Published 3 May 2024 –

What is Scope 3 emissions?

Scope 3 emissions represent a comprehensive bracket within a company’s carbon footprint, encompassing all indirect emissions that arise both upstream and downstream in its value chain. This category extends beyond the direct operations and electricity use of a company to include a wide array of sources such as supply-chain operations, the use of the products it sells by customers, and even the emissions related to subsidiaries, employees, and assets.

As the global understanding of and commitment to addressing climate change deepens, regulators and stakeholders are increasingly turning their attention towards Scope 3 emissions. This shift has compelled businesses to undertake comprehensive emission reduction strategies that encompass not just direct emissions, but also the full lifecycle of a company’s products and services.

ESG Reporting Standards

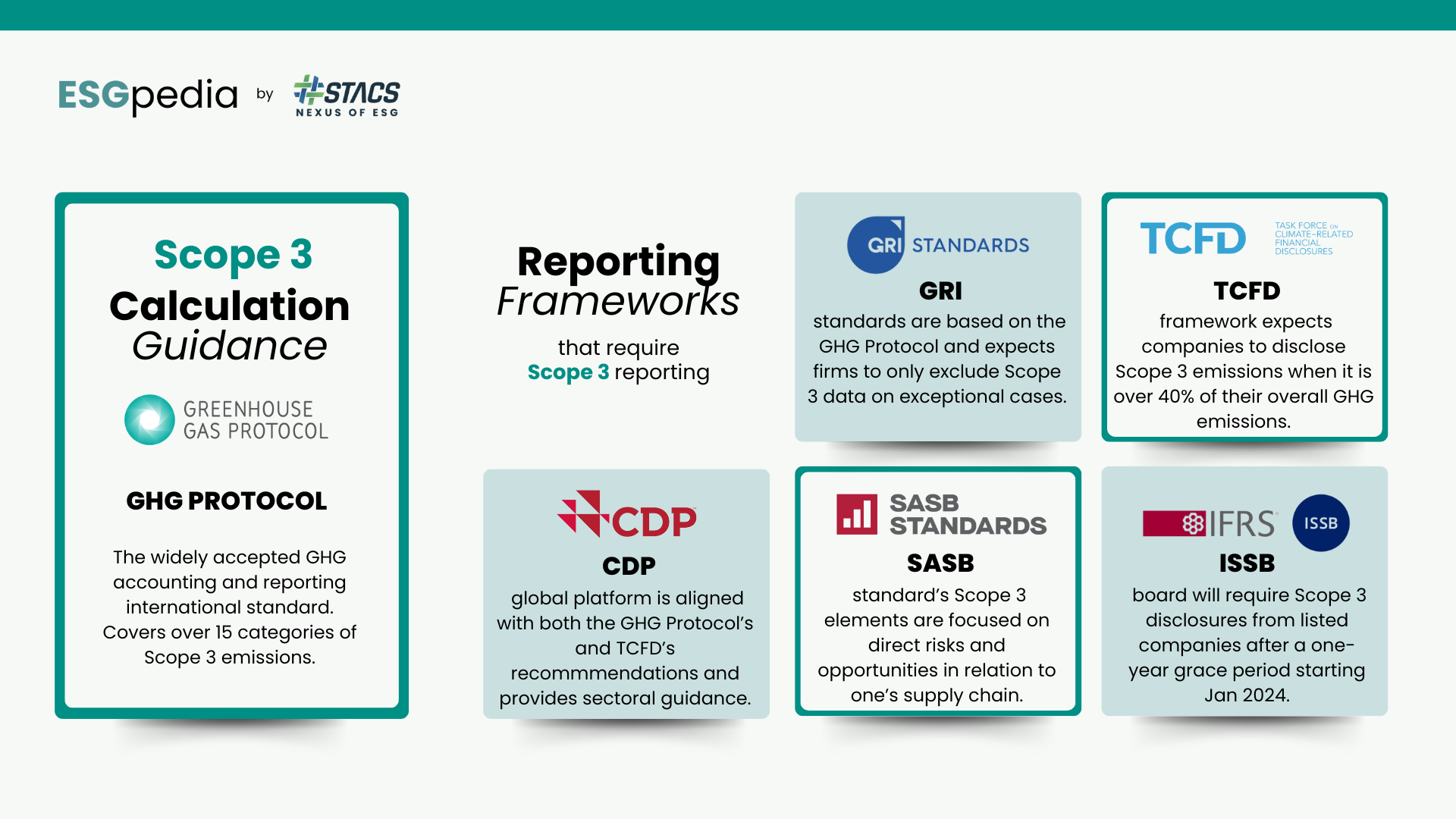

The landscape of scope 3 emissions reporting is guided by a range of frameworks, each designed to ensure accurate and comprehensive accounting of indirect greenhouse gas (GHG) emissions. Among these, the Greenhouse Gas Protocol (GHG Protocol) stands out for its widespread adoption and detailed methodology, providing 15 qualitative categories to identify and report Scope 3 activities.

This level of detailed guidance has made the GHG Protocol a preferred choice for various entities, including the Climate Registry, Mexico’s GHG Program, and the UK’s Department for Environment, Food & Rural Affairs (DEFRA) with its Voluntary Reporting Guidelines.

The International Standards Organization (ISO) complements the GHG protocol with its ISO 14064-1:2018. Certification, which serves as a unified tool for measuring, quantifying, and reducing GHG emissions. This certification is also instrumental in facilitating participation in emissions trading schemes.

In addition to this, the International Sustainability Standards Board (ISSB) has also emerged as a significant player in shaping emissions reporting practices globally. Its standards, which include Scope 3 emissions reporting requirements, have been quickly adopted by most countries; Nonetheless, recognizing the challenges associated with this, ISSB has granted companies a one-year grace period to disclose their Scope 3 emissions. In the Asia-Pacific region, the influence of ISSB is evident in local reporting initiatives, such as Philippine’s Sustainability Reporting Form (SuRe), which draws references from ISSB’s guidelines.

Why do we need a strategy to reduce our scope 3 emissions?

How is Scope 3 and Supply Chain Sustainability interlinked?

Addressing Scope 3 emissions is littered with challenges that limit many organizations’ sustainability efforts. One of the most daunting issues is the scarcity and inconsistency of data. The expansive nature of modern supply chains means that comprehensive and accurate data collection for Scope 3 emissions is a formidable task. This is exacerbated by the fact that information must be gathered across multiple tiers of suppliers, each of which may have varying levels of environmental reporting maturity. The CDP’s Global Supply Chain Report 2019 revealed that suppliers cite the absence of data from their own supply chains as the primary barrier to disclosing and mitigating emissions.

Moreover, as the global economy moves towards a net-zero future, regulatory measures targeting products with high emissions are becoming stricter, which can lead to stranded assets or heightened compliance costs. Concurrently, consumer preferences are shifting towards low-carbon products, as evidenced by Mckinsey’s 2020 consumer sentiment findings that over 60% of consumers would pay more for a sustainable product. These evolving market dynamics and regulatory environments present mounting investment risks for companies not actively managing their Scope 3 emissions.

According to estimates from the GHG Protocol, Scope 3 emissions can be, on average, 11.4 times higher than a company’s direct emissions, highlighting the scale of the challenge at hand. Identifying and estimating these emissions from indirect sources is an intricate process, fraught with methodological hurdles that are often wrongly implemented.

Sectors affected by Scope 3?

Scope 3 emissions permeate every sector due to the interconnected nature of value chains, impacting businesses in varied ways depending on their industry and operations. It is dependent on various metrics that include but are not limited to product type, industry, business travel, number of suppliers, etc. For manufacturing companies, Scope 3 emissions are predominantly tied to the sourcing of materials. In the real estate sector, Scope 3 considerations extend to the carbon footprint of buildings, including aspects like construction materials and the labor involved.

However, the extent to which Scope 3 emissions affect industries varies significantly. Certain sectors are prone to extensive Scope 3 emissions due to their business activities. In fact, Singapore’s current climate-related disclosures (CRDs) are required by listed companies in five prioritized carbon-intensive sectors, including finance, energy, and agriculture. However, starting from FY2026, the newly amended CRDs, which include Scope 3 requirements, will apply to all listed issuers, regardless of their industry. According to a report by the Carbon Disclosure Project (CDP), sectors that are most impacted further include capital goods and logistics. These sectors are directly involved in or facilitate activities with significant environmental footprints, from the production of goods to their movement across global supply chains.

Financial services, although not directly engaged in emissions-intensive activities, represent a sector with potentially substantial Scope 3 emissions. This is because the sector’s emissions are indirectly linked through financing and investment decisions. This underscores the critical role of the financial sector in influencing sustainable practices across industries, highlighting the importance of responsible investment strategies that consider the broader implications.

What does Scope 3 mean across your value and supply chain?

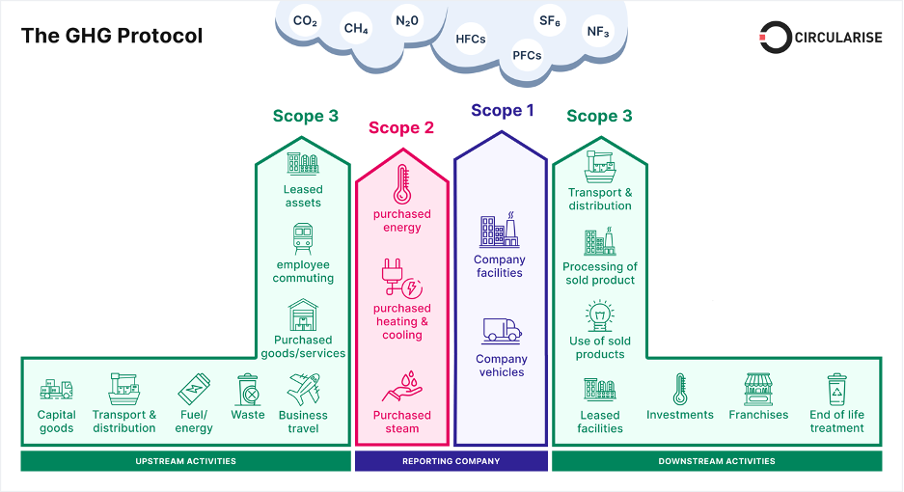

Understanding the implications of Scope 3 emissions across your value chain is essential for companies committed to reducing their environmental impact. As aforementioned, Scope 3 emissions encompass both upstream and downstream activities, offering a holistic view of a company’s indirect greenhouse gas emissions.

Upstream activities within Scope 3 include emissions associated with the extraction, production, and transportation of purchased goods and services. This category also covers emissions from business travel, employee commuting, and waste generated in operations. Downstream activities, on the other hand, relate to emissions resulting from the transportation, use, and end-of-life treatment of a company’s sold products, as well as emissions linked to investments.

Identifying emission hotspots within these activities is a critical step in managing Scope 3 emissions. A thorough analysis helps companies pinpoint areas within their value chain that contribute significantly to their overall emissions profile. By focusing on these hotspots, businesses can allocate resources more effectively, targeting areas that can yield the most significant environmental benefits and cost savings.

Given that a considerable portion of a company’s carbon footprint is often found within its supply chain, collaborating with suppliers to gather data, set reduction targets, and implement sustainability practices is vital. Technological advancements such as blockchain and AI are increasingly being utilized to not only facilitate this but also enhance the transparency of Scope 3 emissions.

A comprehensive understanding of Scope 3 emissions is indispensable for informing business strategies and policies. It enables companies to develop thorough climate action plans, set science-based targets, and align their operations with global initiatives such as the Paris Agreement.

How to take stock and calculate Scope 3 emissions?

This process begins with an initial materiality assessment, which helps businesses identify and prioritize the categories of emissions that are most material to their operations. The Sustainability Accounting Standards Board (SASB) offers a streamlined materiality assessment tool useful for SMEs. For instance, in an aluminum manufacturing facility, investments might not significantly impact the company’s Scope 3 emissions profile, and hence, may not be a priority area for reporting or reduction efforts. A thorough materiality assessment helps clarify these priorities by distinguishing between significant and less critical emission sources.

ESGpedia Nexus carbon calculator can aid in distinguishing categories and accurately report indirect activities.

However, accurately calculating Scope 3 emissions is complex due to challenges such as data availability and the need for supplier-specific information. In many cases, direct data on emissions may not be readily accessible, compelling companies to adopt alternative methods for estimating their Scope 3 footprint.

Methods of Calculating Scope 3 Emissions

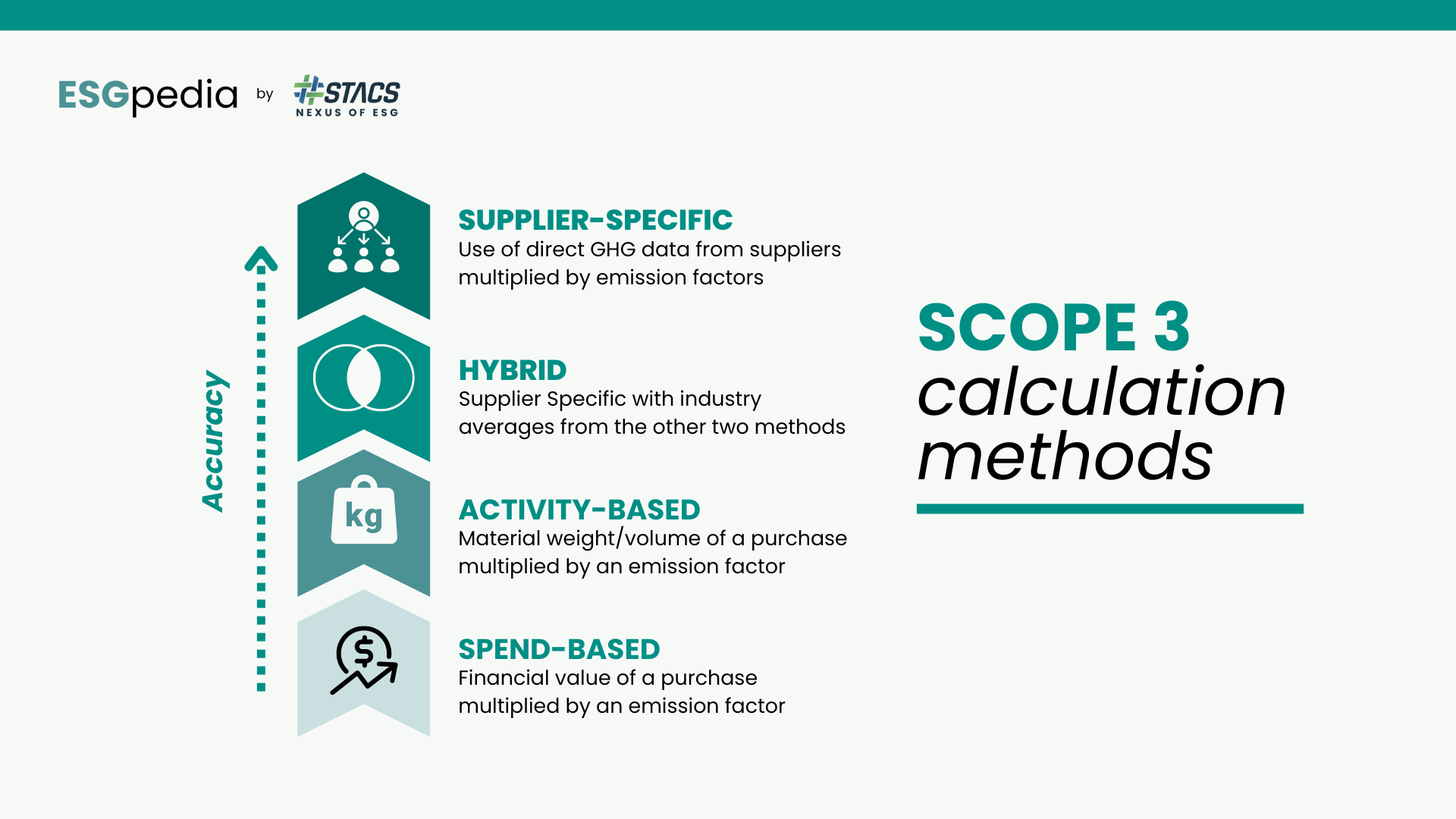

The right scope 3 measurement approach depends on the business and its value chain. It also depends on the type of data available. The four most common methods to calculate scope 3 emissions are spend-based, activity-based, supplier-specific, and a hybrid method that is a combination of the three mentioned previously.

Spend-based is the most common calculation method, although the least accurate. This method estimates emissions based on the monetary value of goods and services purchased. This is derived by multiplying the business’s spending by the emissions intensity of the purchased goods or services. The second calculation method is an activity-based one, which although similar to the spend-based method, activity-based utilizes material weight data instead of financial data. It also suffers from the same accuracy issues as it relies on the use of averages.

The most accurate measurement approach for scope 3 emissions is the supplier specific one, also known as the primary source method. It relies on GHG data from each supplier using disclosures and sustainability surveys. As it is direct data, it provides the most accurate collection. However, data collection is a time-consuming and arduous process. Due to this, a hybrid calculation might work most favorably, as it utilizes supplier-specific and activity-based data and fills the empty spaces with industry averages. ESGpedia has collated over 77 databases into a carbon calculator specifically designed for Scope 3 emissions assessment.

Businesses should consider integrating advanced technologies and methodologies to improve the accuracy of their Scope 3 emissions assessment. Utilizing AI for enhanced supply chain transparency can offer deeper insights into emission hotspots and potential reduction strategies.

Moreover, businesses should not view the assessment of Scope 3 emissions in isolation but as part of a broader sustainability strategy. This involves setting science-based targets, investing in sustainability initiatives within the supply chain, and exploring opportunities for collaboration with peers and industry groups to drive sector-wide improvements.

What’s next for businesses and supply chain sustainability?

Scope 3 is so much more than data and simpler than most businesses would think. From financial institutions to advisory services, tools are readily available to assist both SMEs and large corporations in this journey.

If you are looking to support your suppliers with their environmental reporting, ESGpedia Nexus’ ESG Starter Tool contains the ESBN Green Deal digital assessment that allows suppliers to calculate their Scope 1 and Scope 2 with ease. This tool is localised to different languages in Asia and allows suppliers to easily calculate their carbon emissions by inputting operational data such as existing utility bills. Such enabling digital tools not only facilitate the calculation of emissions but also foster supplier engagement and supply chain transparency.

ESGpedia Nexus’ in-built carbon calculator automatically converts operational data to greenhouse gas (GHG) emissions in accordance with GHG Protocol and ISO14064 methodologies. The carbon calculator aids in distinguishing categories and accurately reports indirect activities.

When it comes to calculating your own Scope 3 emissions, businesses can leverage ESGpedia’s carbon calculator that helps with both data collection and maintaining quality. This is instrumental in helping businesses navigate the complexities of Scope 3 emissions, providing a structured and efficient approach to data management and strategic planning.

It is easy to see now how the task of decoding Scope 3 emissions, while challenging, is far from insurmountable. The key lies in leveraging the right digital tools and fostering a culture of collaboration and innovation. Learn how Asia can decarbonise supply chains and uncover the full guide to sustainability reporting for businesses here.