STACS featured on The Ken — The divide-and-sell lure to DBS’ digital exchange

The first bank to take a plunge in crypto waters, Singapore’s banking leader DBS recently launched ‘Digital Exchange’, and SGX has already invested in it. The doors to the future have opened; who all can walk through?

DBS is the first bank to launch a Digital Exchange, allowing customers to trade in cryptocurrency and digital assets.

These associated blockchain entities have come a long way since the 2017 initial coin bubble that popped with regulatory definition.

The Digital Exchange caters to high net worth individuals, providing a variety of deals and more ways to trade assets.

This is also a step in Singapore’s smart financial hub aspirations — and SGX has jumped at it.

12 January 2021 — When a major bank like Singapore’s DBS decides to adopt blockchain technology, you know the tech is finally going mainstream.

In a first, DBS launched ‘DBS Digital Exchange’ in December 2020, where one can buy and sell cryptocurrency like Bitcoin, which has soared past US$40,000. DBS now has a digital asset exchange as well, which allows everything from companies to properties to be broken up for a larger pool for investors to get in on.

But DBS isn’t alone in this attempt to legitimise crypto assets. By 10 December, the Singapore Exchange (SGX) had already taken a 10% stake in DBS’ Digital Exchange. What’s more, SGX has invested in not one, not two, but three digital asset exchanges, including Digital Exchange.

Despite these prior investments, though, so far, SGX has only ever dabbled in utilising blockchain in its market operations — for a digital bond, where ownership is tracked via digital tokens on the blockchain.

“As innovators in Asia’s capital markets infrastructure, we believe in the digitalisation of markets across asset classes and customer segments,” an SGX spokesperson told The Ken.

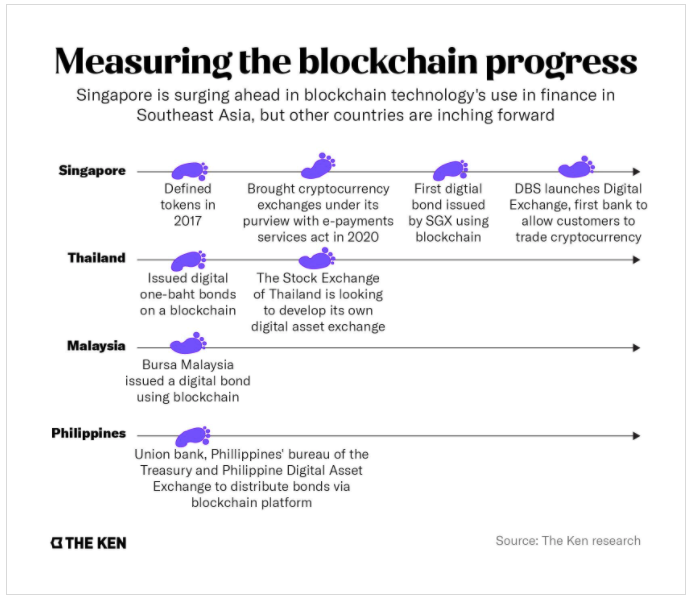

But how has Singapore come so far in legitimising digital assets when the rest of the world is, at best, wary, if not outright opposed, to trading in cryptocurrency? Because Singapore laid the foundation three years ago.

Security tokens, or digital contracts for a fraction of an asset, operated in regulatory grey areas until the Monetary Authority of Singapore (MAS) came out to define it. “The announcement by MAS in 2017 was a game changer, because it gave security tokens credibility and legitimacy, and it laid the foundations for security tokens to eventually become mainstream,” Choo Oi Yee, chief commercial officer of digital asset exchange, iSTOX told The Ken.

With more clarity from the regulator, digital asset exchanges have gotten licences to operate in the city-state. Foreign financial institutions are also attempting to get on the act, with Swiss-based digital asset exchange SIX Digital Exchange, and Japanese investment company SBI Digital Asset Holdings planning to open a digital assets exchange in Singapore by 2022.

“It’s about validating the market space, validating that iSTOX has moved into a space that has also captured the imagination of the board of DBS,” said iSTOX’s Choo.

For DBS, this move is a signal of its private banking ambitions, moving from a regional clientele to something more global. And in doing so, reaching a coveted cohort.

The private equity space is growing, with a quarter of the US$4.1 trillion assets under management worldwide currently being managed in Asia Pacific. Simply put, high net worth individuals (HNIs) are looking for someone to manage their assets and money, and digital exchanges can help out. The Ken sent questions to DBS, but the bank declined to answer them.

Evidently, these exchanges are currently out of reach for the average Joe. But with funding opportunities about to turn more abundant than before, both big and small players have much to tap into.

Getting buy-ins

Every financial product is regulated, which means the transition to digital technology will need checks, too. For instance, will digital bonds require a paper certificate?

These are some issues that digital asset exchanges faced, said Lim Chuan Ji, director at blockchain technology provider STACS. STACS has worked with Bursa Malaysia to complete a bond issuance at the Labuan exchange.

“There is papering of bonds and certificates; if I put it on blockchain, from a regulatory and operational perspective, do I still need to issue a paper certificate for the bond? Those are some of the things that we need to overcome,” said Lim.

The bigger challenge, however, has been getting buy-ins from both the industry and investors. Back in 2017, initial coin offerings (ICO) saw a boom, where investors could buy utility tokens in various blockchain companies. But the lack of regulatory clarity threw investors off. Soon after, MAS defined security and utility tokens. And with regulations like the e-payments services act, it brought cryptocurrency exchanges under its regulatory purview.

Regulatory buy-in is important for any fledgling financial technology. After all, without the regulator’s ok, no one in the financial industry would be willing to even try anything. Digital asset exchanges are working towards getting their recognised market operator licence. Singapore is ahead in pushing this, notes an executive in the digital asset exchange space who can’t be seen discussing policy, as MAS is encouraging it. All due to the regulator wanting an environment where it has influence in developing the space.

“The digital asset ecosystem has been growing in Singapore, with some players being authorised by the MAS as early as 2018. Specifically, digital asset players have leveraged on initiatives such as regulatory sandbox and Sandbox Express to experiment their innovation with actual customers. They have also tapped on financial grants to develop innovative solutions or conduct proof-of-concepts,” a MAS spokesperson told The Ken.

That said, MAS also insists that it’ll continue to review its regulations and “adapt where necessary”. While it has allowed “payment tokens” like Bitcoin trade in light of “the market demand from institutional investors looking for a regulated option” a.k.a HNI, “MAS does not view payment token derivatives to be suitable for most retail investors.” It has even asked financial institutions to put in place additional measures to discourage retail participation.

This alignment with the regulator extends into taxation as well, with the Inland Revenue Authority of Singapore releasing a guide to levy income tax on digital tokens.

“MAS will continue to monitor closely the risks and scale of digital tokens as they continue to evolve in design. Our approach will remain consistent, focusing on addressing the risks associated with such products, while remaining facilitative of innovation,” the MAS spokesperson said.

This is in contrast to the US, where the US Securities and Exchange Commission (SEC) has begun cracking down on Ripple, a settlement, currency exchange and remittance network built on a blockchain. Its pitch to banks was a global network to enable financial transactions of any size within minutes, utilising its token, XRP.

Singapore’s stance is one most countries would term risky. But it comes with benefits. After all, digital asset exchanges can solve one of the key things any vibrant market needs. Liquidity.

Turning it liquid

But, and it’s a big but, digital asset exchanges are currently only available to HNIs. In Singapore, that means accredited investors, or investors with over S$2 million (US$1.5 million) in assets. This leaves out most retail investors, limiting the reach of the digital asset exchanges.

For HNIs, thanks to digital assets’ ability to be put in smaller fractions, nothing is now out of reach. Assets can be divvied up, turned into securities.

A building that costs US$10 million to invest in could theoretically be split into smaller lot sizes of, say, US$10,000 each. Suddenly, more investors can trade these lots, rather than holding it to maturity. Having an option to cash out holdings is always one investors look out for.

SGX, too, has something to gain here. The multi-asset nature of SGX has seen investments in digital asset exchanges and others such as foreign exchange trading platform, BidFX. The exchange is clearly looking to keep up to date with the digital space.

“One of the key highlights of digital assets and fractionalisation is being able to introduce liquidity into non-traditional and illiquid asset classes. The marginal cost of serving each additional investor is a lot lower,” said STACS’ Lim.

For instance, iStox has launched a ‘unicorn fund’ — or a private equity fund investing in unicorn startups — with a minimum investment of US$20,000. This is far below the usual minimum thresholds of US$100,000 to US$1 million, all thanks to tokenisation and fractionalisation. The lower minimum sums opens up the fund to more investors that would have previously been unable to afford to buy in, expanding the investor pool that can be tapped.

This also extends into products that previously had little transparency or long lock-in periods, such as private equity funds and shares in unicorn startups. These products lack a public market, with private markets requiring sellers to look for buyers and vice-versa. That too without a public platform on pricing and discovery.

SGX is looking to fill this gap as well. “We will work with DBS to explore opportunities to deepen the liquidity, scale and growth of Singapore’s capital markets in the growing area of digital assets,” the SGX spokesperson said.

Still, with HNIs making up 80% of a bank’s income, it literally pays to listen to them. And DBS Digital Exchange is looking to help the bank improve its retention and attraction to such individuals.

Enough for all

A report by management consultancy Oliver Wyman and Morgan Stanley even advocates for banks to consider developing digital asset offerings to attract HNIs.

By even building such an exchange, DBS is looking to challenge the giants in the private banking world such as UBS, Credit Suisse, and Société Générale. The ability of these banks to get access to deals, including shares in yet-to-be-listed unicorn startups, is what attracts HNIs to them.

However, when clients wish to sell their holdings in illiquid or non-public financial products and instruments, relationship managers often shout across the office floor to find a buyer. This informal system, while appearing to meet the demands of clients, doesn’t present the client with options. DBS Digital Exchange aims to solve that, said a former private banker who can’t be seen discussing their former job.

“DBS is local and they can’t see that global product range, but they are trying. There is an unevenness in the private banking space; the inequality is very high,” they said.

For instance, if a client buys into a 10-year fund, they can’t sell their holdings in the fund when they need the money. A digital exchange can allow customers to sell internally to other customers within the bank.

“This means that DBS has slightly more pulling power and clients will do more with them because there is more liquidity and issuers will see more allocations,” said the former private banker.

This is something iStox claims it’s also seeing on its platform, with over 20% of its current investors not based in Singapore.

Startups could also benefit here as HNIs can increasingly participate in funding growth-state companies digitally. Digital asset exchanges provide a starting point for some investors to learn, evaluate and start investing, said iSTOX’s Choo.

DBS’ arrival on the digital exchange scene, therefore, benefits more than one party. And it’s a sector that’ll welcome more players. At least at this stage.

“With more players offering digitised securities, there will be more public education about portfolio construction and more avenues for investors to diversify their portfolios,” said iSTOX’s Choo.

Technology providers like STACS are similarly not worried about the big fish crowding the pond, especially since banks are less likely to build their own technology platforms.

“We’ve realised that most institutions are users of technology, rather than sole developers of the technology,” said Hashstac’s Lim. “So the route that we’ve seen most banks adopt, especially recently, is one of co-development with the fintechs, and subsequently joint partnerships.”

For instance, JP Morgan’s blockchain project, Quorum, was developed in-house for internal use. But according to an executive in the blockchain industry who can’t be seen discussing competitors, JP Morgan’s own customers weren’t comfortable using it. This eventually led to the bank selling off the technology to a third-party.

Perhaps that’s the same reason SGX has come onboard as a partner in DBS’ venture: to provide a neutral party and allay fears of rigging or tampering. SGX’s statement does hint at that.

“What we bring to the table is our strengths in market infrastructure and risk management; there are significant opportunities to bring trust and efficiency in price discovery to the global digital assets space. As the exchange partner of choice in Asia, we can share our expertise in building successful, regulated marketplaces, while also benefiting from the ecosystem this would create for digital assets,” the SGX spokesperson said.

While currently the exchange only has cryptocurrency indices, and it’s not trading any actual cryptocurrencies, SGX needs to keep abreast of what others are doing in adjacent markets. Cryptocurrency could be the next asset class and SGX wants a foot in the game. And a 10% stake is a small price to pay for that.

Singapore’s role as a financial hub is also likely to get a boost from this development, as it strives to be at the front of financial developments. From digital banks to e-payments, MAS has been building up a smart financial centre, and this move is just an extension of that course. Having a headstart in regulating cryptocurrency and digital asset exchanges has put Singapore on the map, and perhaps in the lead to its regional rivals.

Like a rising tide that lifts all boats, DBS’ emergence into the digital asset exchange space not only brings validation to current players, but this might be the start of a vibrant ecosystem that would open up more investment choices to everyone. For now, it’ll have to start with those with the capacity to lose.

Headline image credit: cryptostock/Pixabay

The original article also appeared on:

https://the-ken.com/sea/story/the-divide-and-sell-lure-to-dbs-digital-exchange/

About STACS

STACS (Hashstacs Pte Ltd) is a Singapore FinTech development company with a Vision to provide Transformative Technology for the Financial Industry, with its complete infrastructure of ready platforms that make global markets simpler. STACS is leading the way forward by digitalizing assets, processes, and documents using its proprietary STACS Blockchain technology. Its clients and partners include global investment banks, national stock exchanges, custodian banks, asset managers, and private banks. STACS is an Award Winner of the Monetary Authority of Singapore (MAS) Global FinTech Innovation Challenge Awards 2020, a technology partner of Project Ubin led by MAS, and also a two-times awardee of the Financial Sector Technology and Innovation (FSTI) Proof of Concept (POC) grant, under the Financial Sector Development Fund administered by MAS. STACS remains committed to its Mission to empower financial institutions to discover new opportunities through its technology.

For Enquiries

[email protected]

Website

www.stacs.io