU producers subject to carbon pricing and foreign producers who are not.

For businesses in the Asia-Pacific, regardless of size, this development necessitates a strategic reassessment of their production and supply chain processes to reduce emissions and carbon footprints. SMEs stand to benefit from aligning with such environmental standards, giving access to new markets and opportunities. For corporates, the CBAM underscores the importance of greening the supply chain not just as a matter of compliance, but as a strategic imperative to maintain competitiveness in the EU.

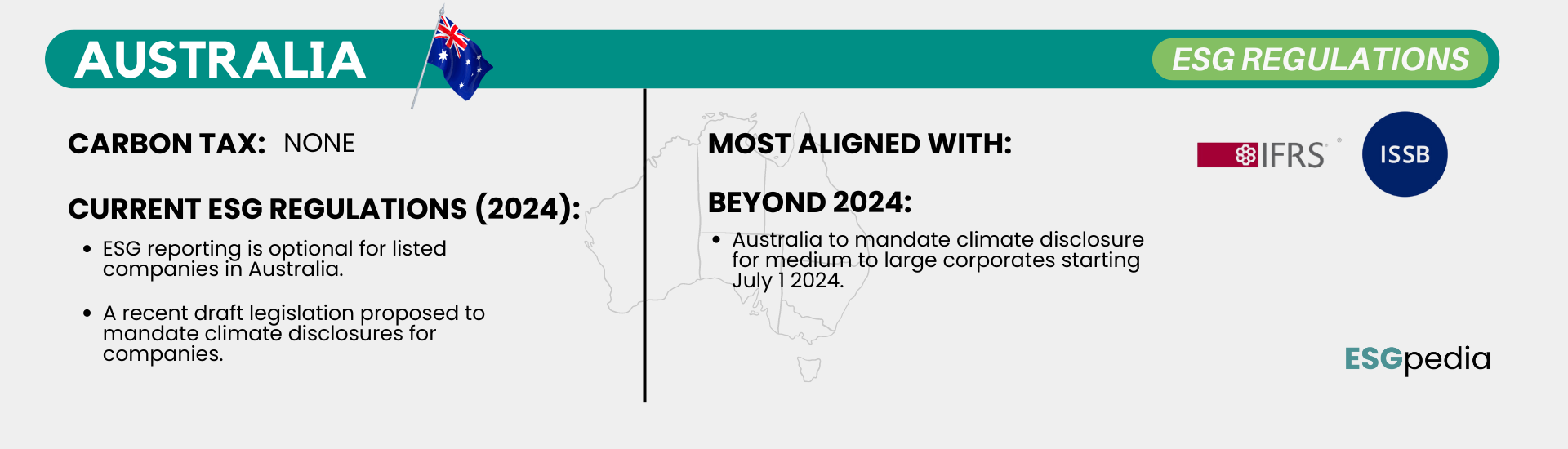

Australia

ESG Frameworks

Currently, Australia does not mandate ESG disclosures for listed companies.

Carbon Tax

Australia currently does not have a carbon tax. Nonetheless, landmark new laws last year have put into motion Australia’s first price on carbon since a former Labor government created a carbon tax in 2012.

2024

While Australia does not require companies to submit sustainability reports, recent developments show significant progress. In October 2023, the Australian Accounting Standards Board (AASB) issued an exposure draft that sets out proposed standards for climate-related reporting, laying the groundwork for new disclosure rules for medium to large enterprises. These proposals align with the sustainability disclosure standards recently introduced by the IFRS Foundation’s International Sustainability Standards Board (ISSB). Additionally, the legislation adopts a phased-in approach to Scope 3 reporting, giving companies an additional year to report their indirect value chain emissions.

Beyond 2024

As previously mentioned, the recent draft of the ‘Treasury Laws Amendment Bill 20024: Climate-related financial disclosure’ has set forth new reporting obligations. This draft was available for public feedback until 1 March 2024. The mandate to compile a sustainability report will be gradually implemented, primarily depending on the entity’s size. Starting from 1 July 2024, entities meeting two or more of the following criteria will be required to comply: over 500 employees, gross assets exceeding AU$1 billion, or consolidated revenues above AU$500 million.

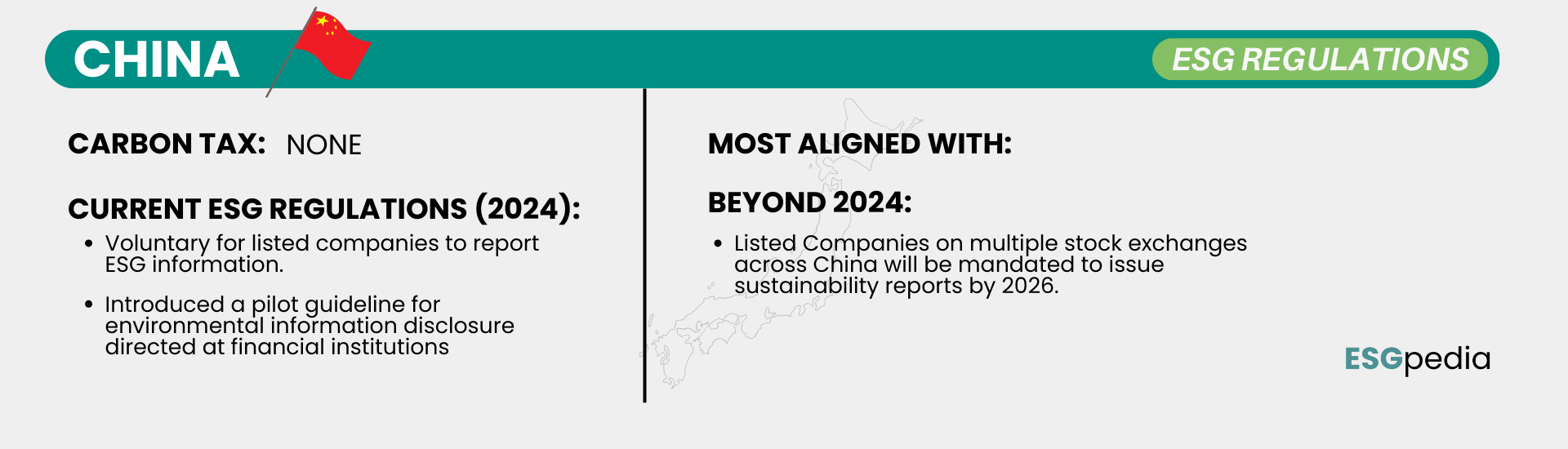

China

LISTED COMPANIES MANDATED TO ISSUE SUSTAINABILITY REPORTS BY 2026

ESG Reporting Frameworks

Listed Companies on multiple stock exchanges across China will be mandated to issue sustainability reports by 2026.

Carbon Tax

China does not have a carbon tax at this time.

2024

Since 2018, China has encouraged its listed companies to report ESG information as per Listed Company Governance Code. Additionally, in 2020, the People’s Bank of China, the country’s central bank, introduced a pilot guideline for environmental information disclosure directed at financial institutions.

In July 2023, the General Office of the State-owned Assets Supervision and Administration Commission (SASAC) published the “Notice on Research on the Preparation of ESG Special Reports of Listed Companies Controlled by Central Enterprises.” This directive was sent to central SOEs and local bureaus overseeing state-owned assets, aiming to enhance guidance on ESG disclosures by SOEs.

Beyond 2024

The People’s Republic of China (PRC) has yet to announce plans for adopting the ISSB standards. However, market participants suggest these standards may become a reference point for PRC’s future ESG disclosure norms.

China’s major stock exchanges have released draft guidelines mandating over 400 companies, including those in prominent stock indexes, to issue sustainability reports by 2026. These companies, representing more than half the total market value of the exchanges, are required to report on their ESG governance and strategies, as well as metrics related to their energy transition initiatives and their environmental and societal impact.

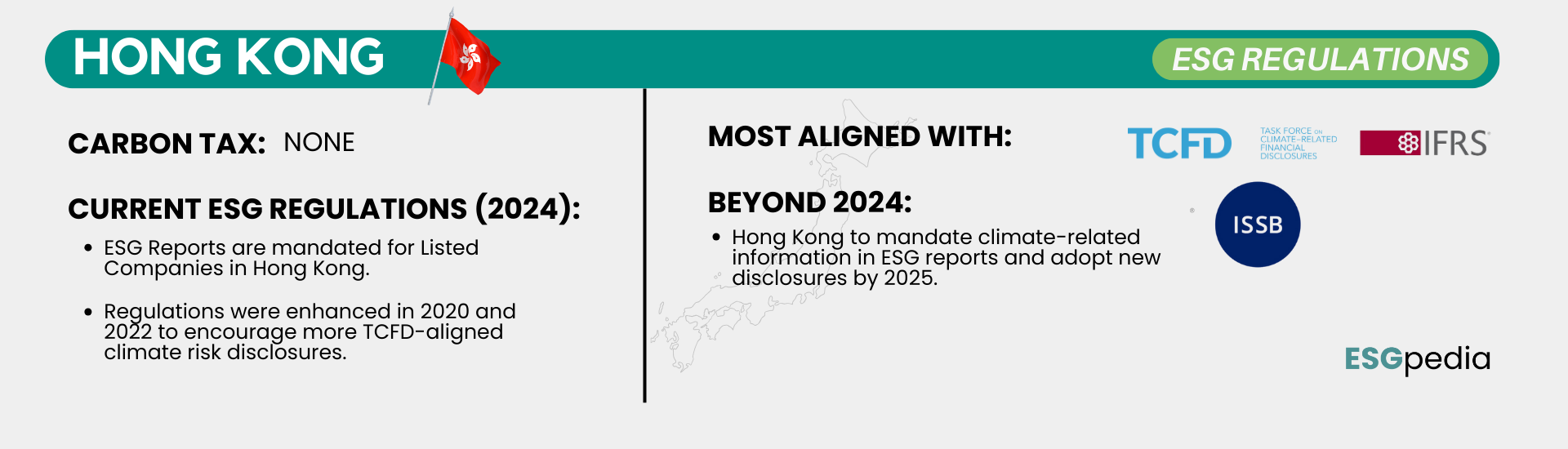

Hong Kong

LISTED COMPANIES ARE OBLIGATED TO ISSUE ESG REPORTS

ESG Reporting Frameworks

ESG Reports are mandated for Listed Companies in Hong Kong. Mandatory climate disclosures are due to come into effect on 1 January 2025.

Carbon Tax

Hong Kong does not have a carbon tax.

2024

Although Hong Kong lacks specific ESG laws, it enforces three regulatory ESG reporting frameworks for listed companies, investment fund managers, and ESG funds, featuring both obligatory disclosures and “comply or explain” aspects.

In 2016, the HKEX mandated annual ESG reports from listed companies, incorporating certain required disclosures and others under a “comply or explain” approach. These regulations were enhanced in 2020 and 2022 to encourage more TCFD-aligned climate risk disclosures.

The HKEX outlines its ESG reporting requirements in the “ESG Reporting Guide,” located in Appendix 27 of the Main Board Listing Rules and Appendix 20 of the GEM Listing Rules.

Beyond 2024

In April 2023, the HKEX released a consultation paper seeking feedback on its proposal to improve climate-related disclosures within its ESG reporting framework. HKEX suggested requiring all issuers to include climate-related information in their ESG reports, moving beyond the existing “comply or explain” standards, and to adopt new disclosures in line with the ISSB IFRS S2 Climate-related Disclosures Standards.

The HKEX has announced a delay in the effective date for the Listing Rules amendments concerning these enhanced climate-related disclosures to January 1, 2025, originally scheduled for January 1, 2024. Issuers will be required to fully adhere to the new climate-related disclosure norms for financial years starting on or after January 1, 2026.

Resources

Hong Kong has established a Green and Sustainable Finance Cross-Agency Steering Group, a multi-regulator steering group co-lead by the Hong Kong Monetary Authority (HKMA), the HKEX, and the Hong Kong Securities and Futures Commission (SFC), to support education and best practice-sharing in Hong Kong’s ESG ecosystem.

In similar fashion, ESGpedia supported the HKSAR Government and Innovation, Technology and industry Bureau as part of the Hong Kong Green Week, in an exciting line-up of ESG seminars and discussions, including being part of the Hong Kong Green Finance Summit 2024, hosting a Lunch Roundtable with GoImpact, and a GreenTech Seminar with IASE International Certifications Body. The aim is to enhance the region’s development in green technology and green finance.

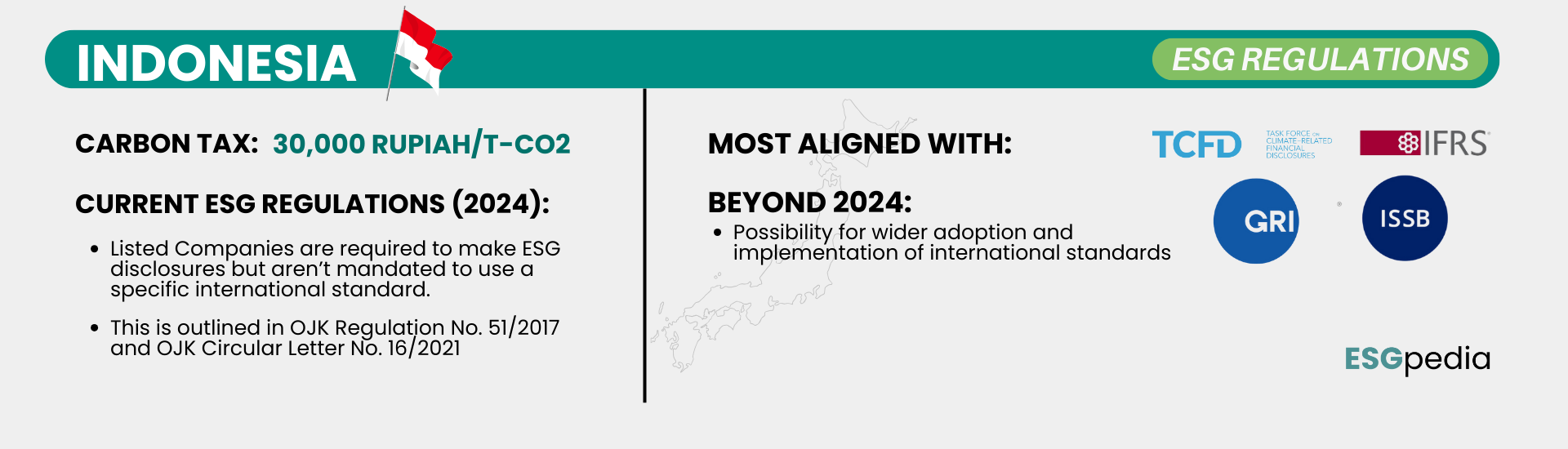

Indonesia

LISTED COMPANIES SUBJECTED TO LOCAL ESG DISCLOSURE REQUIREMENTS

ESG Reporting Frameworks

Listed Companies are required to make ESG disclosures but aren’t mandated to use a specific international standard.

Carbon Tax

Indonesia’s newly launched carbon market has a cap-and-trade system, and the carbon tax is set to be enforced April of 2024 for above-cap pollution levels at a rate of 30,000 rupiah ($2.09)/t-CO2 for coal-fired power plants.

2024

Publicly listed companies and financial institutions are subject to ESG disclosure requirements as outlined in OJK Regulation No. 51/2017 and OJK Circular Letter No. 16/2021. The former mandates these entities to engage in sustainable finance and submit an annual sustainability report. The latter details the format and contents of ESG disclosures within the annual reports of publicly listed companies.

Non-public companies exploiting natural resources are required to develop a plan for corporate social and environmental responsibility as per Government Regulation No. 47 of 2012. Regarding the adoption of sustainability reporting standards and frameworks, the OJK does not mandate a specific international standard. Instead, companies are encouraged to incorporate international frameworks or standards that meet their needs and effectively communicate with stakeholders, in addition to complying with the minimum reporting requirements.

Beyond 2024

In Indonesia, post-2024 holds promise for wider adoption and implementation of international standards to further unify reporting practices, already independently adopted by listed companies. Additionally, there’s potential for expanded ESG disclosure and oversight among non-listed companies, leveraging existing CSR legislation. As of now, specific plans for these developments have not been established.

Resources

The IDX provides ESG-focused training, conducting numerous workshops to assist companies with their disclosures aligned with various international standards, including GRI and TCFD. Similarly, Modalku, Southeast Asia’s leading SME digital finance platform, has partnered with ESGpedia to leverage the platform in facilitating ESG disclosures and promoting sustainable financing options for MSMEs in Indonesia.

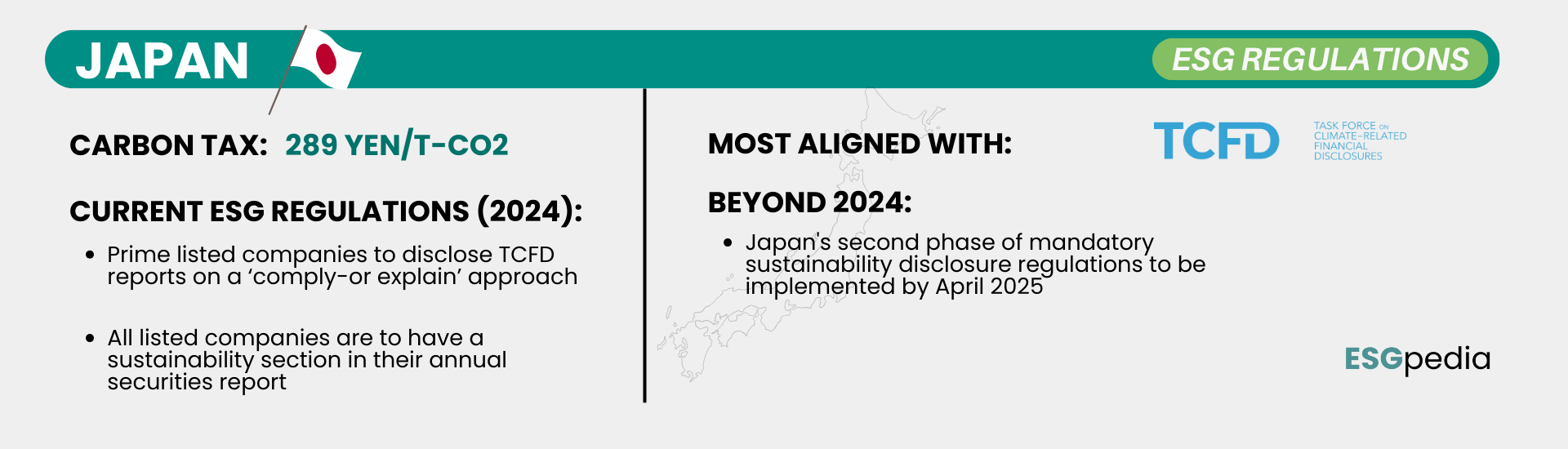

Japan

ALL LISTED COMPANIES TO DISCLOSE ESG METRICS USING THE TCFD FRAMEWORK BY APRIL 2025

ESG Reporting Frameworks

TCFD is in effect for listed companies.

Carbon Tax

Currently, the Carbon Tax in Japan, called the Global Warming Counter measures tax, is set at 289 yen/t-CO2 (USD1.91). According to reports, a carbon levy is set to be introduced in 2028 that will be applicable for power, gas, and oil companies.

2024

In June 2021, the Tokyo Stock Exchange (TSE) updated the Corporate Governance Code, requiring Prime Market-listed companies to disclose TCFD reports and social issues in a “comply-or-explain” approach. By March 2023, the Financial Services Agency (FSA) introduced what could be seen as Japan’s initial phase of compulsory sustainability disclosure regulations. These regulations necessitated a dedicated section in the annual securities report for sustainability information, mandating all listed companies in Japan (around 4,000, including international listings) to provide details on sustainability using the TCFD framework.

Beyond 2024

Japan’s second phase of mandatory sustainability disclosure regulations is anticipated to be implemented by April 2025 at the latest, crafted by the newly formed Sustainability Standards Board of Japan (SSBJ). The timeline includes releasing exposure drafts and final versions by March 2024 and March 2025, respectively. Although mandatory implementation dates are yet to be announced, companies can opt to voluntarily adopt these standards from around April 2025, applicable to all listed firms. These standards aim to align with the International Sustainability Standards Board (ISSB) standards: IFRS S1 for General Sustainability-related Disclosures and IFRS S2 for Climate-related Disclosures.

Resources

The Japan Stock Exchange (JPX) has launched the JPX ESG Knowledge Hub website to share ESG resources, including guidebooks, seminars, and activities for listed companies and investors. Although Japan lacks distinct decision-making frameworks, it has produced domestic guidance like the “Guidance on Climate Change Information Activities to Promote Green Investment“, focusing on adopting TCFD recommendations for disclosure.

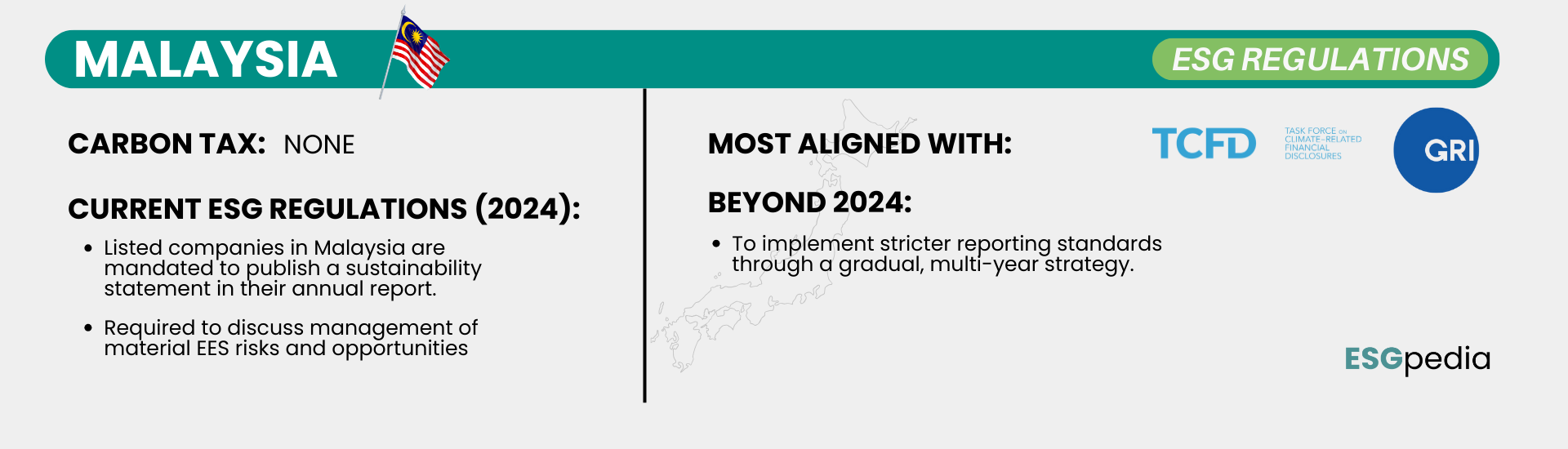

Malaysia

LISTED COMPANIES REQUIRED TO PUBLISH A SUSTAINABILITY STATEMENT

ESG Reporting Frameworks

Listed companies in Malaysia are mandated to publish a sustainability statement in their annual report. The Simplified ESG Disclosure Guide (SEDG) by Capital Markets Malaysia (CMM) provides SMEs within global supply chains with a streamlined and standardized set of guidelines in relation to ESG disclosures.

Carbon Tax

Malaysia is currently considering a carbon tax to reduce greenhouse gas emissions.

2024

In 2014, Bursa Malaysia, in partnership with FTSE, introduced the FTSE4Good Index, assessing the ESG practices and disclosures of publicly listed companies. Under Bursa Malaysia’s listing requirements, issuers must include a narrative on how they manage significant economic, environmental, and social (EES) risks and opportunities (Sustainability Statement) in their annual reports. Specifically, Main Market listed issuers are required to detail their governance structure, the extent of their Sustainability Statement, and their approach to managing material EES risks and opportunities within this statement.

Beyond 2024

Previously, companies could select their preferred reporting framework. Bursa Malaysia is now implementing stricter reporting standards through a gradual, multi-year strategy, aiming to strengthen listed companies’ resilience and attract more investment.

Resources

Bursa Malaysia offers a Sustainability Reporting Guide along with six toolkits designed to assist issuers in preparing their Sustainability Statement. Bursa Malaysia has also launched its ESG Reporting Platform, serving as a central hub for disclosures that adhere to the standardized format required by its updated sustainability reporting guidelines, which were implemented on September 26, 2022.

ESGpedia has also integrated the SEDG into its ESG reporting platform, allowing Malaysian companies to report in accordance for free.

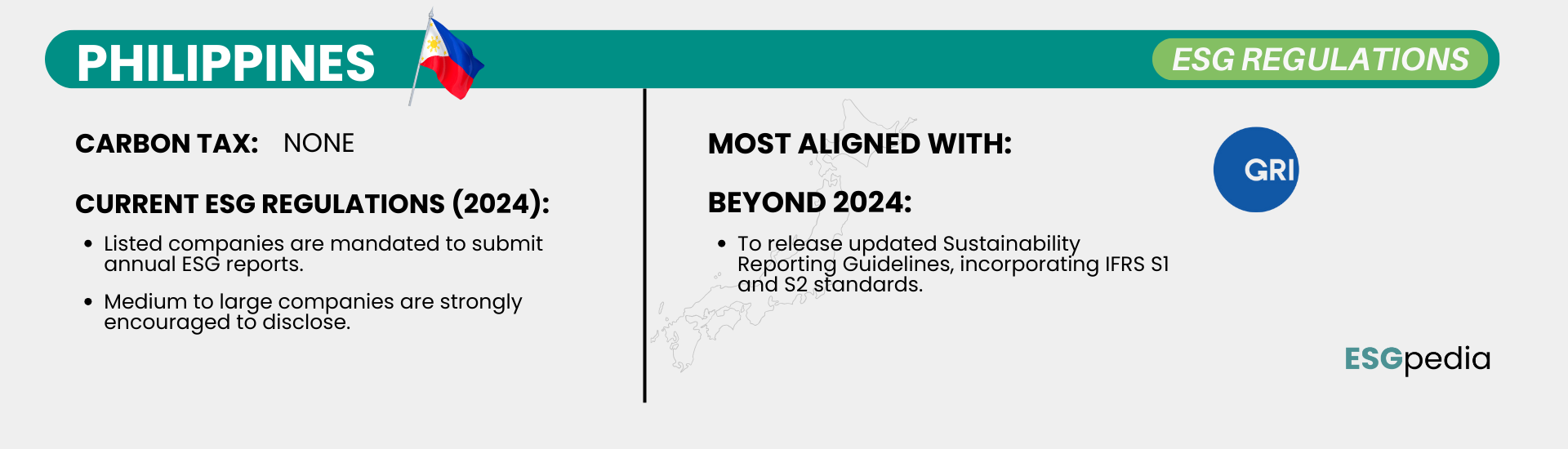

Philippines

LISTED COMPANIES ARE MANDATEED TO SUBMIT ANNUAL ESG REPORTS

ESG Reporting Frameworks

Listed companies are mandated to submit annual ESG reports aligned with the GRI standards.

Carbon Tax

Despite not having a levy on carbon emissions, The Finance Secretary of Philippines claims that the development of a carbon tax and emissions trading system (ETS) is a crucial step towards achieving a low-carbon economy.

2024

As of 2023, Publicly Listed Companies (PLCs) in the Philippines with a public float of 50% or more must adhere to and submit annual ESG reports as mandated by the 2019 Securities and Exchange Commission (SEC) guidelines, aligned with GRI. Medium to large companies and other PLCs not bound by these guidelines are strongly encouraged to voluntarily follow them. They also have made specific changes, such as an additional Sustainability Report (SuRe) form for listed companies to disclose.

Beyond 2024

The SEC Philippines plans to release updated Sustainability Reporting Guidelines, incorporating IFRS S1 and S2 standards to standardize sustainability information reporting among listed companies. Additionally, the SEC aims to extend sustainability reporting requirements to all corporate types, beyond just PLCs. Though a specific timeline for this broader initiative hasn’t been detailed, the SEC’s commitment to expanding sustainability reporting is evident.

Resources

As part of Sustainable Finance Institute Asia (SFIA)’s Single Accesspoint for ESG Data (SAFE) pilot initiative to address ESG data and disclosure gaps in ASEAN markets, Philippine Dealing System Holdings Corp. (PDS Group) is in collaboration with ESGpedia to support corporate sustainability and ESG reporting for businesses and issuers in the Philippines.

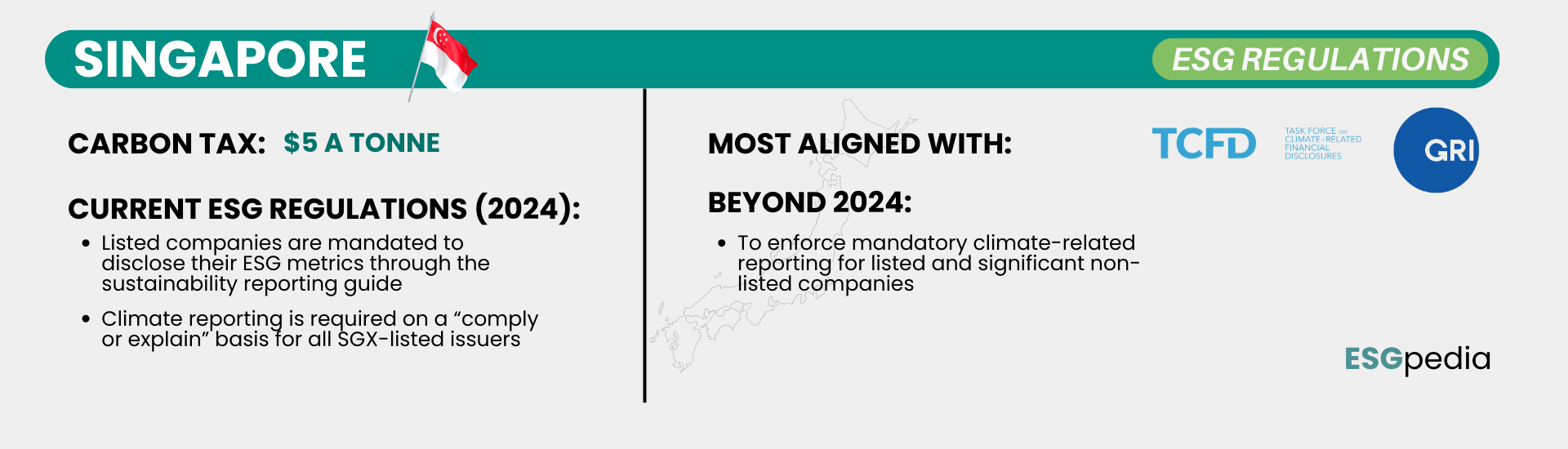

Singapore

ESG Reporting Frameworks

Listed companies are mandated to disclose their ESG metrics through the sustainability reporting guide, which is aligned with the GRI and TCFD.

Carbon Tax

As of 2023, the carbon tax rate is at $5 a tonne, which will be raised to $25 per tonne in 2024 and 2025, $45 per tonnein 2026 and 2027 with a view of reaching $50 to $80 per tonne by 2030.

2024

In 2016, the Singapore Exchange (SGX) mandated all listed companies to disclose their sustainability practices through the Sustainability Reporting Guide. Singapore is harmonizing its reporting standards with international frameworks like the GRI and the TCFD. Following public consultation in 2021, SGX is rolling out mandatory climate reporting in stages, adhering to TCFD recommendations. Currently, Climate reporting is required on a “comply or explain” basis for all SGX-listed issuers since 31 December 2022. There are currently no mandatory requirements for the disclosure of Scope 3 GHG emissions.

Beyond 2024

Singapore is set to enforce mandatory climate-related reporting for listed and significant non-listed companies, with some required to start disclosures according to the ISSB IFRS standards as soon as 2025.

Resources

Initiated in 2020 by the Monetary Authority of Singapore (MAS), Project Greenprint aims to boost ESG transparency using technology and data through platforms such as the Greenprint ESG Registry, powered by ESGpedia. Additionally, MAS has established the Singapore Sustainable Finance Association (SSFA) to enhance cooperation among financial and non-financial sectors. This effort is designed to accelerate the development of Singapore’s sustainable finance landscape, aiding in the region’s shift to a low-carbon economy and sustainable growth.

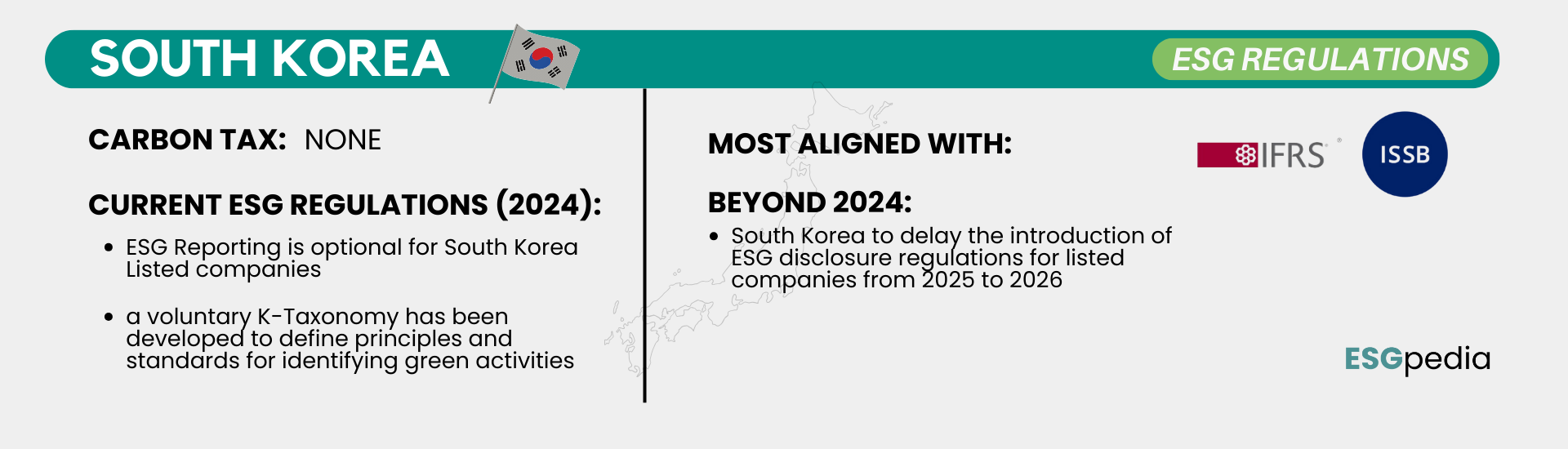

South Korea

LISTED COMPANIES AREN’T REQUIRED TO ISSUE ESG DISCLOSURES

ESG Reporting Frameworks

ESG Reporting is optional for South Korea companies.

Carbon Tax

There is no carbon levy in South Korea as of today.

2024

The 2021 K-ESG Guidelines offer clear and comprehensive criteria that enable companies to assess their ESG performance independently. Additionally, a voluntary K-Taxonomy has been developed to define principles and standards for identifying which economic activities can be classified as “green.”

Beyond 2024

In October 2023, the Financial Services Commission (FSC) declared that South Korea would delay the introduction of ESG disclosure regulations for listed companies from 2025 to 2026 or possibly later, to provide ample preparation time for local businesses.

This delay, extending beyond 2026, is driven by the FSC’s intention to synchronize with international norms, particularly planning to adopt the ISSB standards.

Resources

When the ESG disclosure regulations are introduced, the government intends to offer incentives to businesses that pursue financing for their ESG reporting from state-owned banks and will also provide support for companies’ consulting related to ESG.

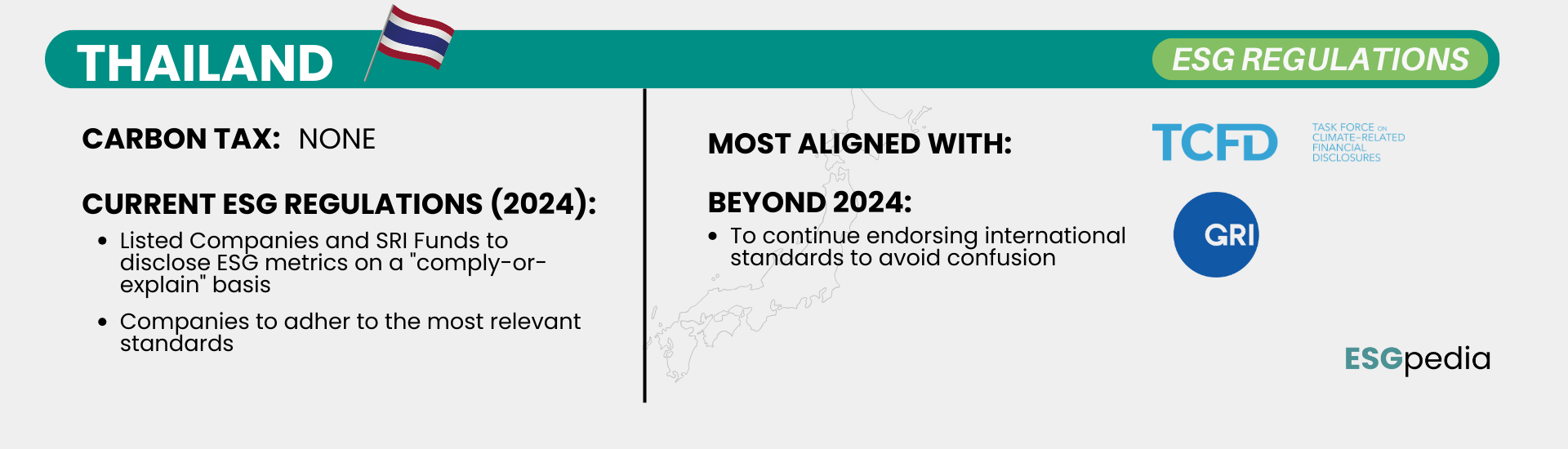

Thailand

ESG Reporting Frameworks

Listed Companies and SRI Funds to disclose ESG metrics on a “comply-or-explain” basis, adhering to the most relevant standards.

Carbon Tax

Thailand is preparing to implement a carbon tax, aligning itself with other nations in the region and the World Bank’s five principles. The data collection to draft the carbon tax regulations is expected to be done by the end of this year.

2024

Due to its status as an emerging economy, Thailand’s efforts in sustainability reporting have mostly begun recently, often as part of its ASEAN membership obligations. Currently, only listed companies and sustainable and responsible investing funds (SRI Funds) are mandated to make ESG-related disclosures. These entities are required to adhere to the Thai Security Exchange Commission’s (SEC Reporting Guide) standards, a detailed guide covering annual reporting through the 56-1 form (“One Report”). This guide emphasizes key areas such as climate change, environmental conservation, reducing carbon footprints, and addressing inequality, with disclosures made on a “comply-or-explain” basis.

Beyond 2024

The launch of an IFC-backed sustainable finance framework in June 2020 coincided with the unveiling of collaborative sustainable finance efforts among numerous public and private entities. The SET’s ‘Initiatives’ document highlights the critical role of sustainability reporting in bolstering investor trust while advising against the proliferation of multiple standards. Consequently, it openly endorsed the TCFD and ISSB initiatives to minimize confusion at the framework level and to harmonize global reporting standards with TCFD recommendations.

Resources

The Stock Exchange of Thailand offers support through its Sustainable Business Development Center website, promoting exemplary practices. Furthermore, the ESBN Green Deal Assessment for Businesses, a joint initiative by UNESCAP and ESGpedia, assists SMEs across Asia-Pacific on their path to sustainability. To enhance transparency, ESGpedia has partnered with the Thailand Greenhouse Gas Management Organization (TGO) to support the local carbon credits market.

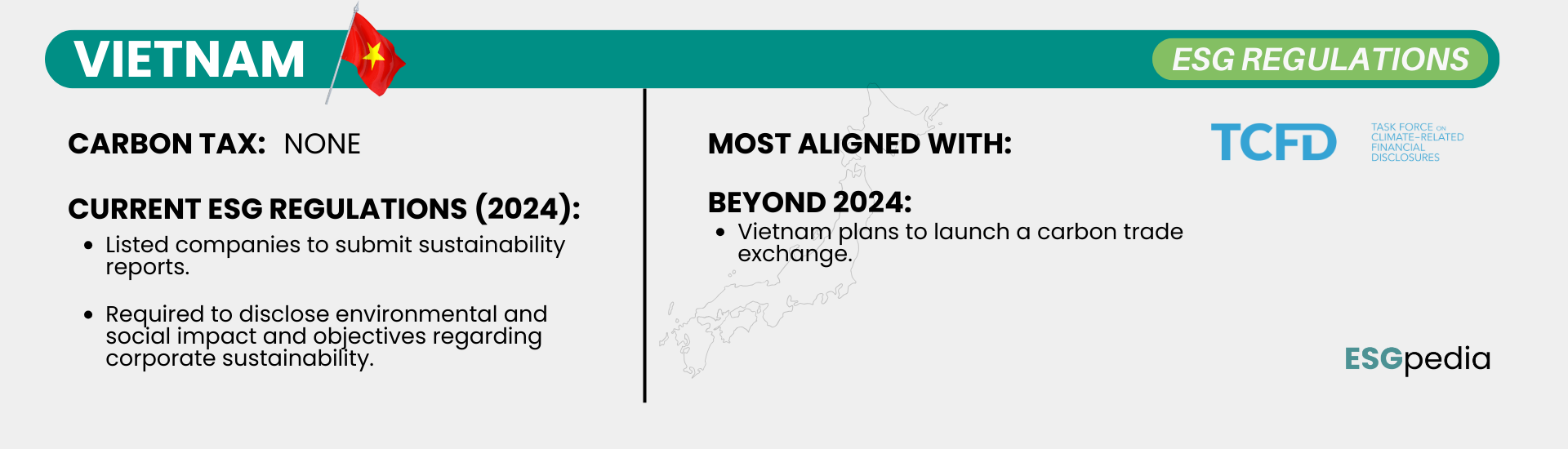

Vietnam

LISTED COMPANIES TO SUBMIT SUSTAINABILITY REPORTS

ESG Reporting Frameworks

Listed Companies are mandated to submit sustainability reports based on the latest circular, although no specific international standard has been recommended.

Carbon Tax

Vietnam currently doesn’t have a carbon tax but is planning to mandate the measurement, reporting and verification of greenhouse gas emissions for industries including steel, cement, and aluminum by 2025.

2024

Since 2016, Vietnam has mandated ESG reporting for listed companies. The most recent update, Circular 96/2020/TT-BTC enacted in 2021, obliges Vietnamese publicly listed companies to submit sustainability reports that discloses their environmental and social impact and objectives regarding corporate sustainability.

Beyond 2024

Vietnam plans to launch a carbon trade exchange in 2028, per a draft project by the Ministry of Natural Resources and Environment, aligned with Government Decree 06/2022/NĐ-CP. The government will persist in offering programs to enhance sustainable awareness and support corporations in their green transition. In 2022, a workshop was organized to help companies learn how to create climate-related financial disclosures in accordance with TCFDrecommendations.

Resources

In 2016, the State Securities Commission of Vietnam, in cooperation with the International Finance Corporation of World Bank Group, published an Environmental and Social Disclosure Guide, which is compiled based on the GRI G4 and encourages independent external assurance. ESGpedia is also in partnership with Bamboo Capital Group to promote ESGpedia platform to support corporate sustainability and ESG reporting for businesses in Vietnam.

Supporting Asia Pacific businesses with a One-Stop Sustainability Solution

Businesses in Asia Pacific can start early and future-proof against upcoming ESG regulations by leveraging digital ESG solutions and adopt sustainability reporting standards. The ESGpedia Starter Tool is a free online ESG enabler tool for businesses kickstarting their corporate sustainability journey, empowering them in ESG reporting and GHG emissions calculation in accordance with GHG Protocol and ISO14064 methodologies. No experience required.

Get started by creating your ESG profile today.

For listed businesses and larger corporates, ESGpedia Nexus Premium enables businesses to download ESG reports, calculate scope 3 emissions and manage their supply chain sustainability. Contact us to learn more.