STACS: 2021 in Review – Enabling Sustainable Finance in partnership with the Monetary Authority of Singapore (MAS)

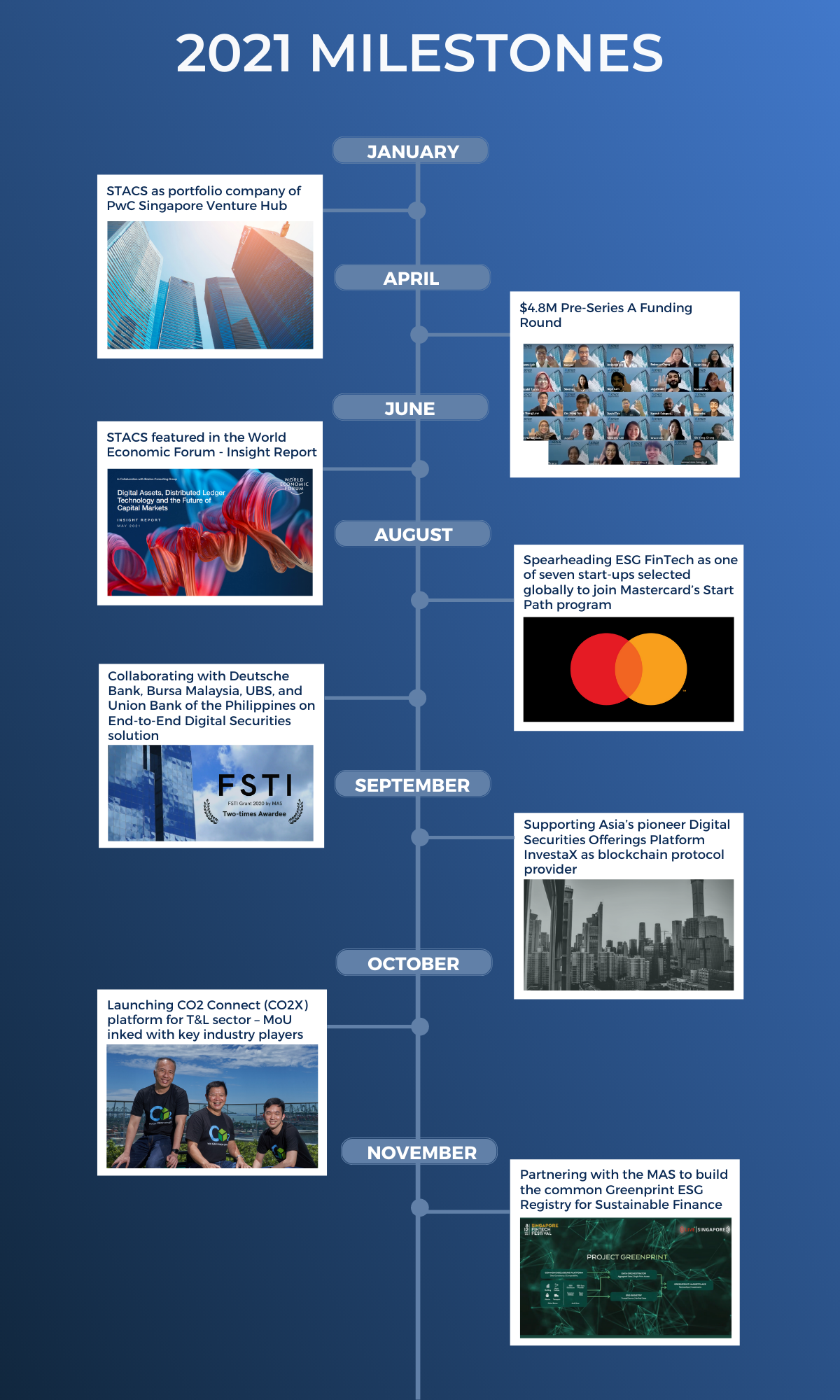

From key milestones marked to purposeful partnerships forged, 2021 has truly been a monumental one for us at STACS in the Green FinTech space. Collectively accelerating the Sustainable Finance agenda with the Monetary Authority of Singapore (MAS) and our ecosystem of partners, we are excited to continue moving the needle on sustainable finance in the financial industry and across all sectors.

Thank you for journeying with us on our mission to unlock value and enable Sustainable Finance. Let’s take a look back at the key highlights of 2021!

The Nexus of ESG Finance

Leveraging on our good work in the capital markets, our business focus expanded to include Sustainable Finance. This year, STACS took up a critical role as the ESG Nexus between the financial industry and sustainability, with our long-in-the-works partnership with the MAS on the Project Greenprint ESG Registry, as well as our new joint venture: CO2 Connect (CO2X).

STACS and MAS partner to build Greenprint ESG Registry for Sustainable Finance

Serving as the common ESG data platform for companies in all sectors, the Greenprint ESG Registry built by STACS in partnership with the MAS, exemplifies the nation’s green fintech capabilities, provides accessibility to quality ESG data of various industry sectors, and enhances the mobilisation of ESG capital.

With more than 10 leading financial institutions and corporates from various sectors already onboard, STACS and the MAS look forward to scaling up the Greenprint ESG Registry with financial institutions, ESG data service providers, certification bodies, ratings agencies, other fintech firms, and corporates from various sectors.

Incorporating Integrated ESG Solutions in STACS Vetta Platform: Enhanced ESG Finance and High-Quality Carbon Credits

On top of the Greenprint ESG Data Registry, STACS provides additional modules that enable companies of all sizes to unlock value in Enhanced ESG Finance via effective ESG financing, ESG investments, ESG insurance, and indisputable quality impact reports, as well as High-Quality Carbon Credits which generate secondary stream of income.

Launching CO2 Connect (CO2X) platform for the Transport and Logistics Sector – MoU inked with key industry players including Aviva Singlife, EY, OCBC Bank, and UOB

Quickly gaining industry traction with several official mentions by financial leaders during the Singapore FinTech Festival 2021, our newly established Joint Venture – CO2 Connect (CO2X), with fellow homegrown technology companies, Ascent Solutions Pte Ltd and Evercomm Singapore launched in October, leveraging DLT, IoT, and Data Analytics to drive sustainability for the transport and logistics sector.

Expanding our good work in the capital markets, in partnership with leading Financial Institutions

Our ecosystem of partners on our Asset/Wealth Management and End-to-End Digital Securities solutions continues to expand, as we enable them to unlock massive value and opportunities in the industry via DLT, enabling efficiencies, risk management, servicing capacity, and an overall increase in profit.

Unlocking efficiencies and improving risk management for global leading custodians and asset managers via our Asset and Wealth Management solution

Deployed live, our solution was featured as one of the few live industry platforms for Trade Lifecycle Management in this year’s World Economic Forum report. Long-standing partners onboard our real-time multi-asset trade processing platform such as Eastspring Investments and BNP Paribas Securities Services have observed massive freed up capital enabled by same-day clearing, >96% elimination of trade breaks, improvement in risk management, and are now able to focus their resources on the value-added items. Phase 2 of our collaboration is in the works and will be announced sometime mid this year, with the addition of more industry participants and clients.

Supporting InvestaX, UBS, State Street, and CMS as blockchain platform provider in PoC tokenization of Singapore Variable Capital Companies (e-VCC) funds industry

Selected as the blockchain protocol provider for Project e-VCC, STACS supported the global first initiative led by InvestaX, UBS, State Street, and CMS, and jointly supported by PwC Singapore and The Tezos Foundation. Industry participants were able to determine the lifecycle and workflow processes for efficiencies gained using an e-VCC by the relevant stakeholders, and in particular, where the use of DLT could enable new market opportunities and operating models.

Collaborating with Deutsche Bank, Bursa Malaysia, UBS, and Union Bank of the Philippines on End-to-End Digital Securities solution

We delivered a functional industry-wide End-to-End Digital Securities solution for digital assets and sustainability-linked bonds, approaching the project from a lens of interoperability, ecosystem-wide roles, and impacts of DLT digitalisation on the traditional processes of securities markets, including the enablement of better ESG and sustainable financing. For this project, STACS was awarded the Financial Sector Technology and Innovation (FSTI) grant, administered by the Monetary Authority of Singapore (MAS).

Fund-raising and Strategic Partnerships to bring global scale

Completing $4.8M Pre-Series A Funding Round, a prelude to Series A commencing 2022

Led by venture capital firm Wavemaker Partners, and joined by Tribe Accelerator and Stellar Partners Limited, the $4.8 million pre-Series A funding round completion brought our fundraising total to $8 million. STACS plans to start our Series A funding round on a larger scale this year, to propel us forward in our plans to expand our Sustainable Finance ecosystem with the MAS.

Joining the PwC Singapore family

As a portfolio company of PwC Singapore’s Venture Hub, our joint business partnership brings about great synergy between the two firms while elevating trust placed in DLT by the financial services industry and driving adoption, with STACS driving solutions to create value for all market participants.

Spearheading ESG FinTech as one of seven start-ups selected globally to join Mastercard’s Start Path program

As one of the only two companies in Singapore, and one of seven globally, STACS was selected to join the prestigious Mastercard Start Path program, allowing us to tap on Mastercard’s robust network and wide range of expertise at a very timely stage to collaborate on real-world use cases and bring global scale to our solutions, to collectively unlock massive value and enable effective sustainable finance for the financial industry.

Propelling the industry forward by hosting events to foster spirit of collaboration and ideas worth spreading

Hosting 6 industry events: STACS Showcase, Green FinTech: Bridging Sustainability and Profitability, DLT and Real-Life Use Cases for Asset and Wealth Management, The Next Five Years of Enterprise Blockchain and Beyond: DLT in Financial Markets, and more

In 2021, STACS hosted 6 industry events, including the annual STACS Showcase, on pertinent topics of ESG FinTech and DLT within the financial industry. These celebratory and collaborative events brought together global leaders from leading financial and tech institutions, regulatory bodies, academic institutions, and more.

Watch the full playbacks of our 2021 events on our YouTube channel

With the global industry sustainability shift and events like the COP26, 2021 begins a vital ‘decade of action’ on sustainability issues. Our achievements to date firmly underline our commitment to Sustainability. While we have met some incredibly ambitious targets in the past year, there is more to do.

With our upcoming Funding Round commencing in 2022, we believe this is only the start! As the ESG Nexus between the financial industry and sustainability, we are excited to continue expanding our ecosystem and current pipelines to bring forward the future of Sustainable Finance today, in partnership with the MAS and all of our valued ecosystem partners. Thank you for making the past year a success for all of us here at STACS.

Here’s to a spectacular and greener 2022 ahead! In the meantime, join our Telegram group for our latest news as well as industry developments, in real-time.

PRESS CONTACTS

If you are a journalist with media queries, contact us.