Published 28 November 2023 –

In today’s corporate landscape, sustainability reporting has become an imperative practice for the world’s top 250 companies (G250). This global trend extends its reach across regions, with Asia Pacific leading among the N100 companies, boasting an impressive 89% engagement in sustainability reporting. Europe follows closely behind at 82 percent, while the Americas and the Middle East & Africa report figures of 74% and 56%, respectively.

Sustainability reporting is the practice of disclosing environmental, social, and governance (ESG) goals, coupled with transparent communication of progress toward achieving these objectives. These ESG objectives encompass three core areas:

- Environmental: This facet concentrates on a company’s ecological performance and its practices to reduce its ecological footprint.

- Social: The social dimension involves the management of relationships with employees, suppliers, customers, and communities impacted by the company’s activities, emphasizing fair labor practices, diversity and inclusion, and community engagement.

- Governance: Governance objectives center on evaluating the company’s leadership, internal controls, audits, and overall corporate governance procedures to ensure transparency, risk reduction, and ethical decision-making.

Why is Sustainability Reporting Important?

Sustainability reporting is not just a corporate trend; it is a strategic imperative for businesses, especially today where global dynamics and environmental consciousness are constantly evolving. This urgency is underscored by stringent regulations emerging from the European Union (EU) concerning ESG reporting and sustainable procurement. Importers to the EU are now subject to levies corresponding to the price of emissions allowances under the EU Emissions Trading System.

These regulations have a ripple effect on the ASEAN region, who is a major global supply chain, accounting for more than 45% of the world’s economy, with over 96% of these being small and medium-sized enterprises (SMEs). Furthermore, we are seeing a growing number of ASEAN countries aligning their regulations with international standards, such as the ISSB (International Sustainability Standards Board), and are implementing sustainable procurement policies. This is indicative of rising regulatory pressures from both international and local developments to embrace ESG reporting.

What are the benefits of sustainability reporting?

Embracing sustainability reporting offers a myriad of advantages to businesses, making it a cornerstone of modern corporate strategy. First and foremost, it provides a means to future-proof an organization. In a rapidly changing world where ESG considerations are paramount, sustainability reporting enables companies to adapt and thrive, equipping them with the tools to stay competitive in the global supply chain and positions them to capitalize on emerging opportunities.

Investor sentiment also underscores the significance of sustainability reporting. Almost half of investors have made investment decisions based on a company’s stance on social and environmental issues, with 38% choosing to sell shares in companies that lack clarity in this regard. Moreover, the 2015 EY Global Institutional Investor Survey of over 200 institutional investors revealed that non-financial disclosures are increasingly shaping their investment decisions, emphasizing the influence of sustainability reporting on financial markets today.

Sustainability reporting attracts not only investors but also customers. A study by Nielsen discovered that a remarkable 81% of global respondents believe that companies should actively contribute to improving the environment. In this era of conscious consumerism, 66% of global consumers are even willing to pay a premium for sustainable products and services. In essence, consumers are making choices that align with their values, opting to support companies with a strong social or environmental mission.

What are the Current Sustainability Standards out there?

As sustainability reporting gains traction worldwide, a range of standards have emerged to streamline the evaluation and comparison of sustainability reports. With more than 90 percent of the world’s largest companies choosing to disclose their sustainability impacts, the Global Reporting Initiative (GRI) Standards are renowned for their comprehensiveness and adaptability, making them a preferred choice for companies of all sizes.

GRI has been a dominant force in non-financial reporting since its inception in 1997, setting the benchmark for sustainability disclosure. Nevertheless, alternative frameworks have also found their place in the market. The International Integrated Reporting Committee (IIRC) offers a holistic approach to reporting by integrating financial and non-financial information, fostering a comprehensive understanding of a company’s value creation. Additionally, the U.S. based Sustainability Accounting Standards Board (SASB) provides sector-specific standards tailored to the unique ESG risks and opportunities faced by companies, enhancing reporting relevance and comparability.

Businesses now have the flexibility to choose the framework that aligns best with their goals and stakeholder expectations, ensuring transparency and accountability in their sustainability reporting efforts.

Emerging Global Developments in Standards and Frameworks

The evolving landscape of sustainability reporting is marked by three significant global developments. In Europe, the Corporate Sustainability Reporting Directive (CSRD) is gaining traction, aiming to enhance corporate sustainability disclosure across the continent. Simultaneously, the International Sustainability Standards Board (ISSB) is spearheading the IFRS Sustainability Disclosure Standards, which has garnered international attention for their potential to harmonize sustainability reporting practices. Aimed at promoting consistent and comparable reporting on sustainability matters, the new IFRS standards are set to take effect on 1 January 2024. Additionally, the United States Securities and Exchange Commission (US SEC) has introduced a climate proposal, recognizing the urgency of climate-related disclosures in financial reporting.

Each of these proposals carries distinct focus areas and potential implications for companies. Notably, the ISSB and US SEC proposals emphasize financial materiality, aligning sustainability disclosures more closely with financial reporting. In contrast, the CSRD places a unique emphasis on ‘double materiality,’ considering both financial and ESG materiality

Given these variations in materiality criteria, companies must carefully assess the impact of transitioning from one materiality standard to another—or even adopting both, depending on the applicable standards.

How to Select a Framework?

Choosing the right sustainability reporting framework is a pivotal decision for companies, driven by two key factors: materiality assessment and stakeholder engagement.

Firstly, conducting a materiality assessment is essential to identify the sustainability issues that hold the most relevance for your business and its stakeholders. This process involves pinpointing issues that have a substantial impact on your company’s operations and are of utmost concern to your stakeholders. It is crucial to recognize that different reporting standards place varying emphasis on materiality.

Secondly, understanding your key stakeholders—be they investors, customers, employees, regulators, or others—is equally vital. Gaining insight into their information needs and preferences regarding sustainability reporting helps tailor your approach.

For instance, the Global Reporting Initiative (GRI) standards cater to a wide array of stakeholders, making them an attractive choice for businesses seeking a broad reach. Conversely, the International Integrated Reporting Council’s Integrated Reporting Framework (IRF) encourages companies to publish “concise” integrated reports, which can be instrumental for significant investment decisions.

By aligning your materiality assessment with stakeholder preferences, you can make an informed choice about which framework best suits your business, ensuring transparency and relevance in your sustainability reporting efforts.

What is the Sustainability Reporting Procedure?

The sustainability reporting procedure is a critical aspect to comprehend. We can break down the procedure into 5 key stages:

- Internal Audit: An internal audit is conducted to establish a baseline of your organization’s sustainability performance. This audit is a meticulous process that involves evaluating various aspects of your business, including its ESG practices. Armed with this baseline data, you can establish specific sustainability goals and key performance indicators (KPIs) to track progress over time.

- Engaging Stakeholders: This stage requires you to gather valuable input and perspectives, both internal and external, on your sustainability initiatives. This includes employees, customers, investors, suppliers, and local communities.

- Data Collection & Analysis: This stage involves gathering quantitative and qualitative data related to sustainability metrics. It encompasses everything from carbon emissions and energy consumption to social impact. To streamline this process, consider adopting sustainability reporting software and tools that can automate data collection and generate insightful reports.

- The Report: You should provide a transparent account of your organization’s sustainability performance, including achievements, challenges, and future commitments. Ensure that your report aligns with recognized reporting frameworks, such as GRI, SASB, or TCFD, to enhance its credibility and comparability.

- Communication: Share your sustainability report with stakeholders through various channels, such as your website, annual reports, and direct engagement. Invite feedback and use it to refine your sustainability strategy, ensuring that your organization continues to evolve on its path towards responsible and sustainable business practices.

What are the Challenges Faced in Sustainability Reporting?

While sustainability reporting is gaining traction, it is not without its share of challenges. One major hurdle is the labour-intensive nature of data collection, often prompting companies to craft a sustainability report just once annually. This infrequent reporting hinders the seamless integration of sustainability considerations into day-to-day business decision-making, limiting its real-time impact.

In Asia, despite the growing trend of ESG awareness and requirements, many companies, particularly SMEs, face hurdles. A shortage of expertise and resources often deters them from initiating sustainability reporting efforts, contributing to a noticeable SME data gap in the Asian market. This gap is significant, considering that 90% of global supply chains comprise SMEs who are yet to embark on ESG reporting.

Large corporations and financial institutions globally are also now confronted with mounting regulatory reporting requirements. This is causing them to grapple with a scarcity of data, particularly for mid-cap to small-cap enterprises in the Asia Pacific region. In particular, financial institutions seek data at the asset level, prioritizing primary data that aligns with various industry reporting frameworks, such as GRI, ISSB, and TCFD. This allows them to gain a deeper understanding of their portfolio’s environmental impact, facilitating more informed green financing decisions.

To address these challenges and bridge the ESG data and disclosure gap, Green FinTech companies are emerging as catalysts. They play a crucial role in lowering barriers to sustainability and reducing the cost of adoption for companies, especially SMEs, embarking on their sustainability and ESG reporting journey. This, in turn, contributes to enhancing the availability of data for large corporations and financial institutions, enabling effective supply chain tracking and facilitating green finance initiatives.

How to Get Started with Sustainability Reporting for Your Organization

To begin, particularly concerning the environmental pillar of sustainability reporting, companies can tap into various initiatives, both from governments and the private sector, to kickstart their efforts.

These initiatives offer valuable tools and resources that empower both SMEs and corporates to assess their environmental impact. By utilizing these complimentary tools, businesses can measure their carbon footprint, benchmark their performance against industry peers, and identify opportunities for improvement. These metrics and insights also serve as the building blocks for a comprehensive sustainability report.

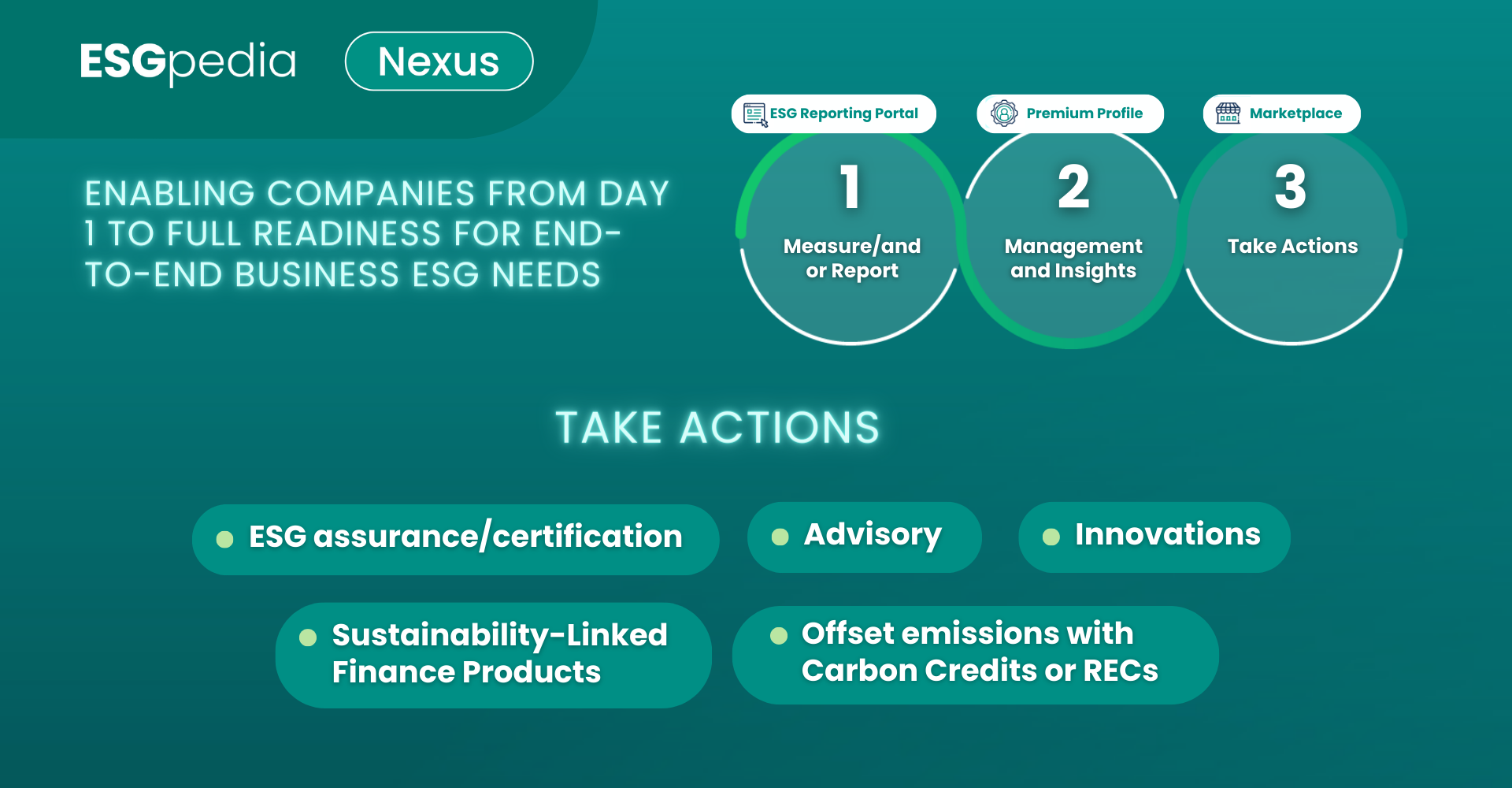

ESGpedia is a digital platform that simplifies various ESG standards, taxonomies, and regulatory frameworks. It guides organizations on their sustainability journey and includes digital tools that automate the conversion of operational data, such as fuel, refrigerant, and electricity consumption, into greenhouse gas (GHG) emissions in accordance with the GHG Protocol. Our platform, localized to multiple countries across Asia, empowers businesses to comply with ESG regulatory requirements, understand their ESG profile (including carbon footprint), and make informed decisions.

Fuss-free Scope 1 and 2 carbon calculation tool

In partnership with the ESCAP Sustainable Business Network (ESBN), ESGpedia Nexus ’ ESG Starter Tool includes the ESBN Asia-Pacific Green Deal digital assessment, available for free to businesses and SMEs across Asia. This program aims to lower the barriers to sustainability reporting and enable businesses to initiate their ESG data reporting and decarbonization journey. Upon completion of their company’s ESG profile on ESGpedia, participants are awarded a Green, Silver, or Gold ESBN Green Deal Badge, serving as a valuable incentive to showcase their commitment to sustainability.

By taking these initial steps in understanding their sustainability profile and GHG footprint, businesses are better positioned to manage their emissions through active decarbonization strategies and energy transition measures.

Calculating Scope 3 Carbon Emissions in accordance with GHG Protocol and ISO14064 methodologies

For businesses and large corporates that are looking to decarbonise their supply chains, an understanding of your Scope 3 emissions would be the fundamental first step. ESGpedia Nexus has an in-built calculator in accordance with international standards including the GHG Protocol and ISO14064, that allows businesses to calculate their Scope 3 emissions by completing a guided and digitalised assessment. Businesses can choose to utilise ESGpedia for sustainability repporting in accordance with international and country-specific frameworks such as GRI, TCFD, IFRS, SuRe, SEDG, and more.

Request for a demo today and enjoy exclusive rates as an early adopter.

What’s Next for businesses?

For businesses that have taken their initial steps in creating sustainability reports, the journey towards sustainable business practices continues with a range of progressive actions. One such step is the pursuit of emissions offsetting, a crucial strategy to neutralize the environmental impact of operations. By investing in carbon offset projects, businesses can mitigate their carbon emissions and contribute to global sustainability efforts.

Another avenue for advancement is the pursuit of sustainability certificates and assurance. These certifications provide external validation of a company’s sustainability efforts, reinforcing transparency and credibility. They not only demonstrate a commitment to responsible practices but also enhance the organization’s reputation among stakeholders.

Businesses can also explore sustainability-linked financial products, such as green bonds and sustainability-linked loans. These financial instruments tie the cost of capital to sustainability performance, offering incentives for continuous improvement in ESG metrics. By engaging in these financial products, businesses can access funding while aligning their financial goals with their sustainability objectives.

If you are interested in exploring these next steps and how ESGpedia Nexus can complement your sustainability strategies, we encourage you to connect with us or create your free ESG company profile today to get started.