Published 04 October 2024 –

Why are ESG Reporting Platforms important?

An ESG reporting platform is software specially designed to track and report companies’ Environment, Social, and Governance (ESG) management data and initiatives.

In view of tighter ESG regulations and reporting requirements for both listed and increasingly non-listed companies, such as the IFRS’ International Sustainability Standards Board (ISSB) standards being adopted in Singapore by FY2025, the need for companies to kickstart ESG reporting has become ever more pressing.

Soon, following the phased approach in which governments across the globe are rolling out disclosure requirements, we expect these regulations to be extended and eventually made mandatory for SMEs and non-listed companies in the future. Tender and business requirements are also increasingly including sustainability criteria. Hence, businesses regardless of size must future-proof and take action to comply with the standards they are subject to and the evolving demands, or stand to lose competitiveness and business.

This is where ESG Reporting Platforms play a crucial role – empowering companies to meet these requirements and streamlining complicated ESG reporting processes to lower barriers to entry.

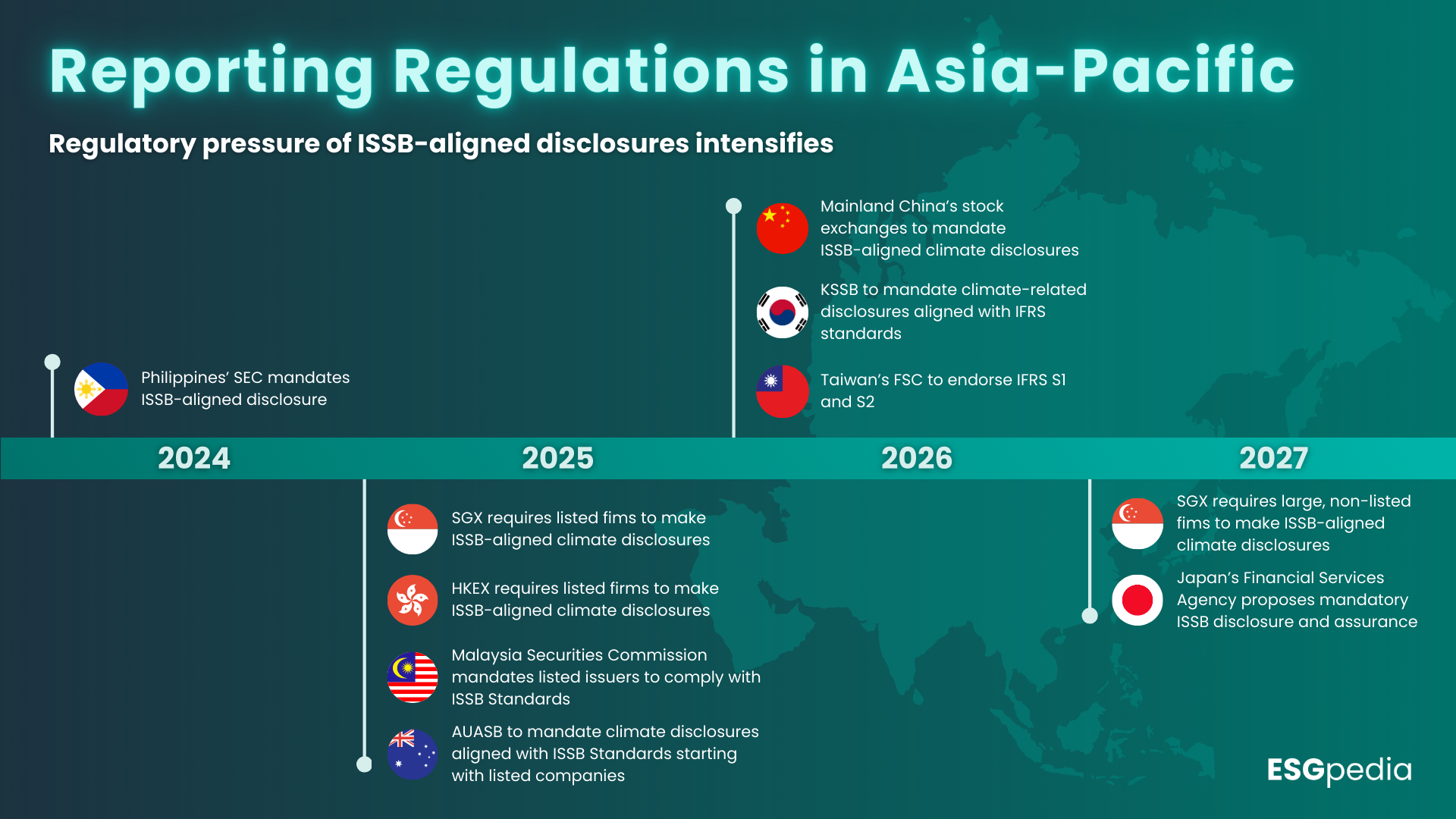

Asia’s evolving regulatory landscape

Asia Pacific is a key example of regions ramping up on ESG reporting requirements aligned with the ISSB framework, with countries such as Philippines mandating ISSB-aligned disclosures starting FY2024, Australia implementing compulsory climate-related disclosures from FY2025, and Singapore eventually requiring large non-listed firms to make ISSB-aligned climate disclosures from FY2027.

Additionally, the fine tuning of both local and international ESG reporting standards have changed the way businesses operate – for instance, the Singapore government will be assessing sustainability credentials of companies bidding for meetings, incentives, conferences, and exhibitions (MICE) tenders, as well as events organised by the public sector starting FY2025. This includes climate-related disclosures and sustainability-related certifications.

Companies are also starting to recognise the value of incorporating ESG reporting and sustainability measures in their core strategies, giving themselves a head start by engaging ESG reporting platforms amidst rising ESG reporting requirements.

The 2024 Sustainability Action Report by Deloitte found that almost all (99%) of companies are preparing for increasing disclosure requirements, with 74% of public companies planning to invest in sustainability reporting technology and tools over the next year.

This transformation of the business landscape plays a crucial role in positioning companies as ESG leaders within their industries, while maintaining trust with investors and customer loyalty by showcasing their commitment to sustainability.

Benefits of engaging an ESG Reporting Platform

In KPMG’s 2024 Sustainability Organisation Survey, 44% of organisations cited insufficient resources or capacity to collaborate effectively as the top structural challenge hindering their ability to integrate a sustainability strategy into broader business goals. ESG reporting platforms present a solution to fill the gap in resource planning for businesses, with the following key benefits.

Technical expertise and resources to keep up with complex ESG regulations

- Streamlined and guided processes

- Real-time tracking of data

- Employees can easily familiarise with ESG reporting processes, with no prior expertise or experience required

Cost-effective approach to handling ESG reporting

- Companies are empowered to take charge of their own ESG data and strategy

- Time and resources saved, translating to efficient work processes and business profitability in the long run

Continuity of core business partnerships

- Larger companies may require data points from their suppliers, likely to be SMEs, to report and reduce their Scope 3 emissions

- With data and ownership of their Scope 1 and 2 emissions, SMEs will be empowered to continue business with large companies in the future

Ensuring full compliance with latest ESG reporting frameworks and standards

- Reporting in accordance with global and local frameworks

- Calculate GHG emissions in accordance with recognised standards such as ISO14064 methodology and the GHG Protocol

- Adds an additional layer of security and reliability to ESG reporting through proper enterprise automation, technology, and tools – allowing companies to report with confidence

5 Factors to look out for in an ESG Reporting Platform

It is paramount to select the right ESG reporting platform – ensuring the service provider can match your business needs and aid your company in achieving ESG goals.

Amongst all the benefits of engaging an ESG reporting platform, we have shortlisted 5 core features to look out for while considering various service providers.

1. Regulatory Compliance

It is essential that the ESG reporting platform can produce reports catered to your specific organisational structure and the respective geographical regions/regulatory landscape your business is based in.

For instance, while a subsidiary in Malaysia would have to report in alignment with Bursa Malaysia’s reporting rules, another branch in China would have to comply with the region’s new ESG reporting standards, and at the same time a different subsidiary in Europe would be subject to Europe’s Corporate Sustainability Reporting Directive (CSRD).

The flexibility and ability of an ESG reporting platform to allow reporting according to relevant or multiple international and local frameworks for your business is key to ensuring compliance with evolving requirements, as ESG reporting gradually becomes a global norm. For smaller companies in which resources may pose a constraint, ESG reporting platforms can fill the gap by providing the relevant expertise and guidance on the latest frameworks they are required to comply with.

Some of the most used frameworks and standards include international ones such as:

- Global Reporting Initiative (GRI)

- Task Force on Climate-Related Financial Disclosures (TCFD)

- International Sustainability Standards Board (ISSB) formed by International Financial Reporting Standards (IFRS)

- ISO14064

- Greenhouse Gas (GHG) Protocol

Local frameworks include:

- Simplified ESG Disclosure Guide (SEDG) for SMEs in Malaysia

- Sustainability Report (SuRe) form in the Philippines

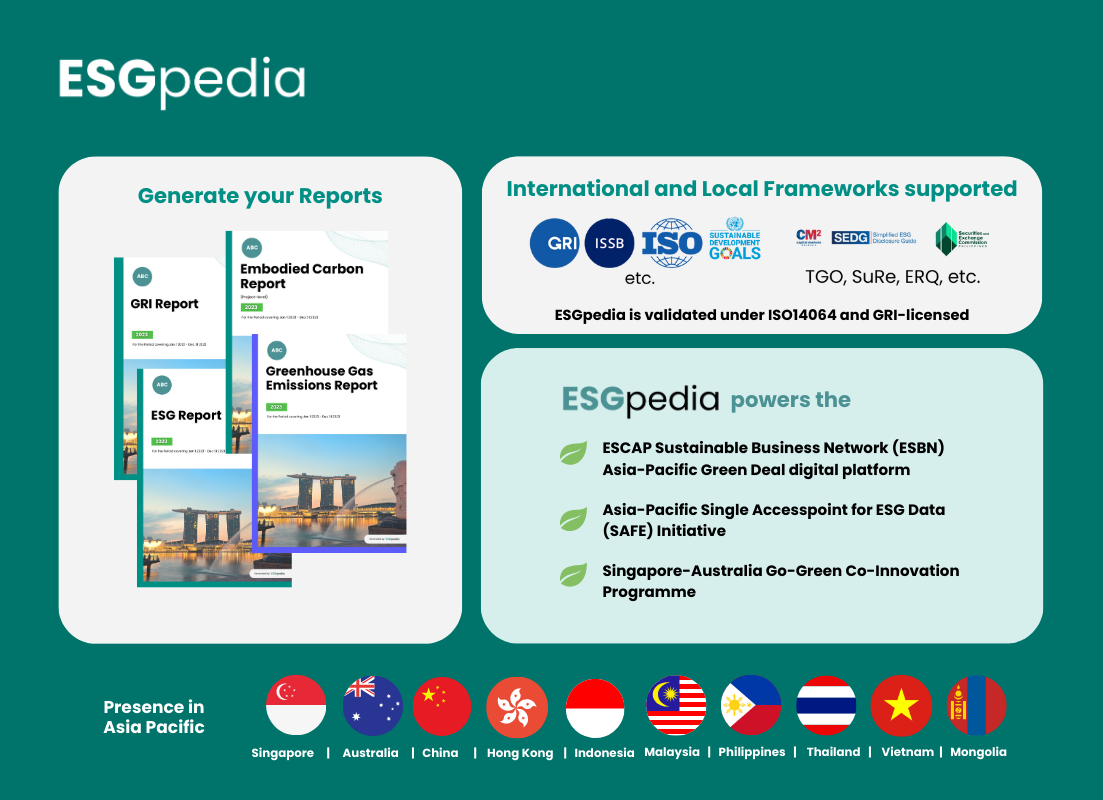

ESGpedia also powers the ESBN Asia-Pacific Green Deal for Businesses, which is an initiative launched by the UN Economic and Social Commission for Asia Pacific (ESCAP). The programme is aimed at lowering barriers to sustainability and enabling companies to demonstrate their commitment by calculating their GHG emissions and disclosing common ESG metrices as a first step towards corporate sustainability.

Your selected ESG reporting platform must support your business in reporting in accordance with such requirements, ensuring full compliance with the latest reporting requirements.

2. Data Collection and Integration

A reliable ESG reporting platform would also have built-in capabilities to handle large amounts of data, extract, and auto-fill relevant fields and information where required, allowing businesses to upload ESG data with ease, reducing the time needed compared to manual processes.

For large, listed companies, reporting Scope 3 emissions which encompasses upstream and downstream activities would warrant close and oftentimes, manual coordination with suppliers to gather their emissions data. Having streamlined, automated, and technology-assisted data collection processes and datapoints across various industries within a single platform is a key consideration for these sizeable companies.

Compatibility with external platforms such as Enterprise Resource Planning (ERP) suites is important for businesses which amass considerable amounts of data. Resource and accounting softwares such as InfoTech and operations technology platforms such as InfoDeck are integrated into our ESGpedia platform, with automated extraction and filling of information required.

Lastly, integrated Optical Character Recognition (OCR) is essential in streamlining operations and improving efficiency in the reporting process. OCR is an artificial intelligence technology that ESG reporting platforms ideally should implement to scan documents (e.g. invoices, bills, etc.), and hand-filled forms to extract key ESG metrices for auto-fill. An example would be how ESGpedia leverages OCR through mass scanning modules to extract and handle ESG data at scale, saving time and minimising human error by reducing manual data entry and document processing.

Seamless integration with these systems is a factor which businesses would want to look out for in deciding which ESG reporting platform to use, to simplify the tedious process of managing large amounts of data.

3. Cost-effectiveness

Leveraging ESG reporting platforms for your business’s ESG reporting processes could potentially cut costs as it increases operational efficiency. A KPMG survey found that although 83% of organisations believe they are ahead of their peers in sustainability reporting, a substantial 47% still use spreadsheets to aggregate their data. The corresponding cost incurred by time lost through manual handling of data could affect your organisation’s efficiency in the long term.

Additionally, using an ESG reporting platform could significantly minimise risks related to erroneous reporting, including reputational damage or fines from greenwashing, and even financial consequences when wrong business decisions are made from unreliable data.

Companies that continue to rely on manual ESG data collection and reporting face increased risks of human error and inaccuracy.

The CSRD reporting requirements in the EU mandate that companies that fail to report and comply face fines of up to 10 million Euros or 5% of their annual revenue. These heavy penalties emphasise the need for transparent, accurate, and reliable reporting – which can be mitigated by using an ESG reporting platform.

4. Collaborative and User-friendly

Having a collaborative, user-friendly platform provides avenues for both internal and external partnerships, presenting potential for businesses to connect with partners and expand their ESG efforts.

Within the business, engaging an ESG reporting platform which allows for multiple user accounts and cross-team partnerships would make collaboration within the company easier, increasing the enhance companies’ management of their ESG data and reporting. The engaged reporting platform should improve the existing workflow and optimise user efficiency.

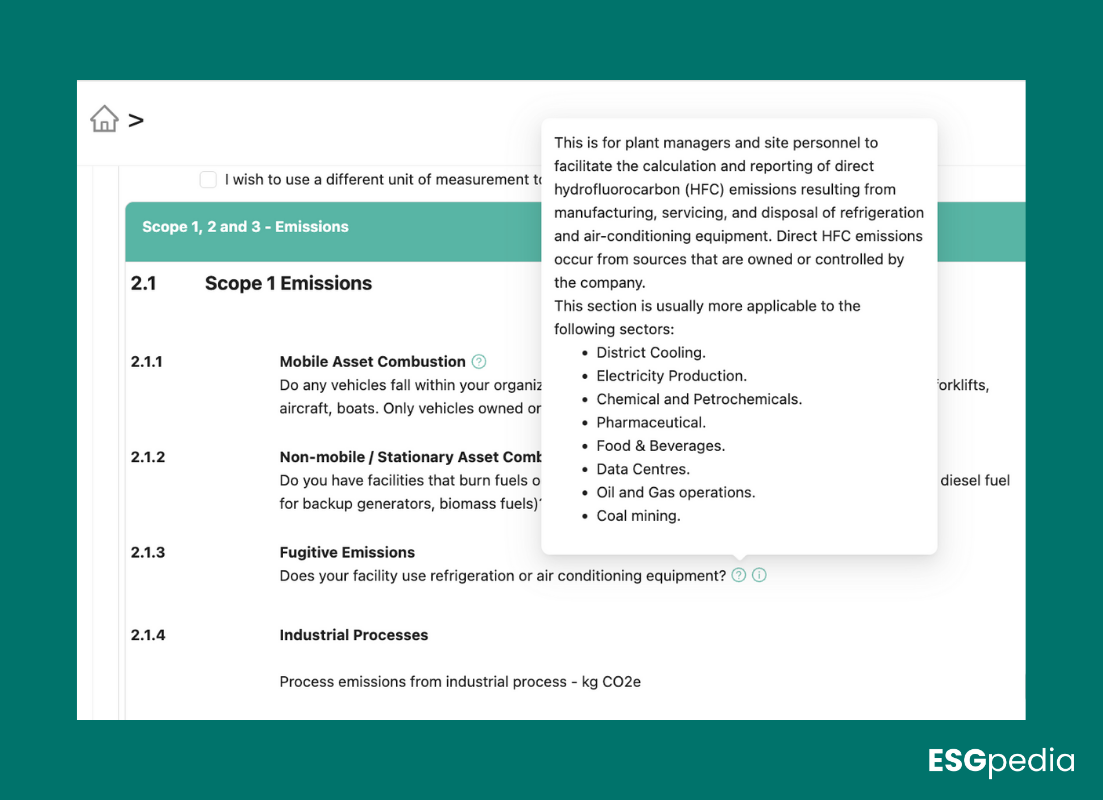

Guidance notes are a crucial part of the user interface on an ESG reporting dashboard to ensure user clarity about industry jargon and accurate information is being input.

A well-designed ESG reporting platform should also allow non-ESG-trained employees to easily navigate and utilise their software, minimising risks of human error and incorrect data input. This could come in the form of guidance notes within the platform for all categories, including Scope 1 emissions, to lower barriers to entry for ESG reporting.

Multiple languages available within the platform could also play a crucial role in encouraging collaboration and for companies to easily input and understand data across regions.

Finally, the ESG reporting platform should minimally provide your business with end-to-end support on utilising their software, whether through comprehensive onboarding sessions or guidance resources.

5. Credibility

Reliability and credibility through established stakeholder partnerships, collaborations with international or local regulatory bodies, and live use cases are some aspects you keep an eye out for when considering an ESG platform. Additionally, look for a platform which provides continually updated Emissions Factors or standards, allowing your company to keep up with the evolving regulatory landscape.

The selection and accuracy of Emissions Factors (EFs) available, along with the calculation of uncertainty of Greenhouse Gas (GHG) Emissions based on users’ inputs ensures the credibility of calculations and reported data. For instance, ESGpedia now has over 280,000+ EFs, covering more than 1,100 product categories, to help companies across various industries calculate their GHG emissions. EFs on the platform should include the latest product and most updated country and industry-specific EFs, while accounting for potential discrepancies by calculating and publishing uncertainty to help companies report with confidence.

A well-established reporting platform within the wider ESG ecosystem speaks volumes about its credibility. Some collaborations which can attest to an ESG technology provider’s credibility and interoperability include having partnerships with recognised global and regional institutions , whether to digitally enable their targeted ecosystem or integration to seamlessly provide verified sustainability data. Some initiatives that ESGpedia currently powers and supports include:

- The UN Economic and Social Commission for Asia Pacific (ESCAP) Sustainable Business Network (ESBN) Asia-Pacific Green Deal program

- Sustainable Finance Institute Asia (SFIA)’s Single Accesspoint for ESG Data (SAFE), initiativeUnited Nations Global Compact ‘s local chapter Global Compact Network Singapore (GCNS)’s Carbon and Emissions Recording (CERT) Tool

- Singapore-Australia Go-Green Co-Innovation Programme

Check out more of ESGpedia’s collaborative partnerships and clients here.

Partnerships with local banks across the region and Non-Governmental Organisations (NGOs) also demonstrate the reporting platform’s commitment to providing end-to-end guidance in a business’s ESG journey, including sustainability linked financing.

Industry-Specific Considerations

In addition to the 5 key considerations earlier highlighted, here are a few other considerations you can keep in mind, especially for the transport and logistics and the built environment industries.

The transport and logistics sector would garner a significantly larger carbon footprint and requires specified devices or technology to track distances travelled by their vehicles, or industry-recognised certifications like the GFA Labelling and Certification Programme by Green Freight Asia (GFA), to demonstrate their commitment to sustainability.

On the other hand, companies in the construction and ICT industries looking to secure tender for large projects face time-sensitive regulations implemented by the government in Singapore, which calls for efficient ESG reporting before FY2025. Engaging an ESG reporting platform that provides project-level data reports on top of company-level reports is important for construction companies’ reporting, setting them apart from competitors.

Additionally, an ESG reporting platform that enables the company to obtain certifications could play an instrumental role in choosing the right provider.

For the built environment for example, these include:

- Green Mark certification launched by Singapore’s Building and Construction Authority

- Singapore Green Building Council Green Certification

- Singapore Environment Council (SEC) Eco Office Certification

- Singapore Green Labelling Scheme by SEC

- bizSAFE

Reap the full benefits and create your ESG report today

Maintaining a competitive advantage by getting a head start in ESG reporting is pertinent to your business’ success.

To summarise, a good ESG reporting platform should be able to address current reporting needs and yet remain flexible to support future reporting requirements. Given the rate at which regulations are rising and evolving across the world, a reliable ESG reporting platform must have the ability to support your business through growth and help future-proof your company.

If you are looking for a reliable, established ESG reporting platform to engage, ESGpedia is a one-stop digital platform of ESG solutions for businesses of any ESG maturity to kickstart or accelerate your ESG journey. Our platform ESGpedia is GRI-licensed and built in in accordance with ISO14064 methodologies and the GHG Protocol, ensuring that businesses are well-equipped to comply with regulatory requirements to achieve excellence in their ESG strategies. ESGpedia is enterprise-ready, as a ISO/IEC 27001, ISO 22301:2019, and Data Protection Trustmark Certified Company.

For large companies with extensive supply chains, ESGpedia offers a Supplier Engagement module which allows companies to actively engage with their suppliers and stakeholders, from data collection, to monitoring, analysing, and taking action. This ensures effective collection of data across multi-tier suppliers for streamlined Scope 3 Emissions reporting and as the first step to decarbonising your supply chains.

SMEs can also expect tools such as the ESGpedia Starter tool, which empowers companies to kickstart their sustainability reporting by establishing core ESG/GHG metrices aligned with international standards. This prepares SMEs for increasingly demanding reporting requirements in the future.

Create an ESG profile and generate your ESG report.

ESGpedia is more than an ESG reporting platform – our suite of ESG solutions empower businesses’ end-to-end ESG needs, and our established Marketplace of ecosystem partners across financial institutions, assurance and certification bodies, advisory, NGO partners, carbon offset partners, and more, will enable your business to connect with a network to take further actions.

Get in touch with us to find out more about our digital sustainability solutions.