Green and Sustainable Finance – Investments, Banking, and FinTech by Nanyang Business School, with Monetary Authority of Singapore (MAS), STACS, GIC, and JP Morgan

Green and Sustainable Finance – Investments, Banking, and FinTech on 26 August

Green and sustainable finance – investments, banking, and fintech were some of the important themes that brought together a distinguished panel of speakers alongside our own Co-founder & Managing Director, Benjamin Soh, at the tail end of August.

Nanyang Business School, whose Associate Professor in Finance, Tao Chen, moderated the session, set the scene: “Green and sustainable finance is blossoming and increasingly playing a key role in global business practice.

“To achieve Singapore’s vision of becoming a regional green finance hub within the next decade, the Green Finance Industry Taskforce, convened by the Monetary Authority of Singapore (MAS), launched several initiatives earlier this year.

“These initiatives aim to accelerate green finance in the city-state through improving disclosures and fostering green solutions.”

Speakers: (Top Left to Bottom Right): Moderator – Tao Chen Jonas (Nanyang Business School), Rachel Teo (GIC), Wei Han Ong (JP Morgan), Kwok Quek Sin (MAS), and Benjamin Soh (STACS).

Watch the full panel here .

Below are some of the key takeaways from each of the speakers (in some cases edited for brevity):

Quek Sin Kwok, Executive Director of Green FinTech, MAS says:

MAS has and plans to introduce and accelerate the sustainability focus in the financial sector. I see three main motivations that can drive action. Since companies are made up of people, I believe that they do have social conscience and a desire to do good. Even if it’s not for altruistic reasons, companies are looking at social responsibility more as a business necessity to build a strong reputation and to attract talents that are today demanding greater purpose and support for social good.

However, we know that social conscience alone is not enough. Climate actions cannot be just driven by philanthropy. The core purpose of business existence is to make money, so we must address the economic and financial motivations for this to become tangible actions. We know that there is a growing awareness and advocacy of environmental issues and increasing preference for greener investments and products among consumers and investors.

A recent survey by Fidelity highlighted that 57% of people in Asia wanted their money to make a positive change in the world. And 66% of Singaporean investors would consider sustainable investing if they are made more accessible. But of course, we can’t trust the survey completely, as when it comes to putting money where their mouth is, many investors will still look at investment returns.

There are research studies that have found a strong correlation between market performance and ESG ratings. We hope that if that continues to be proven, then the ability to make a positive impact while making money will further incentivize focus on ESG issues. Beyond investing, there’s also a need to better understand how the economics behind financing, insurance, and other financial products can align with the green and sustainability agenda.

We also need to be aware that climate changes will threaten financial resilience and longer term prosperity. These risks include physical risks, transition risks, liability risks, and collectively systemic risks given how interconnected our economies and sectors are. These risks are not black swan events. The issue isn’t the lack of awareness – but whether there are immediate motivations to act (as Mark Carney, former governor of Bank of England, has put it).

Rachel Teo, Head of Futures Unit, GIC says:

Sustainability is integral to GIC’s mandate, which is to protect and enhance the international purchasing power of our reserves that have been placed under our management. And we believe that actually companies with good sustainability practices are expected to deliver good risk-adjusted returns over the long term. It is not just about social responsibility, but sustainability has financial relevance.

The next investment belief that we hold is that it is more constructive to support companies in their transition to a low-carbon or more sustainable business model. That can be done through watermark engagement with companies rather than just divesting out of whole sectors, which reduces our influence to encourage the companies to transition.

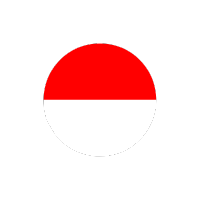

We take a holistic and long term approach when integrating sustainability into our investment process. What does this mean? It means that we not only look at environmental issues, but we balance it with what that means for financial issues or financial costs, and social issues that affect the company and the community that the company operates in. We also look at climate risks from all aspects, not focusing just on transition risks but also fiscal risks.

And finally, when thinking about addressing climate change in our portfolio, we take a holistic approach to integrate climate change considerations at all levels of our investment decision making. We see climate change really as a material investment risk that investors need to manage. It affects investments through three broad channels: physical risk, transmission risk, and market risk.

The first two are very familiar to many of us so I will not go into details. More information can be found on our website, where we publish our thoughts on these topics. But I want to highlight market risk as an impact channel because it is not commonly discussed. And there are two effects here. First is whether markets will price in future climate-related risks via transition rates or physical risk into market pricing today. Second is whether markets will overreact when they start pricing in future climate related risks.

Wei Han Ong, COO & CFO for Singapore and Southeast Asia, JP Morgan says:

Banks are complicated citizens like other companies, so it’s very important that we focus on our physical operations and the environmental impact of our operations. JP Morgan operates in more than 100 countries: in the US we actually have close to 1,000 retail bank branches and many data centers across the world. JP Morgan is a big energy consumer.

I’m glad to say that over the past few years we have been addressing some of the sustainability of our operations. In 2020, we actually achieved carbon neutrality in our operations globally, which is a big step forward. We’ve done that through improving the efficiency of energy use as well as sourcing from renewables. Carbon credits, certificates, and carbon credit offsets also play a key role.

We have a target that by 2030, 100% of our global power needs must come from renewable energy sources. We’re also looking to transition our vehicles to electric cars by 2025 and reduce office paper use going forward. Those are just things that a good corporate citizen should do. Over the past 12- 24 months, I see banks increasingly playing three roles in the sustainability space.

We need to be a financier, so we need to finance our clients’ sustainable solutions and their carbon transition. If you look at estimates that are made by different institutions like the UN, carbon transitions are an expensive exercise. Some estimated costs suggest that it will require US$3 trillion annually between now and 2050 for us to deal with climate change. Other estimates have different numbers, but everything is in the trillions of dollars.

This is an expensive exercise, and that’s where banks are important to mobilize private capital – besides government funding, taxes, and incentives. It’s important that banks play a part in mobilising private capital towards that effort. It’s very important that banks be very conscious about how they think about sustainable solutions and financing those solutions going forward. In our financing portfolio, we actually identified three particular industries that we will focus on helping to reduce carbon intensity: oil and gas, electric power, and auto manufacturing.

Benjamin Soh, Co-Founder & Managing Director, STACS says:

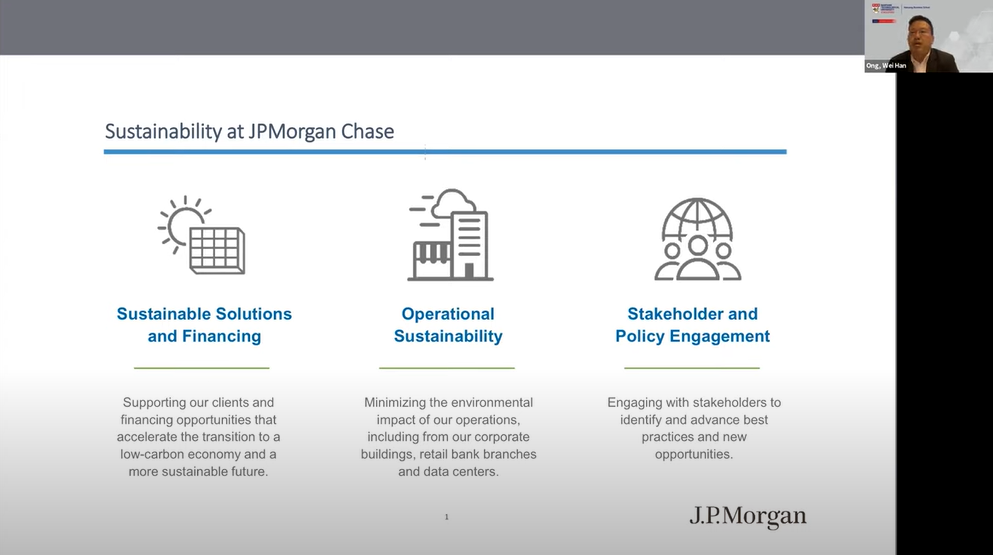

Technology from fintechs can help all stakeholders to improve trust in green finance. Asset managers and banks have assuredly stated that they are very interested in promoting green investments and green financing. And, of course, MAS has many incentives that are laid out for the industry to increase green finance. However, we still see that there are various problems in the market.

There is still a fragmentation of information on one side and a funding gap on the other. The UN’s sustainable development goals suggest there’s a US$2.5 trillion green funding gap every year. Individual corporates are telling us that it is expensive and difficult to get sustainability certification. There’s just simply not enough certifiers or auditors out there to measure every single building or project.

At the same time, financial institutions are facing a problem when they are trying to finance green projects: it is difficult for them to get reliable data analysis to avoid greenwashing. This is because pools of data they rely on are fragmented, with bespoke methods in different industries and markets. It is virtually impossible for the banks to accurately measure end-to-end carbon emissions today.

As a fintech, STACS provides a technology platform to overcome some of these challenges in terms of transparency. The end objective is for institutions, banks, insurance companies, asset managers, etc. to be able to mobilize more capital for the private sector and ultimately ensure we have efficient green and carbon markets.

We feel that at the center of it all, we need a common blockchain-powered nexus, which is why we started building something for the financial industry that is interoperable with any sector providing us information. These sectors in aggregate make up the entire end-to-end value chain, and once on a distributed ledger technology (DLT) layer, we are able to put in place programmable smart contracts for transparency and accountability.

We are very encouraged by innovative products such as sustainability-linked bonds, for example, which are able to trigger financial incentives based on certain KPIs being met. But of course we want to be able to ensure these triggers only occur with credible data. With digitalization, the industry is able to achieve portability of such green financing products across various systems and channels.

Thank you Nanyang Business School for the invite! Once again, you can watch the full panel here.

PRESS CONTACTS

If you are a journalist with media queries, contact us.