ESG Ratings – The Good and the Gaps

Methodologies

To determine a company’s ESG rating, ratings agencies typically assess E, S, and G components separately before aggregating them to compute an overall score. Different ratings agencies employ different methods to compute ESG scores, with each agency possessing their own proprietary criteria, weighting system, and methodology for evaluating ESG performance.

ESG Ratings – A Useful Tool in the Sustainability Journey

ESG ratings provide a snapshot of a company’s ESG performance for investors and stakeholders to assess. From there, investors and other stakeholders can determine if a company is a ‘leader’ in sustainability, or one that faces large ESG-related risks and challenges. Additionally, ESG ratings enable corporates to benchmark their performance against industry peers and identify competitive advantages or areas for improvement.

For financial institutions offering green financial products such as sustainability-linked loans and green loans, ESG ratings are also often used as one of the metrics to determine if a borrower has successfully attained a predetermined set of ESG performance goals. Typically, these criteria include improving their ESG ratings relative to a baseline score.

Some Limitations

Inconsistency across ESG Rating Agencies

As mentioned earlier, ratings agencies possess their own proprietary calculation methodology, often resulting in discrepancies among the ratings given for a particular company. Researchers at MIT found the average correlation of ESG scores across six major raters stood at only 61%, markedly lower than the correlation of 99% amongst credit ratings agencies. As a result, contradictory evaluations of a company’s ESG performance may arise, severely inhibiting the decision-making ability of stakeholders, as pointed out by investment firm Capital Group’s 2022 ESG Global Study, citing the “lack of consistency in ESG scores” as the greatest challenge affecting sustainable investments. Therefore, how one views a company’s ESG performance is largely swayed by the rating agency chosen and the specific factors it chooses to incorporate or exclude when rating the company.Opaque Methodologies and Lack of Transparency

While calls for the standardisation and streamlining of methodologies have been made in recent years and seemingly solve the issue of divergent ESG ratings, the likelihood of this occurring is extremely low. ESG ratings agencies distinguish themselves through their proprietary analysis and calculation methodologies. Hence, the methodologies they use to compute ratings and scores are closely guarded secrets. Since these companies are in competition for market share within the market for ESG ratings, there is little incentive for them to unify and streamline their rating methodologies. These ‘opaque’ methodologies also create a host of problems when agencies revise their ratings. Businesses may find it difficult to understand the underlying cause of the downgrade in their rating and thus perform precise adjustments to improve their scores. These rating downgrades may also result in companies receiving less favourable interest rates on their sustainability-linked loans, as well as loss of reputation.Plugging the Gaps

A survey of the top 50 global asset managers revealed that 40% of respondents used ESG ratings from a minimum of 4 ratings agencies to inform investment decisions. 30 firms also expressed intentions to develop internal ratings systems to reduce the dependence on ratings agencies, hinting at the fact that ESG ratings alone may not be meeting the needs of stakeholders along the sustainability value chain. While ratings are useful, what investors, financiers, and corporates of all sizes truly want is the data behind the ratings to better support and enhance their decision-making.Benefits of Primary ESG Data for Financial Institutions

Beyond ratings, having primary data offers investors and large corporates the ability to aggregate and analyse a company’s ESG data according to their specific, individual needs. This benefits several stakeholders along the sustainability value chain, such as financial institutions, who support the activities of both SMEs and large corporates financially through products like sustainability-linked loans and green loans. Relying on changes in ESG ratings alone, financial institutions may not accurately assess a company’s ESG performance. Instead, the availability of primary data paints a clearer picture of the progress a business has made in its sustainability journey, strengthening the green financing process by first allowing banks to understand a company’s baseline through emissions figures. Primary data offers banks a granular view of a company’s emissions which they can then compare against the baseline figures to evaluate the firm’s sustainability performance.Benefits of Primary ESG Data for Large Corporates

Large corporates also stand to gain significantly from the availability of primary data, with most looking to reduce their Scope 3 emissions across their supply chain. In such cases, ESG offers ratings may not be available for their suppliers, many of whom are SMEs. In the absence of these ratings, primary data, in the form of a suppliers’ Scope 1 and 2 emissions data, allows large corporates to evaluate and assess their suppliers’ sustainability performance to eventually inform their procurement decisions.Better Data with AI and Corporate Disclosure Portal on ESGpedia

While primary data plays a pivotal role, it is key to note that they often originate from corporate disclosures and reporting, of which verification by third-party assurance bodies is required to ensure that the data is robust and valid.

Amid the rise of the low-carbon economy, Artificial intelligence (AI) has emerged as a key enabler in this pursuit, harmonising vast data from diverse sources, validating it, and leveraging this intelligence to aid in strategic decision-making and risk assessment.

Powered by Artificial Intelligence (AI), STACS’s ESGpedia extracts data from a diverse set of data sources and has aggregated over 5 million and growing sustainability disclosure data points (as of Aug 2023). With leading banks and corporate clients onboard, ESGpedia is Asia’s leading ESG data and technology solution, offering granular asset-level data for in-depth ESG risk and sustainability assessment by banks and corporates. Turning unstructured data into actionable insights, ESGpedia harmonises a company’s complete sustainability information into a single standardised ESG profile, enabling banks and corporates to perform comprehensive analysis of corporate sustainability data and rigorous climate risk management. Combining data with technology, ESGpedia also offers digital solutions specifically catered to the needs of various users such as financial institutions, large corporates, and SMEs.

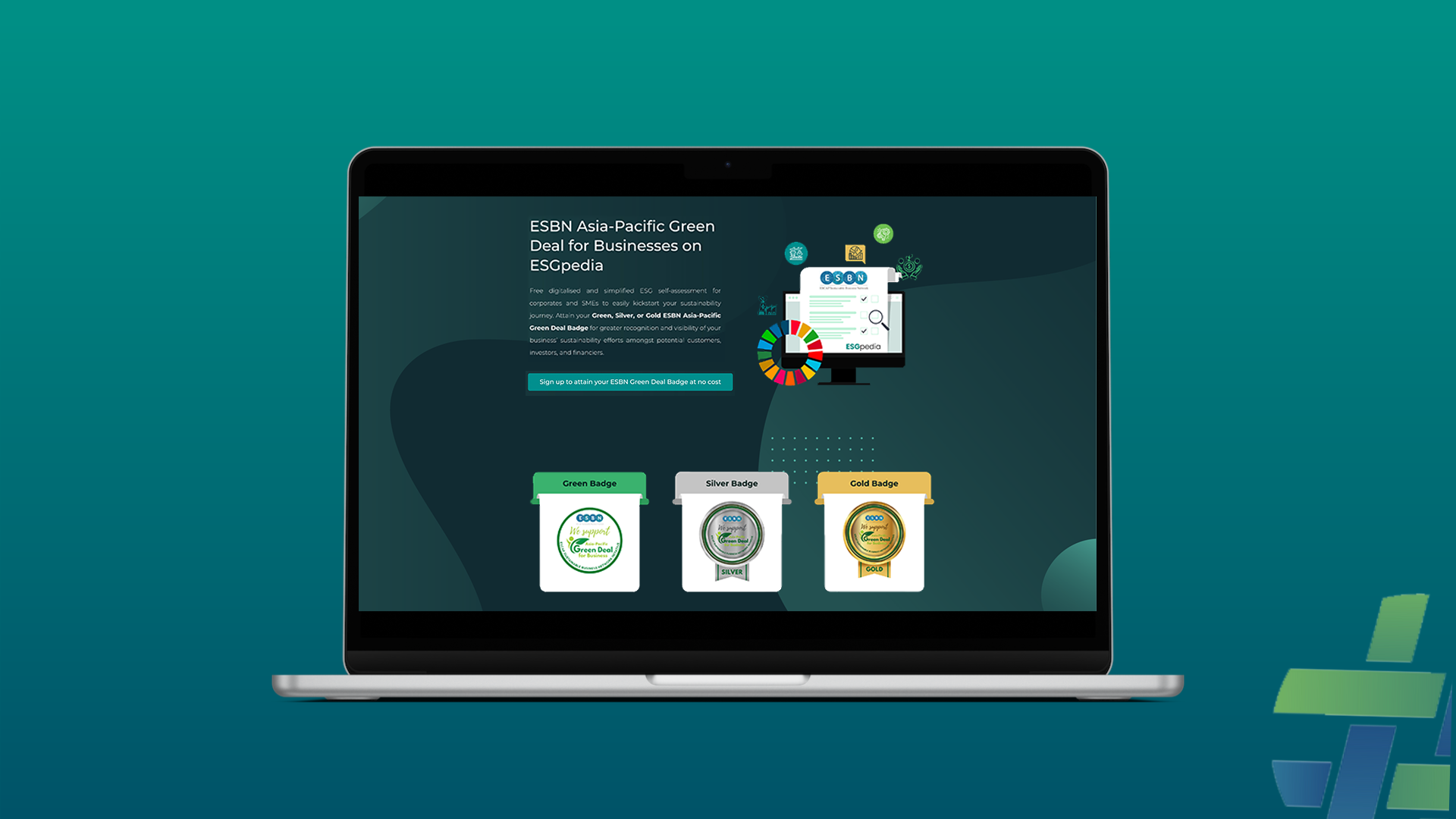

ESBN Asia-Pacific Green Deal digital assessment for SMEs

Digital corporate disclosure tools targeted at SMEs also help rapidly grow the availability of primary ESG data coverage of companies, while at the same time, simplify the process for businesses to submit and upload ESG data, lowering the barriers to sustainability.

SMEs currently face multiple pain points when trying to go green, such as the inconvenient and cumbersome nature of completing existing emissions disclosure tools.

Earlier in May, the ESCAP Sustainable Business Network (ESBN) launched the ESBN Asia-Pacific Green Deal digital assessment on ESGpedia to serve as a streamlined platform to help businesses kickstart their ESG reporting journey. Available for free, the digitalised and simplified self-assessment requires businesses to report ESG metrics aligned with stakeholders’ needs, and thereafter awards businesses with a Gold, Silver, or Green badge as a recognition for their commitment to sustainability.

The ESBN Green Deal self-assessment on ESGpedia simplifies the task of uploading a company’s ESG data by providing informative guidance notes and video walk-throughs directing users to where the necessary data could potentially be acquired. Having uploaded their ESG data, SMEs may also choose to amplify it to demonstrate their ESG performance to potential customers and partners. Emissions conversion factors localised to specific countries within APAC are also built into the platform to automatically derive the emissions produced by the company’s activities. The true strength of this feature is in enabling companies to calculate emissions from factories and assets across multiple countries within the region.

While public ESG data in the form of ESG ratings, disclosure data, and sustainability certificates may be readily accessible, they may only paint a limited picture of a firm’s ESG performance. Public data for SMEs, who are not (yet) required to publish sustainability reports nor rated by ESG ratings agencies, may also not be available. Therefore, the ESBN Asia-Pacific Green Deal digital assessment on ESGpedia enables large corporates and financial institutions to access private ESG data uploaded by SMEs who choose to amplify it.

The result is a more comprehensive and cohesive overview of businesses’ ESG metrices and sustainability initiatives on a common ESG data platform for financial institutions and corporates to easily and confidently access for sustainable financing, ESG risk monitoring of portfolio, as well as to monitor the sustainability performance of suppliers.

ESGpedia for Banks and Financial Institutions

ESGpedia for Large Corporates

ESGpedia for SMEs

Better Primary ESG Data to empower Sustainability across Asia through Technology

As Huishi Li, Senior Vice President, Sustainable Business, Corporate Sustainability Office at UOB, put it, “The [sustainability] journey is not an easy journey, but this is a journey that organisations, big or small, need to get going on”.

At the end of the day, sustainability is a value chain comprising stakeholders who play equally critical and interlinked roles. SMEs supply large corporates with goods and services, and financial institutions provide the necessary funding for both their business activities.

These stakeholders require a transparent, standardised, and meaningful way of evaluating companies’ ESG performance to enhance their internal evaluation and decision-making process. Technology comes in as a key enabler, aggregating holistic ESG data points, including certificates, credentials, and primary data from disparate sources on a common, standardised digital registry, to empower companies across Asia to make strides in their journey towards net zero.

Find out more about rising mandatory ESG disclosures or view our Live Industry Use Cases to learn how ESGpedia is today empowering corporates, financial institutions, governmental organisations, NGOs, and more, towards net zero.