by ESGpedia | May 25, 2021 | blockchain, Blog, capital-markets, fintech, sustainability, sustainable-finance

Digital assets and sustainability-linked bonds are a key component of the future of financial services, as the world transitions to green mandates in every industry including banking. At STACS, with our mission to make capital markets simpler and sustainable, this...

by ESGpedia | May 18, 2021 | Press Release

FOR IMMEDIATE RELEASE Deutsche Bank and Singapore fintech STACS complete ‘bond in a box’ proof-of-concept on the use of DLT for digital assets and sustainability-linked bonds Industry participants include UBS, Malaysia National Stock Exchange Bursa Malaysia, and Union...

by ESGpedia | May 14, 2021 | Blog, Events

DLT IN THE REAL WORLD podcast by The ValueExchange — STACS and Trade Processing How is DLT really making an impact in the capital markets space today? Listen to the episode here. Our inaugural joint podcast with The ValueExchange: DLT In the Real World — the...

by ESGpedia | Apr 29, 2021 | Blog, earth-day, esg, fintech, fintech-startups, sustainability

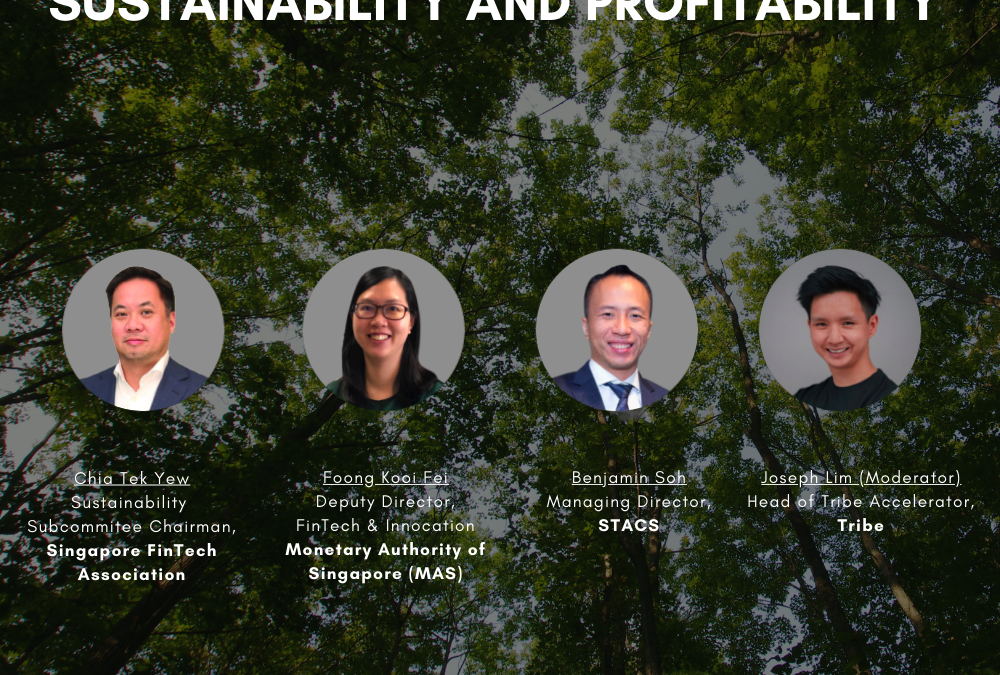

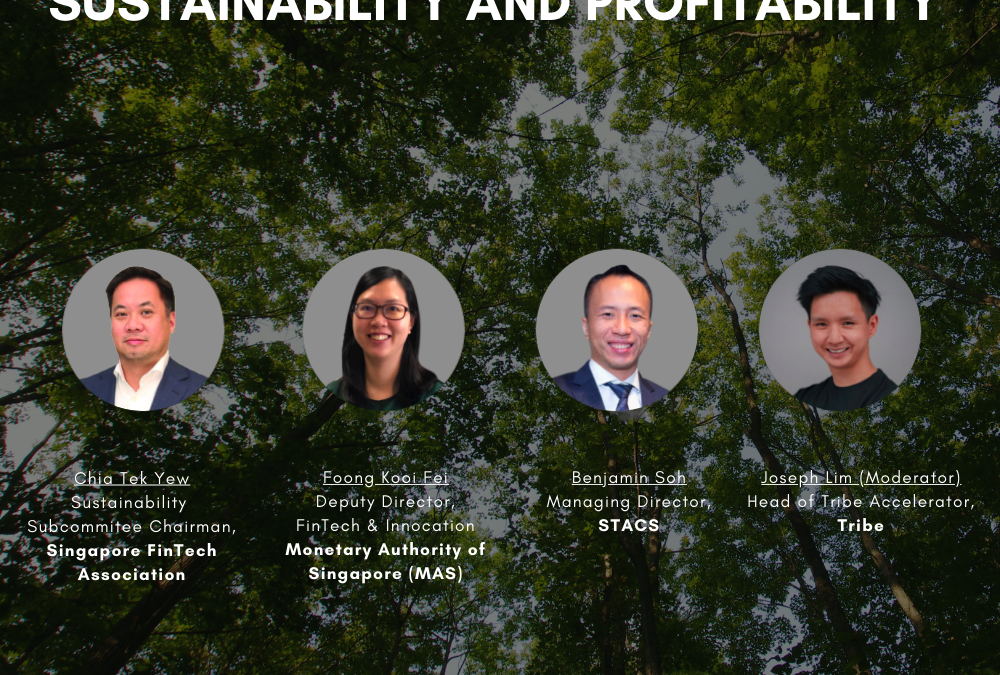

GREEN FINTECH: BRIDGING SUSTAINABILITY AND PROFITABILITY In celebration of Earth Day 2021, STACS co-hosted a Green FinTech panel at Bridge+ 79 Robinson Road in partnership with Tribe Accelerator, Alibaba Cloud, and enabled by flexible workspace Bridge+ by CapitaLand....

by ESGpedia | Apr 20, 2021 | Press Release

FOR IMMEDIATE RELEASE Singapore fintech start-up STACS raises S$5 million in pre-Series A funding. Investors include Wavemaker Partners, Tribe Accelerator, and Stellar Partners, bringing total funding to date to more than S$8 million SINGAPORE, 20 April 2021...