ESG ratings are confusing investors – How to navigate the pool | IMAS-Bloomberg Investment Conference 2022 Key Insights

Held at The Ritz Carlton, Millenia Singapore, Grand Ballroom, the speakers for the Transition Finance panel at the IMAS-Bloomberg Investment Conference 2022 included (top left to bottom right): Andy Howard from Schroder Investment Management (on screen), Paul Milon from BNP Paribas Asset Management (on screen), Caroline Chua from BloombergNEF (Moderator), Benjamin Soh from STACS, and Herry Cho from Singapore Exchange.

A Wall Street gold rush is underway in environmental, social, and governance (ESG) investing, but rating and ranking how companies measure up on these criteria remains a challenge for global capital markets and asset managers.

Singapore’s Senior Minister and Chairman of Monetary Authority of Singapore, Tharman Shanmugaratnam giving an opening address during the IMAS-Bloomberg Investment Conference 2022

Singapore’s Senior Minister Tharman Shanmugaratnam said earlier this month that there are immense opportunities for investment in innovation to shape a better and more sustainable world, even as we face a “perfect storm” of higher inflation and slower growth amid the geopolitical security challenge.

Part of the solution is around accelerating the transition to a low-carbon economy through green technologies, even as the world faces an energy crisis resulting from a spike in oil prices/supply in the short-medium term.

The ESG investment boom, which sits at the heart of this green transition in capital markets, is being driven by the sheer weight of money flooding into these types of funds as climate change and sustainability move up the investor agenda.

About US$2.7 trillion of assets are now managed in more than 2,900 ESG funds, according to Morningstar, but the lack of available data as well as standardisation on ESG ratings needs to be addressed if the industry is to grow smoothly.

Singapore Inc. as ESG investment destination

Indeed, academics at MIT Sloan School of Management have said the lack of standardisation on ESG scoring urgently needs to be addressed, dubbing the problem “aggregate confusion” in a recent report.

One survey conducted by Duff & Phelps, A Kroll Business in partnership with the International Valuation Standards Council (IVSC), highlighted the issues caused by the lack of a standardised system for ESG ratings.

According to the findings, businesses currently use “a wide range of ESG frameworks, with no single system having a clear majority. Amongst those surveyed there were 14 different combinations of frameworks used”.

“Some of the most popular current ESG frameworks include Global Reporting Initiative used by 33 per cent of respondents, Sustainable Accounting Standards Board at 32 per cent, and Task Force for Climate related Financial Disclosures at 25 per cent.”

Yet demand for ESG investments is clearly only growing: in the fourth quarter of last year alone, there were about US$142.5 billion of new inflows into the ESG sector.

At STACS, we aim to enable Singapore Inc. and businesses to be well equipped to attract more of this global capital earmarked for sustainable investments, by providing ESG data that stands up to ESG criteria and bringing more transparency and accountability to private-sector ESG performance.

Making sense of ESG ratings pool

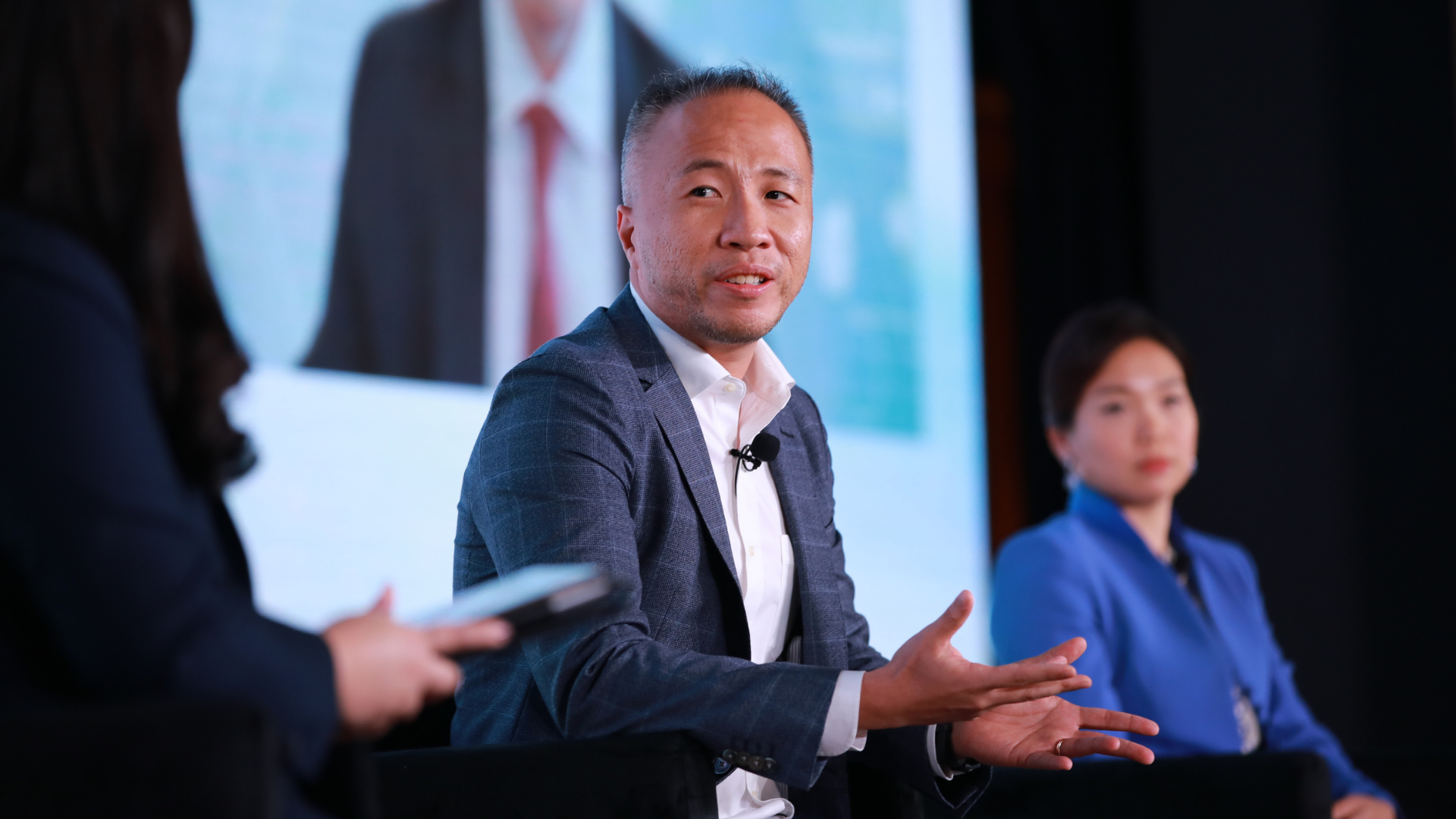

Benjamin Soh, Co-Founder and Managing Director of STACS representing Singapore FinTechs on the panel “Transition Finance in Asia: What Does an Effective, yet Inclusive Transition Look Like?”

Widening ESG projects pool for investment

Despite a growing amount of ESG capital being set aside by banks and large asset managers, there is still a shortage of transparent projects to invest in.

At STACS, we level the playing field by making it easier and cheaper for small and medium enterprises (SMEs) without a dedicated in-house ESG team to do ESG reporting, as well as access sustainable financial services from global financial institutions.

Currently, data is fragmented and hard to collect as they are in non-digital systems. For corporates to access sustainability services or achieve ESG certifications, auditors or certification bodies need to manually collect data. This process is labour-intensive and therefore expensive as a result. By digitalising them and hosting not only self-disclosed data but ongoing project data on a single registry, we simplify the entire process, making it more accessible and affordable for companies to have verified data and ESG certificates on our platform.

Takeaways: IMAS-Bloomberg Investment Conference

Speaking at the same IMAS-Bloomberg Investment Conference where Minister Tharman made his comments (9 March 2022), our Co-founder and Managing Director, Benjamin Soh, provided insights in a headline panel on “Transition Finance in Asia: What Does an Effective, yet Inclusive Transition Look Like?”.

Representing FinTechs, Benjamin Soh spoke alongside global sustainability expert co-panellists from the Asset Management Industry: Andy Howards, Global Head of Sustainable Investment at Schroder Investment Management, Herry Cho, Managing Director and Head of Sustainability and Sustainable Finance at Singapore Exchange, Paul Milon, Head of Stewardship, Asia Pacific at BNP Paribas Asset Management, and Caroline Chua (moderator), Lead Southeast Asia Analyst at BloombergNEF.

STACS contributed to the panel our perspectives as a leading ESG FinTech digital platform firm under Project Greenprint led by the Monetary Authority of Singapore (MAS).

With questions being raised by global fund managers and institutions on the need for more ESG transparency when it comes to ratings/ rankings, the panel was extremely fitting.

Some key insights shared by our Managing Director, Benjamin, include:

1. Sustainable investment needs to be powered by data: The problem of ESG data today is that it is mostly fragmented, and whatever is available is a historical snapshot of self-disclosures with little value to forward-looking risk assessments.

2. Risk management: Investors and portfolio managers face challenges in real-time risk management due to having a hard time gathering the true sustainability posture of their portfolio, and an even harder time in performing ongoing monitoring and analysis.

3. As an ESG fintech firm, we aim to be an enabler: Our role in Project Greenprint led by the MAS is to develop the ESG registry, ESGpedia. As the name suggests, ESGpedia aims to become an encyclopedia of ongoing ESG data for companies, both from public data and alternative independent sources, adding great value in data digitalisation, structuring, and interoperability.

4. Ecosystem collaboration: Fintechs like us must work closely together with global financial stakeholders and institutions including banks, exchanges, asset managers, and of course governments/ regulators. This will be vital if we are to succeed in standardising ESG ratings and rankings here in Singapore and beyond.

Connect with us to find out how we can help your business measure and track its ESG performance via our ESGpedia registry, in turn helping you take data-driven investment decisions to the next level if you’re an investor, or access the world of green financing being offered by global institutions if you’re a corporate.

PRESS CONTACTS

If you are a journalist with media queries, contact us.