Top 8 Stories from STACS Showcase and Singapore FinTech Festival 2021

Our partnership with the Monetary Authority of Singapore (MAS) on the Project Greenprint ESG Registry, Live Platform Showcases, and more.

It’s a wrap of another very successful run of STACS Showcase! The 2nd edition of STACS Showcase, a celebratory and collaborative fintech event, happened during the week of Singapore FinTech Festival (SFF) earlier this month, 8 – 12 Nov, as a digital event.

This year, we had 40 distinguished global industry leaders across finance and tech join us across a total of 19 panels and live platform showcases during the week-long STACS Showcase 2021. The event brought together over 500 participants in the financial industry, as well as policy makers and key stakeholders.

It’s our hope that get-togethers like STACS Showcase can kickstart more collaborations and partnerships within the financial industry, and ideas worth spreading for our collective future.

STACS’ partnership with the Monetary Authority of Singapore (MAS) featured on the Channel NewsAsia Singapore Tonight on 9 November 2021

STACS is building the Project Greenprint ESG Registry, in partnership with the Monetary Authority of Singapore (MAS)

STACS and the Monetary Authority of Singapore (MAS) officially announced our partnership to build the Project Greenprint ESG Registry, a blockchain-enabled aggregated platform that can empower ESG finance across various industry sectors, by enabling institutions to perform ESG data aggregation, portfolio analysis, and effective reporting, enhancing the mobilisation of ESG capital and verifying the impact of their climate action strategies in the journey towards net zero.

The Greenprint ESG Registry is now being made available to businesses across a wide range of industries. Our initial collaborators include financial institutions like Aviva Singlife, Citi, OCBC Bank, UBS, UOB, with corporates like CDP (global environmental disclosure platform), CO2 Connect (CO2X) Pte Ltd (transport and logistics sector platform), Containers Printers (manufacturing sector platform), SGTraDex (supply chain platform), Surbana Jurong Private Limited (building and construction sector platform), and more.

The announcement by STACS and the MAS was picked up by an extensive list of global digital and traditional media, including CNA TV, The Business Times, Yahoo Finance, Regulation Asia, ESG Today, Finextra, and more. The announcement also made it to the official Top 10 Stories from Singapore FinTech Festival 2021 covered by Fintech News Singapore.

Sopnendu Mohanty, Chief FinTech Officer at MAS, shared: “The ESG Registry platform aims to solve two pertinent issues in Green Finance – the lack of transparency and trust in ESG certifications and the inefficiencies in accessing different certification standards and requirements in different industries domestically, and even globally. MAS is happy to work with STACS in bringing together different players in different industries and sectors to provide, verify, certify and share data in a secure an efficient manner, so as to unlock green finance.”

We are heartened to see the great partnership from many parties within a short period of time. Through such collaborations, we will further optimise our Greenprint ESG Registry to better serve ESG use cases across various sectors.

Talk to us to find out more on what the Greenprint ESG Registry means for your company and how we can jointly move the needle on sustainability.

STACS Showcase 2021 Theme: ESG FinTech, Asset and Wealth Management, and Digital Securities

STACS Showcase 2021 featured thematic days, with an overall focus on DLT in the financial industry: ESG FinTech on Day 1 and 2, Asset and Wealth Management on Day 3, and Digital Securities on Day 4.

Over the course of the week, we were joined by our partners and esteemed speakers from global leading institutions including: SIX Group, Standard Chartered Bank, PwC Singapore, UOB, Singapore Environment Council, Nikko Asset Management, Northern Trust, OCBC Bank, BNY Mellon, Climate Impact X, Cyberdyne Tech Exchange, Evercomm, Ascent Solutions, CO2 Connect, Evfy, Aviva Singlife, Turnkey Group, Phillip Capital Management, BNP Paribas Securities Services, CSOP Asset Management, Spark Systems, vestr, AsiaVerify, PDS Group, Amazon Web Services, SBI Digital Markets, Ernst & Young, Singapore Fintech Association (SFA), and more.

The headline topics covered across the 15 live panels included: Collective Technology-driven approach towards Sustainability, Data-Driven ESG FinTech, High-Quality Carbon Credits, Digital Transformation within the Asset and Wealth Management industry, Post-Trade Processing and Automation on DLT, Digitalising Capital Markets with Stock Exchange and Ecosystem Participants, how banks are preparing for the future of Digital Securities, and Tokenization: The Future of Funds.

If you’ve missed any of the action last week, playbacks for all sessions are available in the event for the next month till 12 Dec, here.

The sessions will also be made available on our YouTube channel and LinkedIn. Follow us there and stay tuned as we’ll be posting the full recordings of all sessions starting this week!

Watch the full replay of the first ESG FinTech panel that kickstarted STACS Showcase 2021 on Day 1 already on YouTube here.

The distinguished panellists include Ong Wei Han, Managing Director, Senior Country Business Manager, South and SEA, J.P. Morgan, Jasper Wong, Head of Construction and Infrastructure, Sector Solutions Group, UOB, Barnaby Nelson, CEO, The ValueExchange, and Derrick Liao, Chief Operating Officer, Nexus FrontierTech.

STACS Showcase Day 1 ESG FinTech Panel: Collective Technology-driven approach towards Sustainability. Are we ready?

STACS Sharing by Leaders

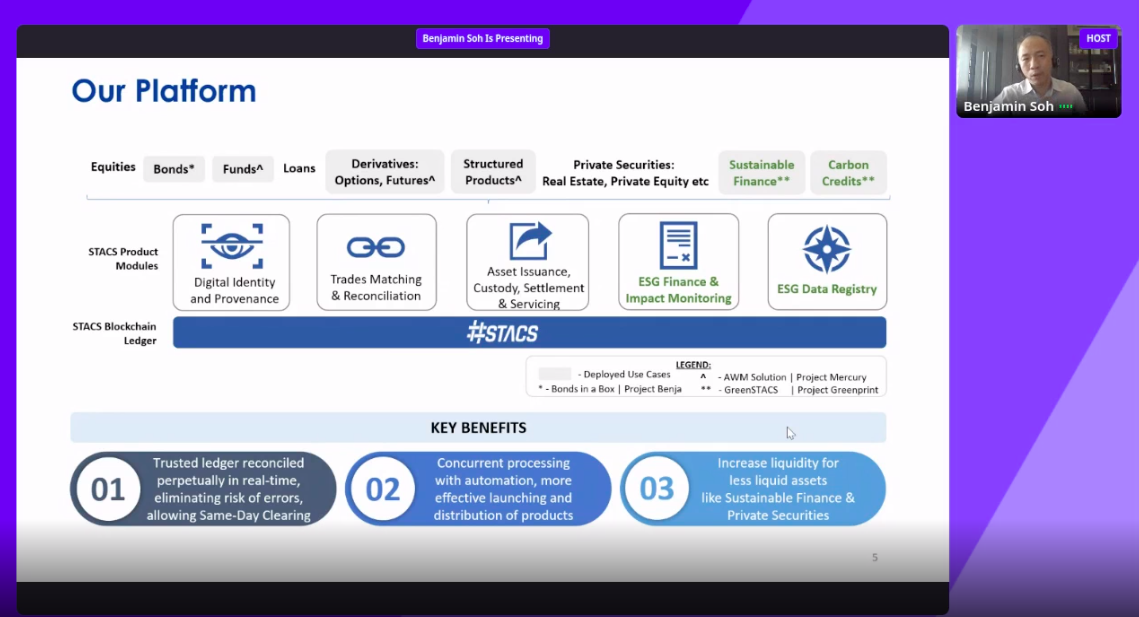

STACS Founder and Managing Director Benjamin Soh shared a Company Overview on STACS Showcase 2021 Day 3

Other than industry panels, STACS also hosted three sharing sessions during the week-long STACS Showcase 2021 for those who were new and keen to find out more about what we do, including a Company Overview by STACS Founder and Managing Director Benjamin Soh, our Technology and Platform sharing led by the STACS Solutions Architect Director Jin Ser, and a Kopi Chat with STACS Chairman Ray Ferguson, former Standard Chartered Singapore CEO and current Chairman of Aviva Singlife on his vision and aspiration for the financial industry.

Official Unveiling of the Project Greenprint ESG Registry in partnership with the MAS, and other live platform showcases with partners

Following the launch announcement by STACS and the MAS on 9 November, the Project Greenprint ESG Registry was officially unveiled on STACS Showcase later that day. Participants were amongst the first in the industry to learn more about the industry-wide DLT-based ESG Registry, and what it means for their company.

Over the course of the week, STACS Showcase 2021 also featured 3 other platform showcases, including CO2 Connect (CO2X) platform, a one-stop platform leveraging on DLT, IoT, and Data Analytics to enable sustainability for the Transportation and Logistics sector. Launched earlier in October 2021, CO2X already has 10 corporate fleets and financial partners like OCBC Bank, UOB, and Aviva Singlife onboard.

Along with BNP Paribas Securities Services, Head of Investment Solutions APAC, Nadim Jouhid, we also jointly unveiled new platform features of our Asset and Wealth Management solution, deployed live since June 2020 with global leading asset managers, brokers, and distributors, and proven to eliminate the risk of costly errors and enable institutions to enjoy up to 90% improvements in efficiencies and risk management.

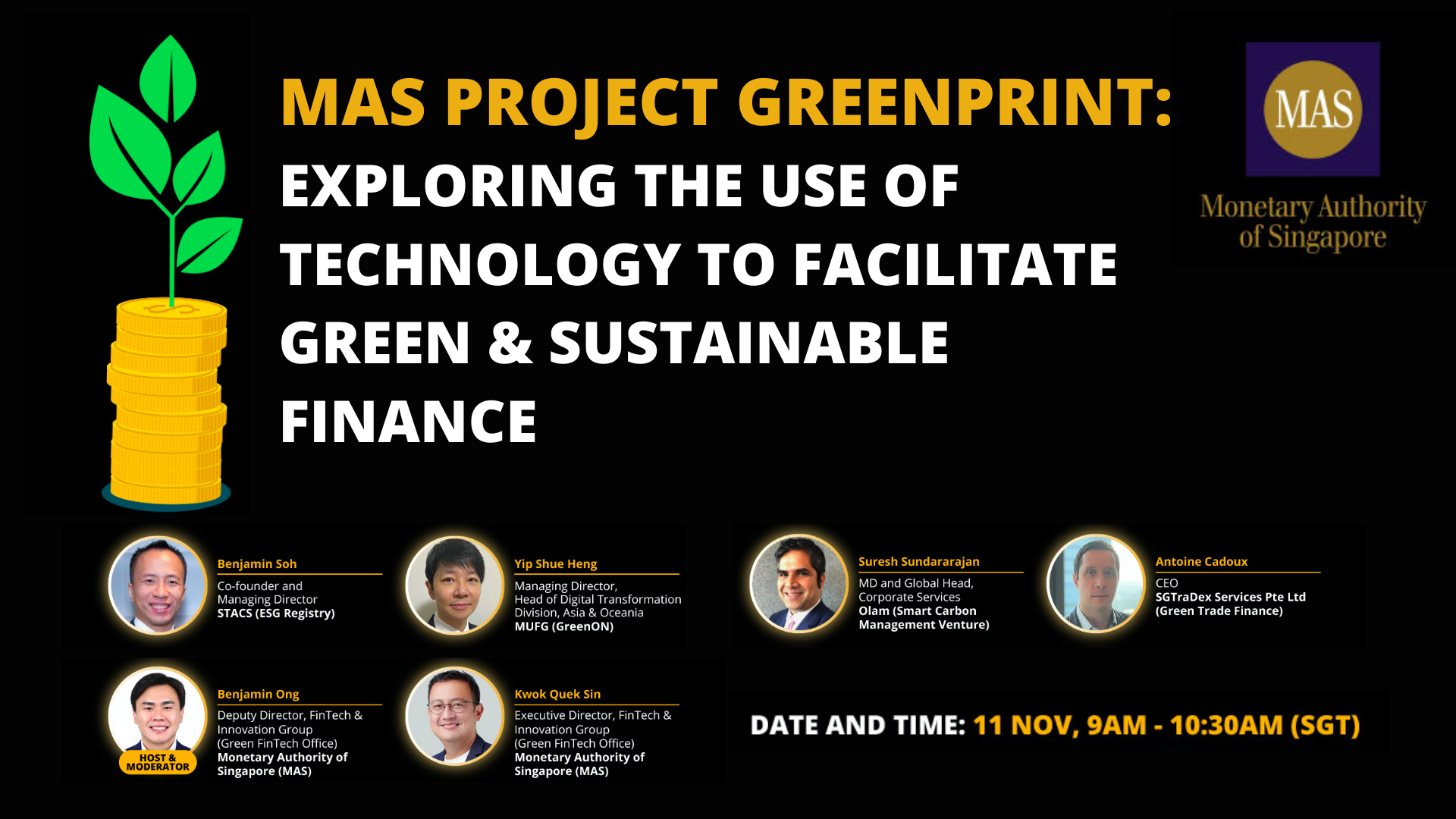

SFF Roundtable – MAS Project Greenprint: Exploring the use of Technology to Facilitate Green & Sustainable Finance

On Day 4 of the Singapore FinTech Festival, STACS and the MAS Project Greenprint team, led by MAS Green Fintech Executive Director Quek Sin Kwok, came together, to share more on the Greenprint ESG Registry for the first time in an exclusive roundtable.

Alongside the three other technology partners under Project Greenprint from MUFG, Olam, and SGTraDex, STACS Managing Director Benjamin Soh demonstrated a live platform showcase of the Project Greenprint ESG Registry.

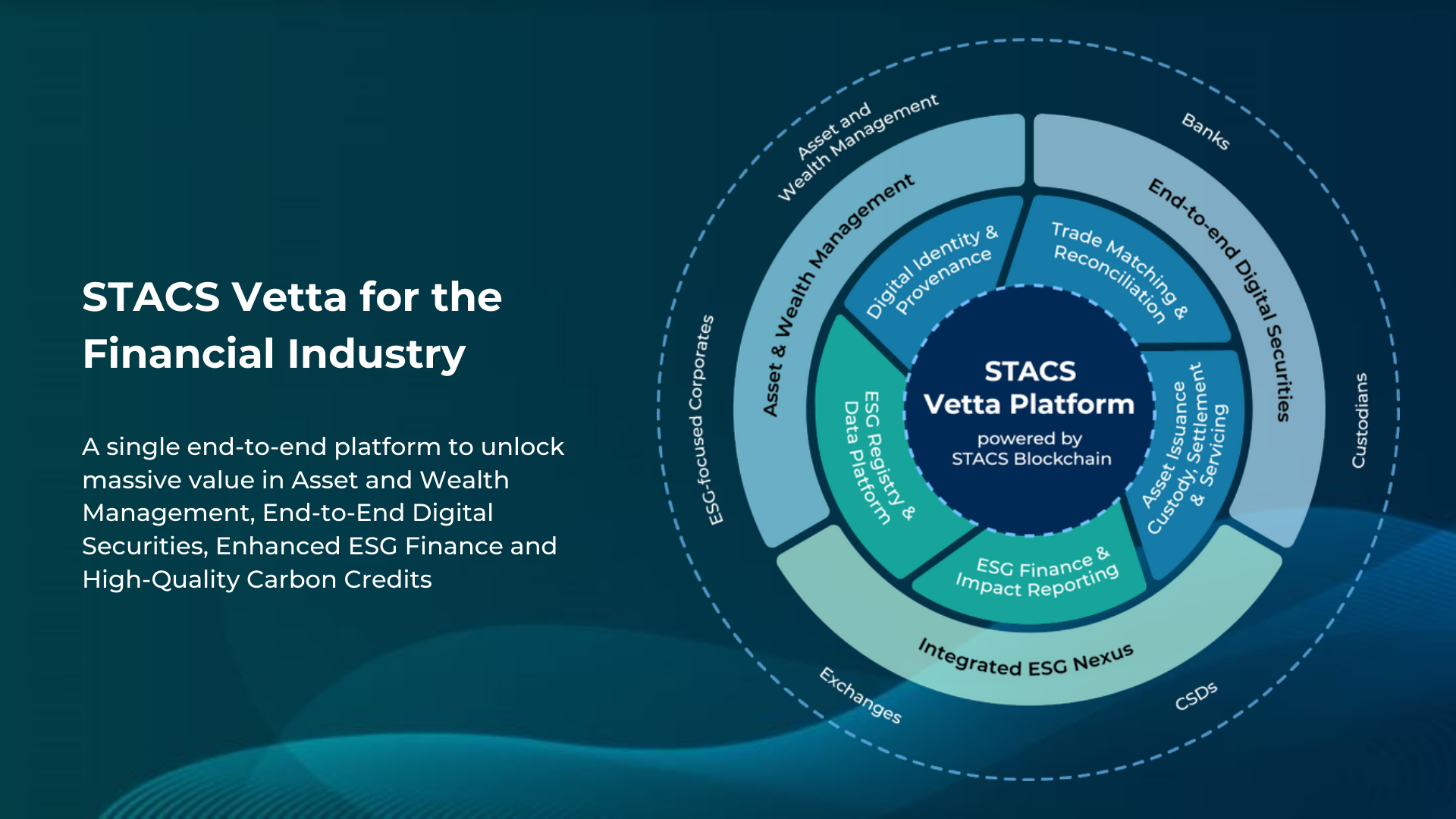

STACS Vetta platform for the financial industry

We officially revealed “STACS Vetta” as the name of our industry-wide DLT platform during the week of STACS Showcase and Singapore FinTech Festival 2021.

Vetta, peak in Italian – With a mission to enable the financial industry to reach its peak, STACS Vetta provides the best in class by bringing together Asset & Wealth Management, End-to-End Digital Securities, and Integrated ESG Nexus in one agile, industry-wide, DLT-based platform that is interoperable – connect your existing infrastructure swiftly for the solution of your preference, as you please.

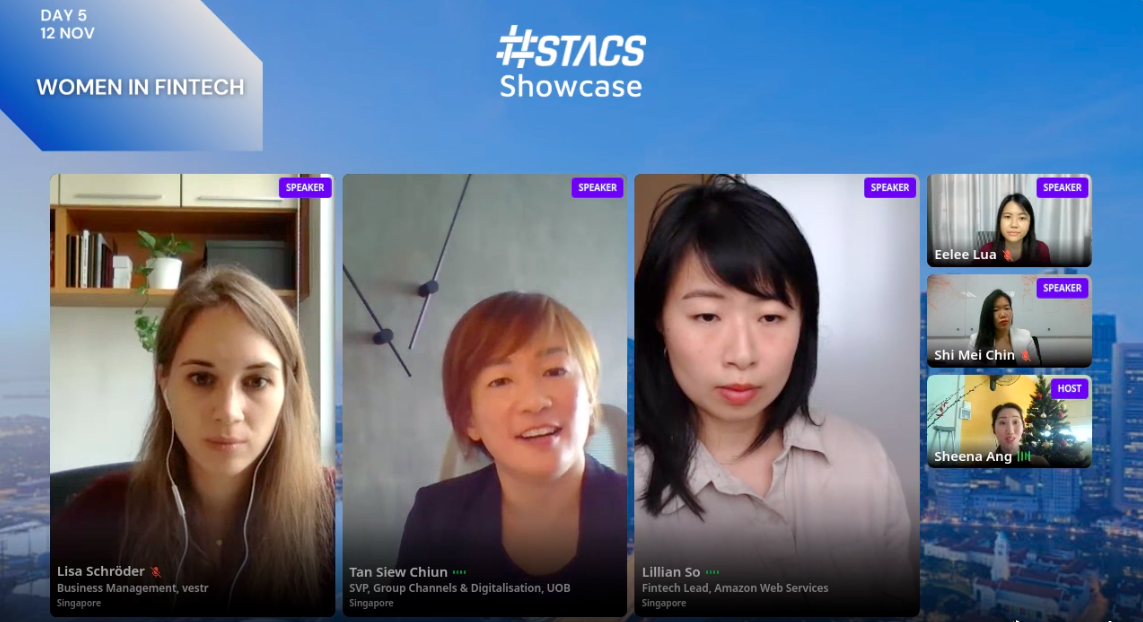

Celebrating the success of Women in FinTech

Wrapping up the week-long event on Day 5, we invited participants to join us for a celebratory panel discussion with an empowering line-up of female leaders from SFA Women in FinTech subcommittee, UOB, Amazon Web Services, and more, who shared with us their unique perspectives on what professional women are facing today especially in the fintech space, both as women and advocates for women in the industry.

STACS at the Singapore FinTech Start-Up Lounge at the Talent Pavilion

As a long-term close partner of STACS, the Singapore Fintech Association (SFA) invited STACS Executive Director David Teo to be a guest speaker at the Singapore FinTech Start-Up Lounge at the Talent Pavilion, where he shared first-hand the purpose behind what we do, and the value of teamwork and excellence.

We are expanding rapidly across roles in ESG Partnerships, Engineering, and Product. Be part of the dream team – apply here.

2021 has been an exceptional year for us, with the past week being the climax of our efforts this year.

The Greenprint announcement with the MAS is a monumental step forward for Singapore in the Green FinTech space, with the nation’s green finance ambitions led by the MAS, and we are extremely humbled and excited to be partnering the MAS on it. Thank you for making this past year a remarkable one, and we hope to continue journeying with you in 2022. We remain committed to empowering the financial industry sustainably through Transformative Technology, and look forward to scaling up our Greenprint ESG Registry with financial institutions, ESG data service providers, certification bodies, ratings agencies, other fintech firms, and corporates from various sectors, to jointly bring forward the future of sustainable finance today.PRESS CONTACTS

If you are a journalist with media queries, contact us.