‘Breaking Down The Deal’ with STACS and Eastspring Investments — FinTech Forum organised by Tech in Asia x Amazon Web Services (AWS)

Leading FinTech shares its best practices behind successful partnerships with renowned financial institutions

STACS was invited to take part in the FinTech Forum conference hosted by Tech in Asia in partnership with Amazon Web Services (AWS) on 23rd February 2021 — virtually and socially distanced, of course.

Our live panel, titled “Breaking Down The Deal”, saw STACS, represented by our Co-founder & Managing Director Benjamin Soh together with our long-standing partner, Eastspring Investments, leading Asia-based asset manager firm, represented by Nelson Tan, Team Lead on New Ways of Working.

The overarching content of the whole session was to explore some of the best practices, and challenges that lead to a successful partnership between FinTechs and Banks or Financial Institutions (FIs). Ben and Nelson shared about the inception of the STACS Mercury platform co-development from first pitch, initial round-table discussions, and our STACS Tech Sandbox, to successful implementation at Eastspring.

For those who do not know, Mercury is our award-winning Real-Time Synchronised DLT (distributed ledger technology) Trade Processing Platform. Within the first month of implementation, Eastspring and BNP Paribas Securities Services observed an 84 per cent reduction in trade breaks and a significant 62% reduction in non-value-added reconciliation work, with reduced risk of errors in client reporting, unlocking massive value and efficiencies.

See below for some of the key takeaways from the session, and be sure to watch the full video to learn how we at STACS approach real industry challenges with real solutions in partnership with real institutions.

A special thank you to Amazon Web Services (AWS) and Tech in Asia for the invitation and organising the event.

Key insights from the session have been included below:

A dated 50 years old capital market operating model

STACS aims to simplify global markets with our transformative technology. The problem we see in the capital markets is that the operating model has been the same for the last 50 years.

Since the 1970s, the capital markets have been fragmented where institutions operate on different systems and ledgers, and go through a linearly-dependent process where settlements take between 2–14 days, depending on the asset class.

This leads to US$800 billion of capital being locked up every single day in the clearing system.

With multiple layers of processing, nearly US$300 billion is being spent on transaction costs and this model isn’t even effective.

In the EU alone, approximately 6 per cent of trades fail to settle, resulting in €35 billion in penalties annually.

Timeline of a deal

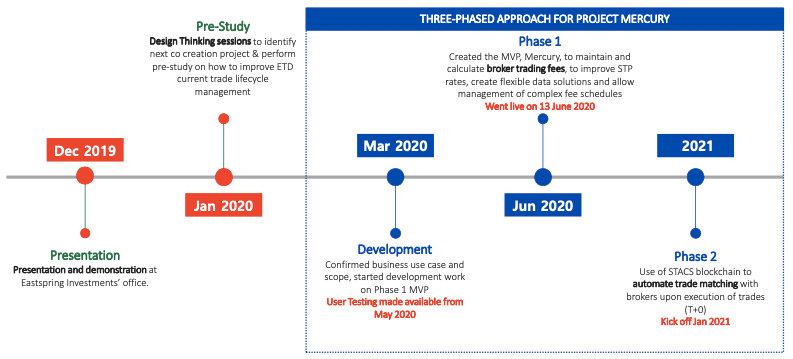

The STACS team first began talks with Eastspring after the Singapore Fintech Festival in November 2019, when we delivered a presentation and demonstration at their office.

This was followed by a series of zero-based design thinking workshops a month later in January, the aim of which was to identify the basis of the co-creation project. For these workshops, both the operations as well as senior management of Eastspring were heavily involved. STACS also managed to get some inputs from external stakeholders and counterparties. This helped validate the conversations that were ongoing. The zero-based design approach allowed both teams to explore freely, with zero assumptions and constraints, on how possibly a blockchain solution can be used to overcome certain painpoints. Besides just driving efficiency, could it possibly be a new business model to create new revenue streams?

The scope was eventually narrowed down to exchange-traded derivatives (ETDs) trade processing, and a pre-study on how to improve the process for the business ensued in the workshops with the same teams..

Once we had confirmed the business use case and scope of the Mercury co-development and implementation, we kicked off a three-phased project in March 2020, that is still ongoing to this day.

Even today in February 2021, STACS meets the teams from Eastspring and its middle office provider, BNP Paribas Securities Services, on a weekly basis to update and explore further iterations of the platform. Mercury is set to cater to all asset classes in its upcoming roll-out plans.

Visualising a transaction on the Blockchain with STACS Tech Sandbox

Ben and Nelson highlighted the importance and benefits of the STACS Tech Sandbox, where STACS ran multiple live demos on various potential use cases to help the teams at Eastspring visualise a blockchain-enabled transaction, and the tangible benefits that they will be empowered to enjoy with DLT:

“I remember very clearly one of the demos in which we simulated a live transaction on the technology platform, whereby we completed the transaction on the blockchain. I think that was really good because it allowed people to see it visually… That has been very helpful to us as a company. We have intentionally produced a few different types of demos to showcase how some of the smart contracts and blockchain functionality we have developed have been deployed on the AWS cloud so that they can be used on an experimental basis in a light fashion, before we decide to go live… Sandboxes are helpful to get the deal done.” — Benjamin Soh, Co-founder & Managing Director, STACS

“I definitely feel the same. There’s not many presentations where you’re able to see something live. Being able to do and see that allows people to visualise it very well that this solution actually is there. They can imagine how they can use it to solve specific problems. Without this I think it would be hard for people who are not familiar with blockchain to imagine it… Even after the 2 months of intensive workshop, we met weekly to further iterate the solution. I thought that was very helpful as well, as we validate until the very last day when we go live. It was very satisfying to see that when we went live there weren’t many issues. I was expecting a lot of problems here and there, but to my surprise there weren’t any problems with the solution.” — Nelson Tan, Team Lead, New Ways of Working, Eastspring Investments

Once again, you can watch the full session here.

About STACS

STACS (Hashstacs Pte Ltd) is a Singapore FinTech development company with a Vision to provide Transformative Technology for the Financial Industry, with its complete infrastructure of ready platforms that make global markets simpler. STACS is leading the way forward by digitalizing assets, processes, and documents using its proprietary STACS Blockchain technology. Its clients and partners include global investment banks, national stock exchanges, custodian banks, asset managers, and private banks. STACS is an Award Winner of the Monetary Authority of Singapore (MAS) Global FinTech Innovation Challenge Awards 2020, a technology partner of Project Ubin led by MAS, and also a two-times awardee of the Financial Sector Technology and Innovation (FSTI) Proof of Concept (POC) grant, under the Financial Sector Development Fund administered by MAS. STACS remains committed to its Mission to empower financial institutions to discover new opportunities through its technology.

For Enquiries

[email protected]

Website

www.stacs.io