Milestones and Progress as The Nexus of ESG Finance

This year, our ESGpedia platform gained regional traction and garnered the trust of our rapidly expanding ecosystem of partners across both the financial and non-financial sectors.

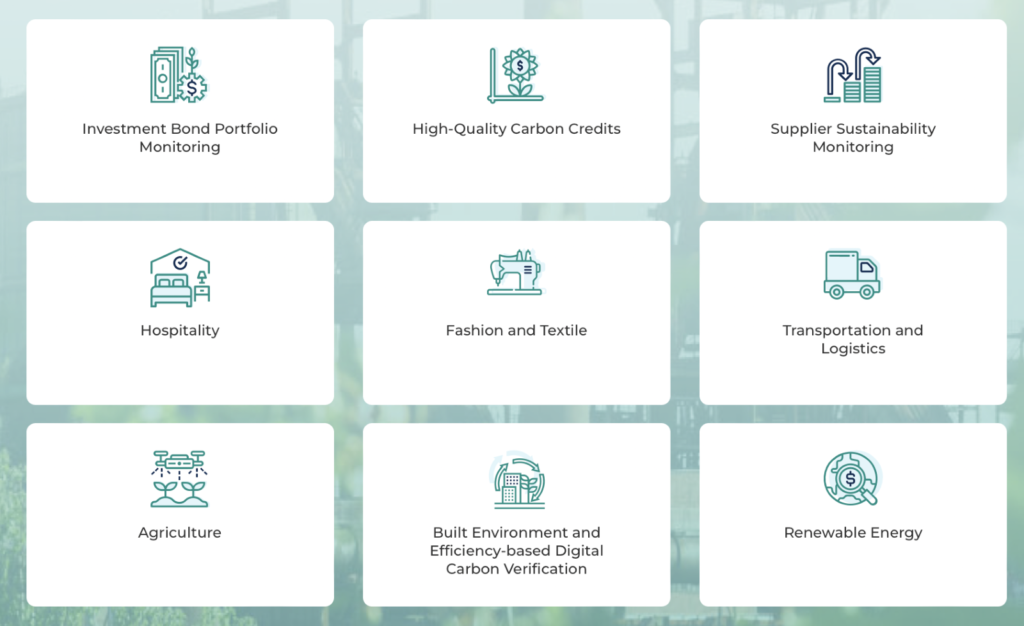

From launch to empowering ESG finance and sustainability in multiple sectors across Asia today

ESGpedia officially launched on 18 May at the Project Greenprint Industry Showcase event. Within half a year, during the Singapore FinTech Festival 2022 week, we are proud to announce that ESGpedia is now live and empowering 9 (and growing) sectors across Asia towards net zero: Investment Portfolio Monitoring, High-Quality Carbon Credits, Supplier Sustainability Monitoring, Hospitality, Fashion and Textile, Transportation and Logistics, Agriculture, Built Environment and Efficiency-based Digital Carbon Verification, and Renewable Energy.

Read the Launch Press Release, with quotes from MAS and partners (18 May)

Read the latest Press Release with partners across 9 industry sectors (9 Nov)

Regional scale-up

With more than 40 global financial institutions and corporates now onboard ESGpedia, we seek to continue scaling up across Asia to empower the region’s net zero goals and contribute to Asia’s ESG FinTech capabilities.

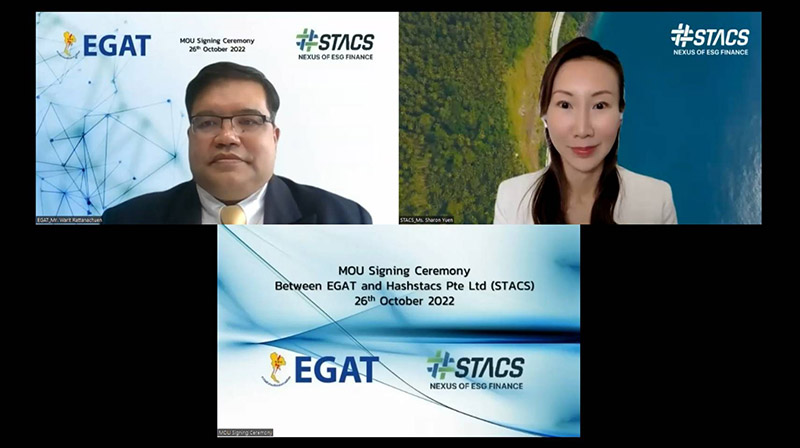

Notably, we officially expanded our scope to the Thailand market through our strategic partnership with Thailand state-owned power utility EGAT, enhancing the Renewable Energy Certificates (RECs) market in Thailand and ASEAN.

Check out the companies onboard ESGpedia via our Partners page

Hear what our partners have to say via our Testimonial page

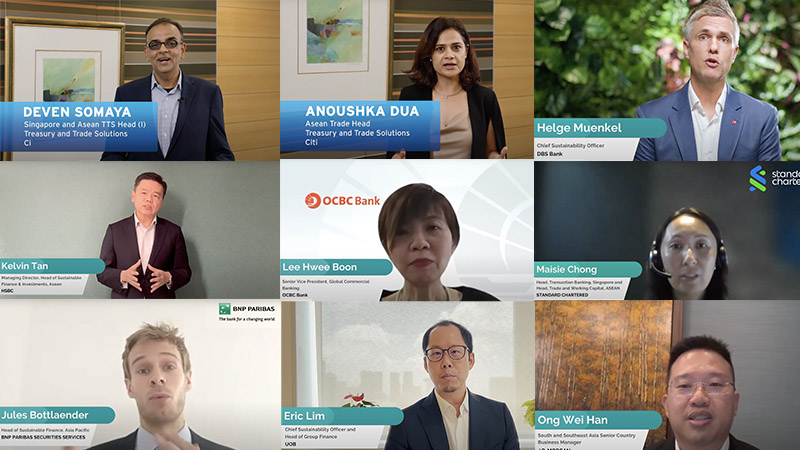

Central data pillar empowering Sustainable Finance

As the central data registry for the financial sector, ESGpedia enables financial institutions to enhance trust in sustainable financing. We asked our global financial institution partners what holistic ESG data and digital tools on ESGpedia mean to them.

Special thanks to our FI partners from Citi, DBS Bank, HSBC, OCBC Bank, Standard Chartered, BNP Paribas Securities Services, ING Bank N.V., J.P. Morgan, UOB, Fidelity International, Singlife with Aviva, and UBS.

Watch here for testimonials by our FI partners

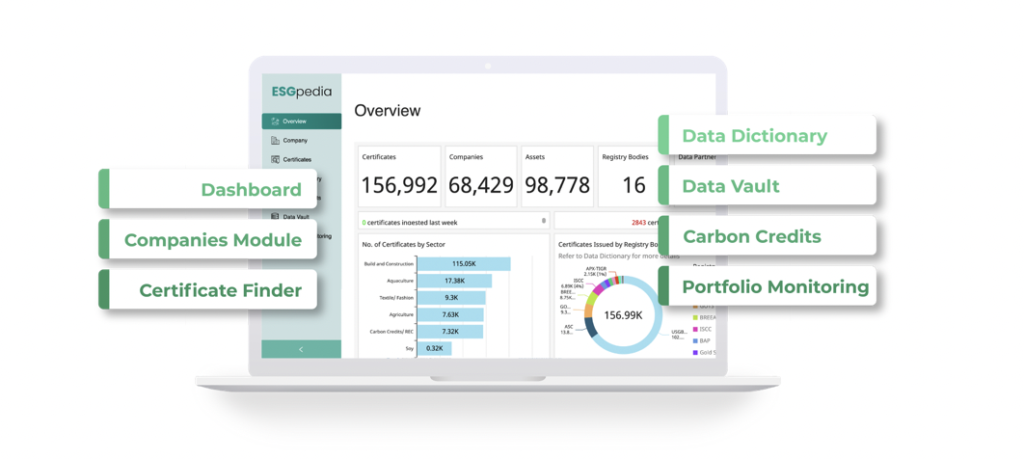

First-in-the-world; ahead in Tech for ESG Finance & Sustainability

Considering the amount of work required in data aggregation and harmonisation, ESGpedia is first-in-the-world and far ahead in terms of aggregating ESG credentials across multiple industries and regions. Big credits to the STACS Engineering team and the collaboration of our data and fintech partners!

The platform technical capabilities and features are live and continually enhanced with constant inputs from our partners onboard. Today, ESGpedia already aggregates data of more than >190,000 certificates, covering more than >58,000 companies, with 18 certification registries and 19 other data partners, covering multiple industry sectors.

Key features of ESGpedia include: Certificate Checker, Data Dictionary, Portfolio Analytics, Automated Risk Notifications, Carbon Credits Module

Epicentre of a robust ecosytem – providing ESG Playbooks for corporates to connect

Operating the Greenprint ESG Registry, we have become an epicentre of a robust ecosystem of ESG partners. Corporates of any size can connect with our robust ecosystem of partners via our ESG Playbooks solution to achieve greater ESG capabilities, reporting, and attain ESG financial services.

Launching Restorify with Razer Inc. to provide end-to-end traceability of high-quality carbon offsets for end-consumer

A key milestone of 2022 is our long-in-the-works partnership with Razer Inc. on the launch of Restorify. Powered by STACS, Restorify is an e-commerce service that allows businesses to provide traceable carbon neutral checkout for end-consumers through fractionalised high-quality carbon offsets, traceable end-to-end on ESGpedia.

Starting from the gaming industry, Razer anfd STACS aim to scale the solution across multiple industries to encourage greater society-wide engagement and impact towards positive climate change.

Read Press Release

Learn More about Restorify by Razer and STACS

Amplifying our voice on Sustainable Finance through Media Coverage and Opinion Pieces

In 2022, our good works in the ESG space were recognised and covered through many press coverages (both print and digital) and opinion pieces we contributed in. In particular, we hit the screens through the Channel NewsAsia Money Mind: Wealth Management TV episode on Sustainable Investing in Volatile Times!

Read key highlights and watch playback of CNA episode here

Other notable press coverages/ media appearances include: The Business Times Press Coverage (Jan 2022), The Straits Times Press Coverage (Jan 2022), The Business Times Press Coverage (May 2022), The Business Times Press Coverage (Nov 2022), Singapore FinTech News Interview at Singapore FinTech Festival, MoneyFM 89.3 Radio Interview, Tech in Asia x IMDA feature article, KrASIA Q&A, United Nations ESCAP article contribution, The Business Times opinion piece.

Leading SFA Green and Sustainable FinTech Subcommittee as new Chairman

In January 2022, our Managing Director, Benjamin Soh, was appointed as the new Chairman of the Singapore Fintech Association’s (SFA) Green and Sustainable FinTech Subcommittee. We are proud to share that the subcommittee has since made big progress in building a vibrant Green FinTech ecosystem and putting together our technologies and capabilities across Singapore and Asia, to accelerate the nation’s Green Plan 2030.

Throughout the year, STACS partnered with the SFA on numerous meaningful industry initiatives and speaking appearances to educate, uplift, and connect on sustainable finance.

Come chat with us! Join the SFA Green and Sustainable FinTech community’s Telegram group

Brand New Corporate Video as Asia’s leading ESG FinTech

STACS’ Commitment: ESG FinTech to Bring Forward the Future of Sustainability

As Asia’s leading ESG FinTech, we propel companies forward on their sustainability journey through holistic data, digital tools, and effective ESG financing. In partnership with the Monetary Authority of Singapore (MAS)’s Project Greenprint, our rapidly expanding ecosystem has brought together global financial institutions and corporates with the same desire for sustainability and net zero.

Watch our commitment to Sustainable Finance

STACS appoints new Chief Commercial Officer, Sharon Yuen

Joining us in March 2022 at an opportune time when STACS was rapidly expanding its verticals in ESG Finance, Sharon Yuen has since led the company’s go-to-market strategy and driven business growth expansion across Asia with great success.

Asia’s Award-Winning ESG FinTech and Data platform provider

The awards and accolades we achieved this year are testaments to STACS being Asia’s trusted ESG FinTech and Data platform provider, offering both quality and enterprise security assurance, and operating in accordance with international standards.

Full list of Awards & Accolades

Advancing the region’s ESG Finance knowledge and capabilities through events

We believe that collaboration is truly the key in accelerating Asia’s race towards net zero, and a big driver of collective action is education and building knowledge.

Hosting industry events on ESG Finance

In 2022, STACS hosted two major Project Greenprint industry events aligned with key milestones of ESGpedia, the Greenprint ESG Registry, to an audience of financial institutions, corporates, NGOs, and supranational agencies, from all over the world:

[18 May] Project Greenprint Industry Showcase Event, in partnership with the MAS and SFA, where ESGpedia was officially launched

[31 Oct, 1 Nov] Greenprint Registry Showcase Event, in partnership with PwC Singapore and SFA, where the 9 live use cases of ESGpedia were unveiled

Speaking at global conferences to advocate for ESG Finance through Technology

We were also invited to speak at many global ESG-focused conferences and events, such as COP27 in Egypt, Singapore FinTech Festival, Bank of Thailand Digital Finance Conference, Asian Development Bank (ADB)’s ‘Environmental and Social Sustainability in Trade and Supply Chains’ Workshop in Istanbul, Asia Tech x Singapore, Singapore-Vietnam Business Roundtable and Sustainability Showcase – Discussant (in conjunction with the state visit to Vietnam by President Halimah Yacob), IMAS-Bloomberg Investment Conference, IMAS Digital Summit, and more.

Watch ESGpedia sharing at COP27

Watch panel discussion at COP27

Educating the next generation of leaders on Digitalisation for Sustainable Finance

To truly enable a successful green transition, the next generation needs to be equipped with the necessary skillsets. This year, STACS celebrated Earth Day with National University of Singapore (NUS) Master’s Club through an educational webinar.

Our Managing Director, Benjamin Soh, was also a Guest Lecturer at NUS Executive Education for Carbon Markets, Singapore Management University, while our Carbon Solutions Lead, Kimberly Lee, shared with Business students in Ngee Ann Polytechnic on how digitalisation can accelerate sustainability.

Watch the full playbacks of our 2022 events and speaking appearances on our YouTube channel

With the timely launch of the Climate Action Data Trust and the United Nations ESCAP (Economic and Social Commission for Asia and the Pacific) emphasizing the importance of a common ESG data registry platform like STACS’ ESGpedia in December 2022, we are heartened that ESG is now at the forefront of business decisions, and confident that STACS will continue its momentum and reach higher peaks in 2023.

This is an exciting journey as we are currently in close collaboration with key global stakeholders across a wide span of industries on upcoming roadmaps and pipelines, including a big announcement on our efforts in ESG reporting for MSMEs, which represent 90 per cent of businesses globally. We aim to expand our outreach to become a central ESG data repository in Asia and are scaling up to enable more industries to decarbonize via high-quality carbon credits traceable end-to-end on ESGpedia.

Asia is where the fight against climate change will be won or lost. The good news is that the technology solutions to support the region’s transition towards net zero are already in place. We look forward to partnering with like-minded industry partners to jointly bring forward the future of Sustainable Finance and win the race against climate change.