Digital assets and sustainability-linked bonds are a key component of the future of financial services, as the world transitions to green mandates in every industry including banking.

At STACS, with our mission to make capital markets simpler and sustainable, this shift to green fintech has been at the forefront of our agenda for some time, evidenced by the launch of our GreenSTACS platform.

While only a proof-of-concept (PoC), most recently we marked an important milestone by completing our ‘bond in a box’ solution with Deutsche Bank in Singapore and put out a corresponding public report co-written with Deutsche Bank that delved into detail on ‘Project Benja’. For this project, STACS was awarded the Financial Sector Technology and Innovation (FSTI) POC grant on 29 Oct 2020, administered by the Monetary Authority of Singapore (MAS).

Set in the context of tokenized securities in the securities market, our team worked closely with the team Deutsche Bank on digital assets interoperability across platforms and related custody.

A wide-ranging collaboration

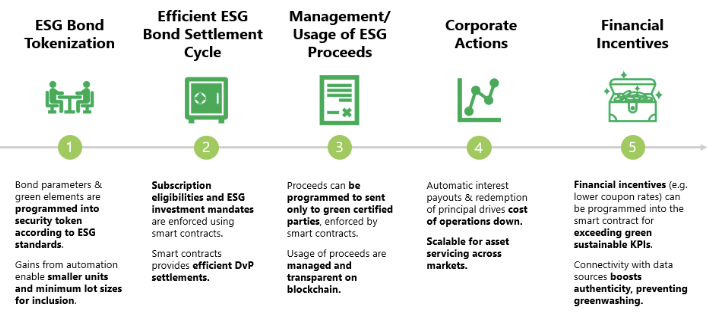

This spanned digital securities and cash delivery-versus-payment practice, distributed ledger technology (DLT) to traditional systems connectivity, operating model evolution, and smart contract templates including those involving sustainability-linked digital bonds.

As we explained in the joint report, we are living through a time of numerous technological advancements that will evolve and influence financial services: e-commerce, instant payments, artificial intelligence-enabled services, and of course DLT-based digital assets and services.

These advancements are also driving changes in capital markets as financial institutions, Fintechs, regulators, multilateral organisations, and other stakeholders utilise these new capabilities to create and realise new benefits for markets, users, and society.

Our premise for the collaboration was simple: the interest of the financial sector in DLT has heightened over the past few years, with a growing number of PoCs being conducted globally to explore the merits and applicability of the technology in capital markets.

Towards full commercialisation

The industry has now reached a stage where participants are progressing to realising broad commercial possibilities.

However, even as adoption gains pace, challenges are also arising from the needs to interoperate which can lower the barrier to participation from more ecosystem participants and increase the important network effects.

We believe the collaborative efforts in this collaboration with Deutsche Bank shows just that commercial potential.

Fragmented liquidity can be overcome through the interoperability between DLT and existing traditional systems.

Multiple payment channels with the support of multiple payment/currency options, and extending into the ESG space to achieve a common technology infrastructure that fulfils practicality and sustainability.

Select use cases

The end of the project signifies the beginning of a meaningful journey towards the ultimate implementation of DLT as the underlying backbone for an optimised and efficient end-to-end bond lifecycle leading to better profitability.

We hope that the sharing of reports like Project Benja with the wider market will help to promote the adoption of new technology within the Singapore (and global) capital markets.

Please do download the full report, which includes not just our collaboration with Deutsche Bank but also additional inputs and use cases contributed by project collaborators such as Bursa Malaysia, UBS, and the Union Bank of the Philippines.

As our Co-founder Benjamin Soh and Deutsche Bank’s Boon-Hiong Chan make clear in their jointly-penned forward: “These esteemed collaborators provided insights from their different capital market roles to determine innovative deployment that leverages on the experiment’s results.”

We look forward to working on more capital market innovations with our partners in the near future.

About STACS

STACS (Hashstacs Pte Ltd) is a Singapore FinTech development company with a Vision to provide Transformative Technology for the Financial Industry, with its complete infrastructure of live institutional green and ESG-enabling platforms that make global markets simpler. STACS is leading the way forward by digitalizing assets, processes, and documents using its patent-pending STACS Blockchain technology. Its clients and partners include global banks, national stock exchanges, and asset managers. STACS is The Asset Triple A Digital Awards 2021 FinTech Startup of the Year, an Award Winner of the Monetary Authority of Singapore (MAS) Global FinTech Innovation Challenge Awards 2020, and a two-times awardee of the Financial Sector Technology and Innovation (FSTI) Proof of Concept (POC) grant, under the Financial Sector Development Fund administered by MAS. STACS aims to empower financial institutions to unlock massive value and discover new opportunities through our technology.

For Enquiries

[email protected]

Website

www.stacs.io