Published 8 January 2024 –

COP28’s historic climate deal marks the end of a big year for ESG, filled with significant progress and challenges, setting the tone for ESG developments in 2024.

Advancements in technology, especially Artificial Intelligence (AI), played a pivotal role in enhancing ESG management, enabling companies to comply with looming ESG regulations and achieve their ESG goals. STACS’s ESGpedia has emerged as a Global Finalist in the AI category for COP28 UAE Techsprint, recognizing best-in-class innovative technological solutions in the pivotal realm of sustainability. This award recognition serves as a strong testament to the platform’s ability to accelerate climate action across Asia, where there is a critical role for technology solutions to play in scaling up ESG in the magnitude that the race against time requires.

The events of recent years, like the COVID-19 pandemic and geopolitical tensions, highlighted the importance of robust and transparent supply chains, causing businesses to shift towards sovereign manufacturing. Globally, regulatory frameworks evolved rapidly, led by the European Union with parallel initiatives in Asia. These developments set the stage for an intriguing 2024, with certain key ESG trends expected to dominate the landscape. Check out the top 6 ESG trends in 2024 below!

Legitimacy of ESG Claims and Mitigating Greenwashing

2024 is expected to be pivotal in refining the approach towards corporate responsibility. A key aspect of this shift is the increased scrutiny of greenwashing practices, which is used to describe superficial or misleading claims about a company’s environmental efforts. However, the definition and legal ramifications of this term are becoming more concrete with recent precents such as an asset manager being fined $19 million in 2023 for misleading claims. The European Union is at the forefront of this movement, implementing new regulations to eliminate greenwashing and ban carbon-neutral claims by 2026.

Alongside this, there is an intensified focus on the authenticity of carbon offsets. Leaders in the voluntary carbon market are stepping up to provide clearer guidelines regarding claims associated with carbon credits. Companies will need to be more diligent in ensuring their environmental claims are not only accurate but also verifiable, to avoid the risks associated with misleading the public. Early last year, an investigation revealed that the forest carbon offsets approved by the world’s leading certifier and used by Disney, Shell, Gucci and other big corporations are largely worthless and could make global heating worse.

Check out STACS and Razer’s partnership, on how we empower consumers to engage in carbon-neutral checkout with fractionalized carbon credits: https://stacs.io/live-industry-use-cases-esgpedia/razer-high-quality-carbon-credits/

Learn more about how ESGpedia helps enhance transparency in the carbon credits market with Thailand Greenhouse Gas Management Organization: https://stacs.io/tgo-partners-stacs-carbon-credits-thailand/

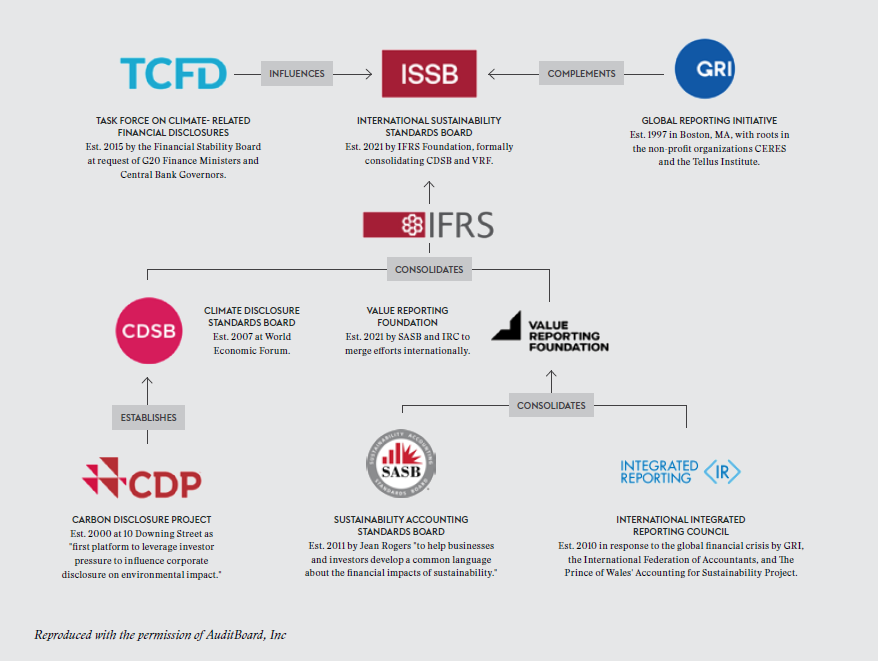

New Mandatory Disclosures to begin on 1 January 2024: ISSB, IFRS & more

Currently, 29 countries across the globe maintain some degree of mandatory ESG disclosure regulation. The United Kingdom has laws mandating large corporates to disclose climate-related financial information in annual strategic reports. Authorities in Japan are mandating disclosure standards in a multi-stage approach. Singapore had a comply-or-explain ESG reporting framework established since 2016. Nonetheless, when it comes to voluntary disclosure of ESG information, which forms the bulk of data available to investors, the information is spurred by the development of several key reporting standards and frameworks, from the GRI to the SASB.

Image: Harvard

Image: Harvard

With investor demand fueling sustainability disclosure regulation worldwide, we are expecting to see significant advancements within corporate transparency in 2024, driven by the implementation of new mandatory disclosure requirements on a global scale. These requirements will compel both public and privately held companies to adhere to more stringent sustainability measurement and reporting standards.

Three notable regulations to look out for in 2024 are the EU’s Corporate Sustainability Reporting Directive (CSRD),California’s climate disclosure bills, and International Sustainability Standards Board (ISSB) IFRS Sustainability Disclosure Standards.

Starting from January 1, 2024, companies under the Non-financial Reporting Directive jurisdiction will need to report their climate impact under the Corporate Sustainability Reporting Directive (CSRD), which is an enhanced version of the existing requirements. By 2025, this mandate will extend to other large companies operating within the EU. 2024 is anticipated to be a transitionary year for many companies as they adapt to more rigorous ESG data collection and reporting practices.

Additionally, two pivotal climate disclosure bills introduced in California by the SEC are set to mandate climate reporting by 2026, forcing companies to begin their preparatory efforts in 2024 if they have not already done so. Given that most large U.S.-based companies operate in California, the impact of these bills is substantial, affecting over 5,000 companies (SB 253) and more than 1,000 companies (SB 261) respectively.

The International Sustainability Standards Board (ISSB) has also issued its first two inaugural sustainability standards that are to come into effect on 1 January 2024. These standards are to ‘mark the start of a new era of requiring reporting entities to make sustainability related disclosures.’

Your essential guide to sustainability reporting: https://stacs.io/sustainability-reporting-guide-for-businesses/

Supply Chain Transparency, especially in emerging markets

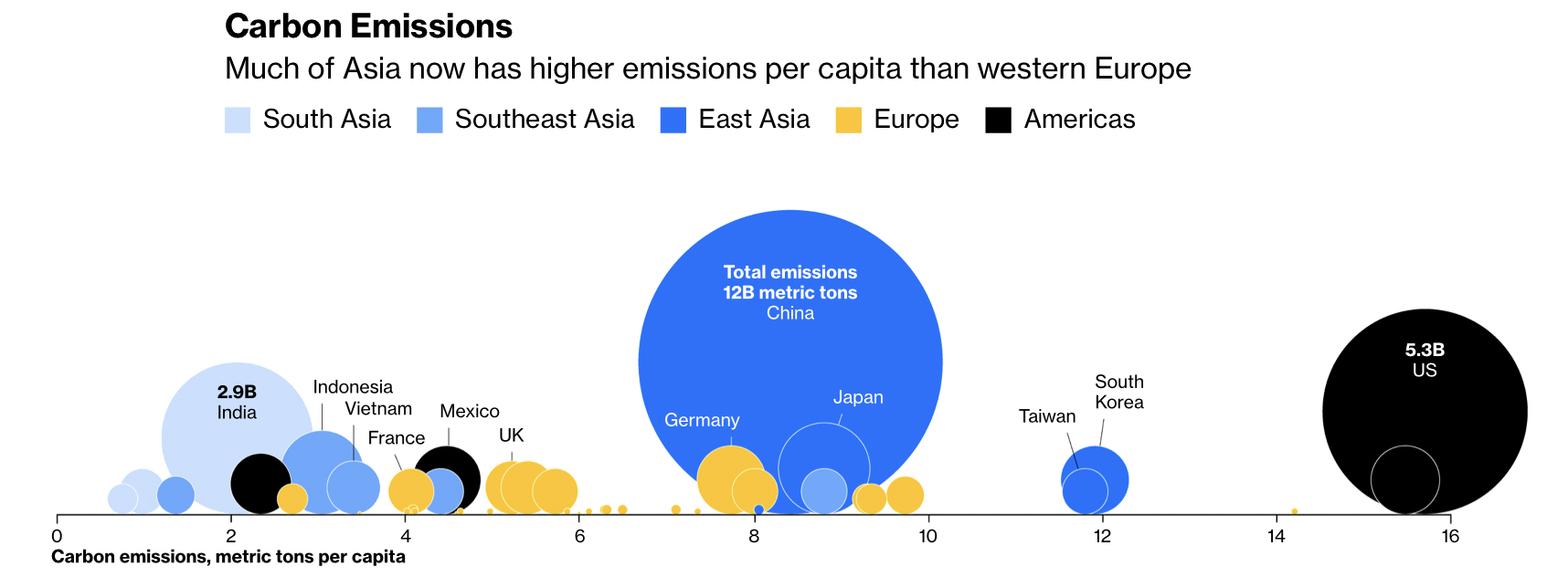

The importance of supply chain sustainability in the 2024 ESG trends is increasingly coming to the forefront, particularly in 2024. Bloomberg recently published an insightful analysis of how Apple’s supply chain is on a collision course with climate change, highlighting its massive exposure to Asia amid increasing extreme weather events and carbon-intensive economies in that region.

Image: Bloomberg

The supply chain challenges of Asia-based production and Europe or USA-destined exports are made clear amid evolving regulatory regimes. Key insights include how “energy-intensive raw materials into the European Union will face new levies” from October 2023. The levies aim to price carbon used in producing these materials at an equivalent level to the EU’s own carbon credits, currently trading at around €84 ($89) per metric ton.

This will reduce the competitiveness of products manufactured in carbon-intensive markets unless manufacturers can prove their green credentials.

Scope 3 emissions, which typically constitute over 90% of a company’s total greenhouse gas footprint, will be a key emphasis. These emissions differ from Scope 1 and 2 emissions, which detail emissions a company can directly control. On top of the upcoming regulations that are mandating more comprehensive reporting on Scope 3 emissions, the International Sustainability Standards Board (ISSB) is also advocating for new sustainability frameworks targeting this element.

The spotlight on supply chain responsibility is expanding beyond large corporations to include small and medium-sized enterprises (SMEs) as well. This shift is partly driven by investors who are increasingly scrutinizing the ethical and sustainable dimensions of a company’s supply chain. Their concerns extend to issues like responsible sourcing, fair labor practices, and minimizing environmental harm across the entire supply chain.

In 2024, we will be seeing companies implementing sustainable, ESG-centric procurement policies and collaborating with suppliers to enhance both data collection and the overall impact of their operations.

Without more data transparency in supply chains, exporters and manufacturers in this part of the world are not going to be able to prove their ESG credentials, leading quickly to reduced competitiveness versus those who do invest in delivering this.

It is primarily through platforms like STACS’s ESGpedia that SMEs in Asia will be able to comply with increasing ESG regulations and amplify their green credentials, so as to ensure they continue to win business from the Apples of the world.

Technology and Data-Driven Approaches to ESG

Data transparency is paramount for the purpose of tracking progress — after all, what are we doing at these climate conferences every year if not updating each other on progress, which requires hard data.

As we look to 2024, the application of AI in sustainability efforts is expected to grow substantially. AI’s ability to optimize resource usage and enhance energy efficiency stands as a testament to its potential in reducing environmental impacts. These technological advancements are not just limited to operational improvements but also extend to the realm of investment and finance.

Advanced analytical tools and platforms, employing AI, machine learning, and natural language processing, are becoming increasingly available to investors. These tools are designed to sift through the vast, often convoluted arrays of ESG data, enabling investors to make more nuanced and informed decisions. By leveraging these technologies, investors can extract meaningful insights from complex ESG datasets.

Furthermore, these AI-driven tools are not just facilitating better decision-making but are also revolutionizing the way investors engage with ESG data. They provide a more holistic and accurate view of a company’s ESG performance, allowing for a deeper understanding of the sustainability landscape. As we progress into 2024, we can expect to see a more widespread adoption of these technologies, as they become integral to the way companies and investors approach ESG challenges and opportunities.

ESG Fintech to remain as a key driver

The intersection of financial technology and sustainability, known as ESG fintech, is rapidly emerging as a critical component in the transition towards a more environmentally friendly economy. Given that trillions of dollars of investment will be required over the coming decades to abate and reverse climate change, ESG fintechs are expected to play a pivotal role in 2024 to facilitate and digitally streamline the sustainable financing processes, making it easier for the banks and more accessible to corporates and SMEs.

ESG fintech companies are at the forefront of offering innovative technology solutions to facilitate sustainable financing, such as sustainailbility linked loans, green bonds, responsible investment funds, and financial support for projects aimed at reducing carbon emissions. Moreover, with these firms becoming more sophisticated by integrating AI and big data into their operations, we will be seeing more resilient and future-proof investment strategies in 2024.

A notable development in ESG fintech is the use of technology to streamline the trading of carbon credits or Renewable Energy Certificates (RECs). In Thailand, we can see over 500 companies and organizations in the carbon-neutral group that are expected to use a common digital platform for the direct trading and exchange of carbon credits.

Increasing Digital Tools and Resources for SME

No longer confined to large corporations and financial institutions, ESG reporting regulations are now increasingly extending to non-listed companies and SMEs. Recognizing this, a plethora of digital tools and resources have emerged, tailored specifically for SMEs. These tools are designed to simplify the process of ESG reporting and sustainable business practices.

In Asia, initiatives like Monetary Authority of Singapore’s (MAS) Gprnt, SFIA ASEAN Safe Platform, and the free ESBN Asia-Pacific Green Deal Assessment on ESGpedia have led the way in empowering SMEs to kickstart their sustainability journey. Europe is not far behind in this trend. The European Commission’s commitment to an SME-friendly environment was strongly reaffirmed in March 2020 with the unveiling of the “An SME Strategy for a Sustainable and Digital Europe”, a clear nod to the importance of SMEs into the broader tapestry of a sustainable future.

Especially with SMEs representing 90% of global supply chains, they play a pivotal role in contributing towards a more inclusive and green economy when they engage in sustainable practices. This highlights a critical trend for 2024: The collective commitment towards sustainability. This shared goal, embraced by entities of all sizes – from global corporations to local SMEs, and even individuals, will drive significant strides in 2024 towards our future.

ESG compliance – a necessary stepping stone to corporate success

It is evident that we are at a crucial juncture in the evolution of sustainable business practices; the message is clear that businesses urgently need to adopt sustainability into their business strategy The burgeoning trend towards mandatory ESG regulations across the globe, coupled with technological advancements and a rising focus on transparency across supply chains, underscores the urgency for companies of all sizes to adapt and engage proactively with sustainability principles.

The message is unequivocal: the time for action is now. By starting early and aligning with these evolving standards, businesses not only position themselves as responsible but also harness the opportunity to lead in the creation of a sustainable future. This proactive approach is not just a strategic advantage but an imperative, as ESG compliance becomes a global norm and a key stepping stone to corporate success.

Get started on your ESG journey today with a free ESG profile