Powering Sustainability: Renewable Energy Certificates (RECs) in Driving Asia’s Clean Energy Transition

What are Renewable Energy Certificates (RECs)?

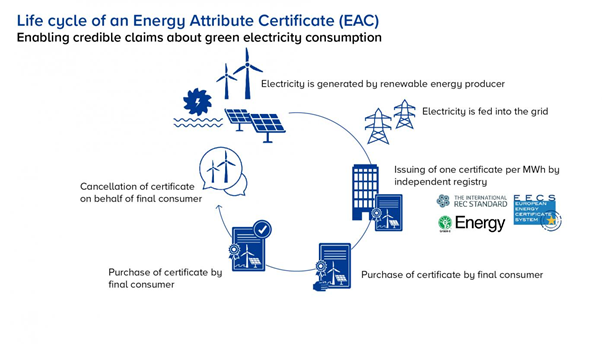

Renewable Energy Certificates (RECs) are a type of Energy Attribute Certificate (EAC). They are tradable, non-tangible energy commodities that represent proof that 1 megawatt-hour (MWh) of electricity was generated from a renewable energy source and added to the grid. Some of these renewable energy sources include: wind, solar, biomass, hydropower, biogas, geothermal, and landfill gas.

RECs are issued by independent third-party organizations that verify and track the production and use of renewable energy. They serve as a market-based solution to promote the development of renewable energy sources by providing financial incentives to renewable energy generators, and an option for corporates to meet their sustainability goals and regulatory requirements related to renewable energy use.

RECs offer companies the opportunity to reduce their Scope 2 Carbon Emissions from electricity use by offsetting the emissions associated with their purchased electricity. Additionally, once a consumer or business owns the REC, they can claim to be powering their operations with the corresponding amount of renewable energy that the RECs represent.

How do RECs differ from carbon credits?

Renewable Energy Certificates (RECs) and Carbon Credits are two distinct offset instruments in the field of sustainability. RECs are proof that one megawatt-hour (MWh) of electricity was generated from a renewable energy source and added to the grid. The purchase of RECs supports the development of renewable energy infrastructure and encourages greater investment in clean energy projects.

Carbon Credits, on the other hand, are tradable certificates or permits which allow organisations to emit a certain amount of carbon emissions. Carbon credits enable businesses to offset their carbon emissions by investing in certified climate action projects that reduce or remove greenhouse gases (GHG) from the atmosphere. Carbon Credits are typically generated through initiatives such as afforestation, renewable energy projects, and energy efficiency initiatives, and are used to incentivise firms to lower their emissions.

Similar to RECs, carbon credit`s must be verified by third-party registry bodies such as Verra and Gold Standard, which are amongst the leading industry standards. Additionally, when both RECs and carbon credits are purchased, they must be permanently retired to avoid the issue of double-counting, so as to ensure that they contribute to real positive climate impact.

Read more about our Industry Insights deep dive into the world of High-Quality Carbon Credits.

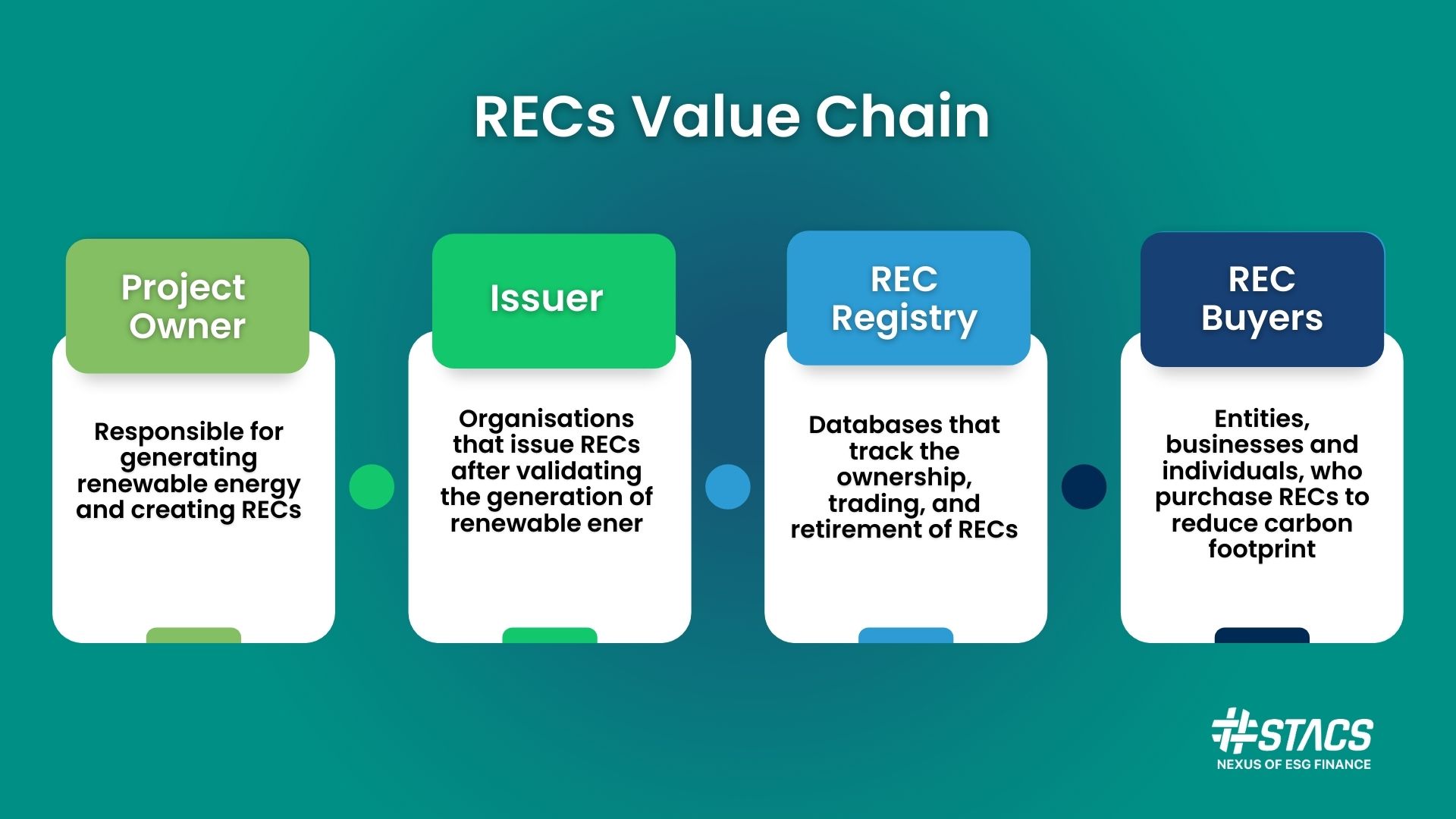

The RECs Value Chain – Breaking down to each Persona

Project Owner

Project Owners are the entity responsible for generating renewable energy, such as a wind or solar farm, or a hydropower plant. Project Owners participate in the RECs market by applying for certification of their renewable energy production, and subsequently selling the RECs to interested buyers. By doing so, project owners monetise the production of renewable energy, which in turn offsets their operational costs. </span

Issuer

The issuer is responsible for validating and verifying the renewable energy production of the project owner and issuing RECs to them. The issuer is typically an independent third-party organization that adheres to internationally recognized standards for RECs, such as the International Renewable Energy Certificate (I-REC) Standard. In some cases, the project owner can also act as the issuer of the RECs. The Electricity Generating Authority of Thailand (EGAT) is one such Issuer. One of the world’s leading independent certifiers of renewable energy, EGAT is the sole local issuer of the I-REC Standard in Thailand, certifying renewable energy production in Thailand to ensure traceability and high-standards of compliance with the I-REC Standard guidelines. EGAT aims to deliver value for Project Owners and proof of claims for Buyers, such as banks, corporates, and organisations.

Find out more about STACS’s partnership with EGAT through ESGpedia.

REC Registry

REC Registries are organisations which offer a database or platform that tracks and manages the issuance, transfer, and retirement of RECs. Some of these registries include the I-REC Standard, APX TIGR, and the American Carbon Registry (ACR). REC Registries provide transparency and accountability for RECs, ensuring that the registration and tracking of RECs meet international quality standards to combat double-counting.

REC Buyers

Buyers of RECs include companies, organisations, or individuals seeking to reduce their carbon footprint in order to meet their emissions targets, or even to demonstrate their corporate social responsibility by supporting the transition to a clean energy economy. Electricity retailers (i.e., companies who sell electricity to end-users) may also purchase RECs to provide customers with an option to purchase renewable energy. Through purchasing RECs, Buyers essentially offset their carbon emissions from non-renewable sources by investing in renewable energy production.

Why should businesses purchase RECs?

Drive Environmental Impact in Asia

When businesses purchase RECs, they directly support the development and growth of renewable energy projects by signaling greater demand for renewable energy. These investments reduce the reliance on fossil fuels and cut GHG emissions, which are a leading contributor to climate change. Businesses in Asia hold a strategically important role in the fight against climate change, as STACS’s Chief Commercial Officer, Sharon Yuen, adds.

Justify Sustainability Claims

Since there is no way of telling whether the electricity businesses and end-users draw from the grid came from a renewable source or not, it is difficult for businesses to make a credible claim that their operations rely solely on renewable energy. RECs therefore represent the sole way to display to a business’ stakeholders, comprising investors and financiers, amongst others, that the energy the business is operating off originates from a renewable source, and that it is committed to making strides towards decarbonisation and actively embracing sustainability.Enhanced Attractiveness to Financiers and Corporates

Today, demands of business stakeholders are shifting to increasingly prioritise sustainability and environmental consciousness. These stakeholders want to see companies taking action to cut their GHG emissions, minimise their waste, and invest in renewable energy sources. Additionally, RECs also improve the business competitiveness of Small and Medium Enterprises (SMEs), making them more attractive to large corporations who are increasingly looking to procure sustainably and decarbonisae their entire supply chain. Purchasing RECs allows companies to evidence their commitment to reducing Scope 2 emissions to their stakeholders. As a result, they differentiate themselves from their competitors and attract a growing body of environmentally conscious customers and investors, developing an edge over their competitors and improving their industry competitiveness.What are some common problems with RECs?

Double Counting

Although RECs have accelerated the progress of renewable energy production globally, concerns regarding double counting have led to doubts regarding the reliability of the renewable energy market. Double counting occurs either when a REC associated with the generation of 1 MWh is sold more than once, or when two or more entities claim the same environmental benefits from one REC.

Double counting artificially inflates the demand for RECs and the perceived impact of renewable energy production, leading to challenges in the accurate tracking and reporting of renewable energy use and emissions reductions. Furthermore, double counting may also affect the credibility of businesses and expose them to accusations of greenwashing.

Fragmented Data

Beyond double counting, Yuen elaborated on the issue of data fragmentation within the RECs space as well, “Data in the industry is also in disparate and fragmented sources, with data often stored in a plethora of different registries. These challenges not only undermine trust in RECs, but also hinder the impact of RECs towards real-world climate mitigation. This is something that ESGpedia looks to address with data aggregation.”

The lack of a unified data registry within the RECs marketplace results in data fragmentation, making it hard for buyers to verify the source and authenticity of the RECs they are purchasing. Additionally, this issue also creates inefficiencies in the market, making it cumbersome for buyers to locate high-quality projects to invest in.

Is it all over for RECs?

In spite of the challenging and deep-rooted issues that exist in the RECs marketplace, RECs remain a critical instrument in the global transition towards clean, renewable energy. To ensure its effectiveness and to resolve existing challenges, what is required is better data – aggregated, unified on a common registry, and easily accessible to various stakeholders along the value chain. As Yuen alluded to earlier, this is what STACS’s ESGpedia provides.

ESGpedia – Enhancing Transparency in the RECs Market

ESGpedia is a global ESG registry recording and maintaining the provenance of ESG certifications accorded by certification bodies in different sectors, as well as data and metrics that are verified by qualified third-party auditors. Integrated with internationally recognised REC registries, ESGpedia serves as a common registry aggregating and harmonising RECs data to prevent double counting of RECs and enhance traceability of RECs lifecycle .

ESGpedia provides end-to-end traceability of RECs, as well as prevents double-counting of RECs by automatically retiring RECs upon purchase, with details recorded immutably on the platform.

STACS-EGAT Partnership: Prevent double counting of RECs in Thailand and ASEAN