Nexus

Empowering companies of varying ESG maturities with an end-to-end suite of sustainability solutions. Join the 200,000 company profiles on our platform and showcase your commitment to sustainability towards a greener Asia Pacific.

Manufacturing

Manufacturing Raw Materials

Raw MaterialsFeatured On

Enabling Companies from Day 1 to Full Readiness

1

Digital Data

Management

- Simplify collection of data

- Handle ESG data at scale, saving time and minimising human error

- Transform operational data into ESG metrics and GHG calculations

GHG Emissions

- Industry-specific project-level carbon emissions (e.g. Construction, MICE, Product footprint)

Carbon calculator validated under ISO14064 methodology

Carbon calculator validated under ISO14064 methodologyReporting

Create a comprehensive ESG Report, aligned with global standards

- Streamline complicated ESG reporting processes

- Win more business deals & project tenders

Get end-to-end visibility of ESG data, aggregated from an entire ecosystem

- Get sustainable finance with preferred interest rates

- Green your supply chains & advance in sustainable procurement

- Build actionable roadmap to decarbonise

1

- Simplify collection of data

- Handle ESG data at scale, saving time and minimising human error

- Transform operational data into ESG metrics and GHG calculations

2

- Industry-specific project-level carbon emissions (e.g. Construction, MICE, Product footprint)

Carbon calculator validated under ISO14064 methodology

Carbon calculator validated under ISO14064 methodology3

Create a comprehensive ESG Report, aligned with global standards

- Streamline complicated ESG reporting processes

- Win more business deals & project tenders

4

- Green your supply chains & advance in sustainable procurement

- Build actionable roadmap to decarbonise, expand opportunities for sustainable finance with preferred interest rates

Simplify ESG Processes. Power Business Success.

Less excel sheets, more impact.

90.8%

4.5 months

250+

Loans Supported

75%

![]()

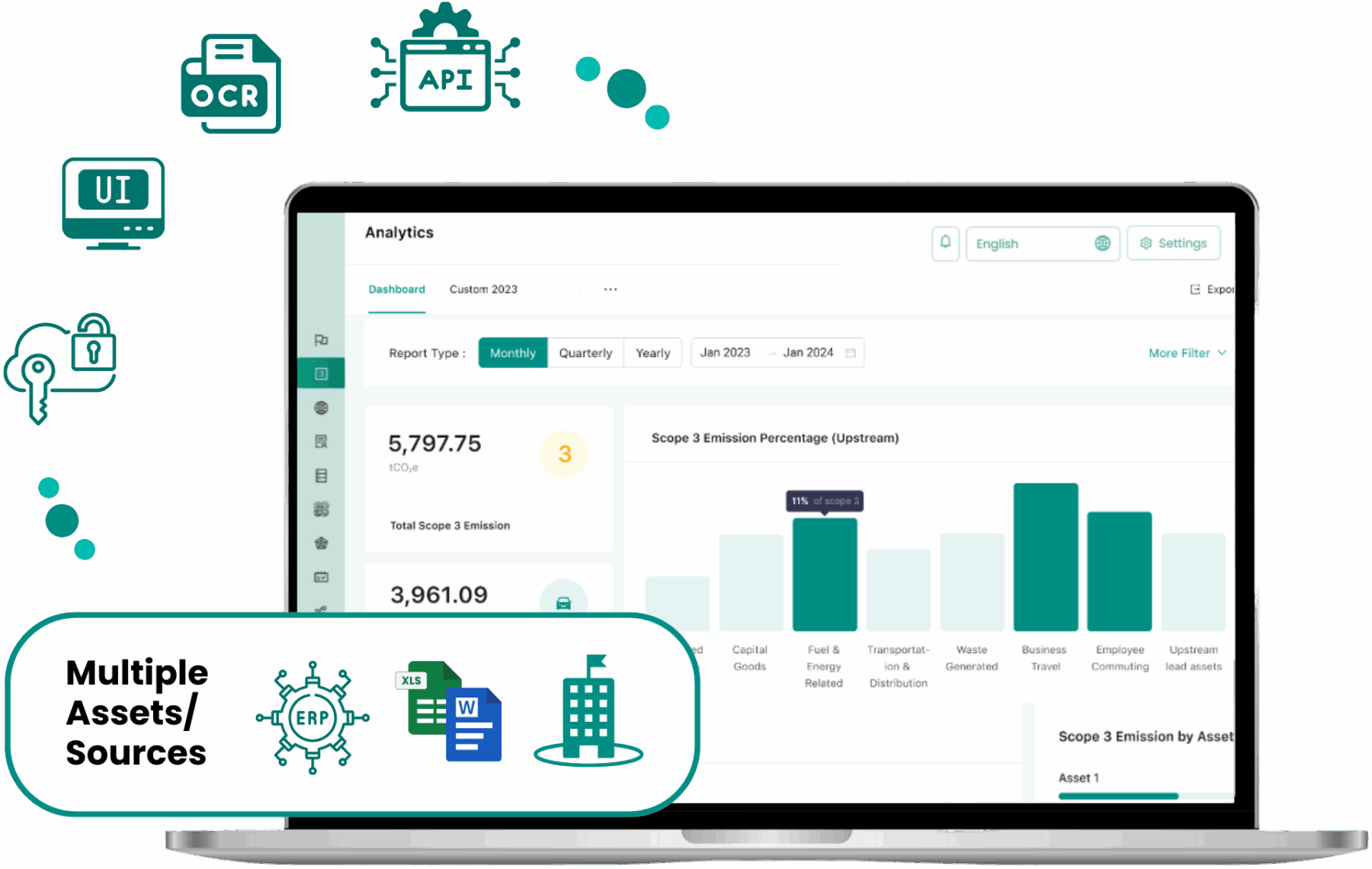

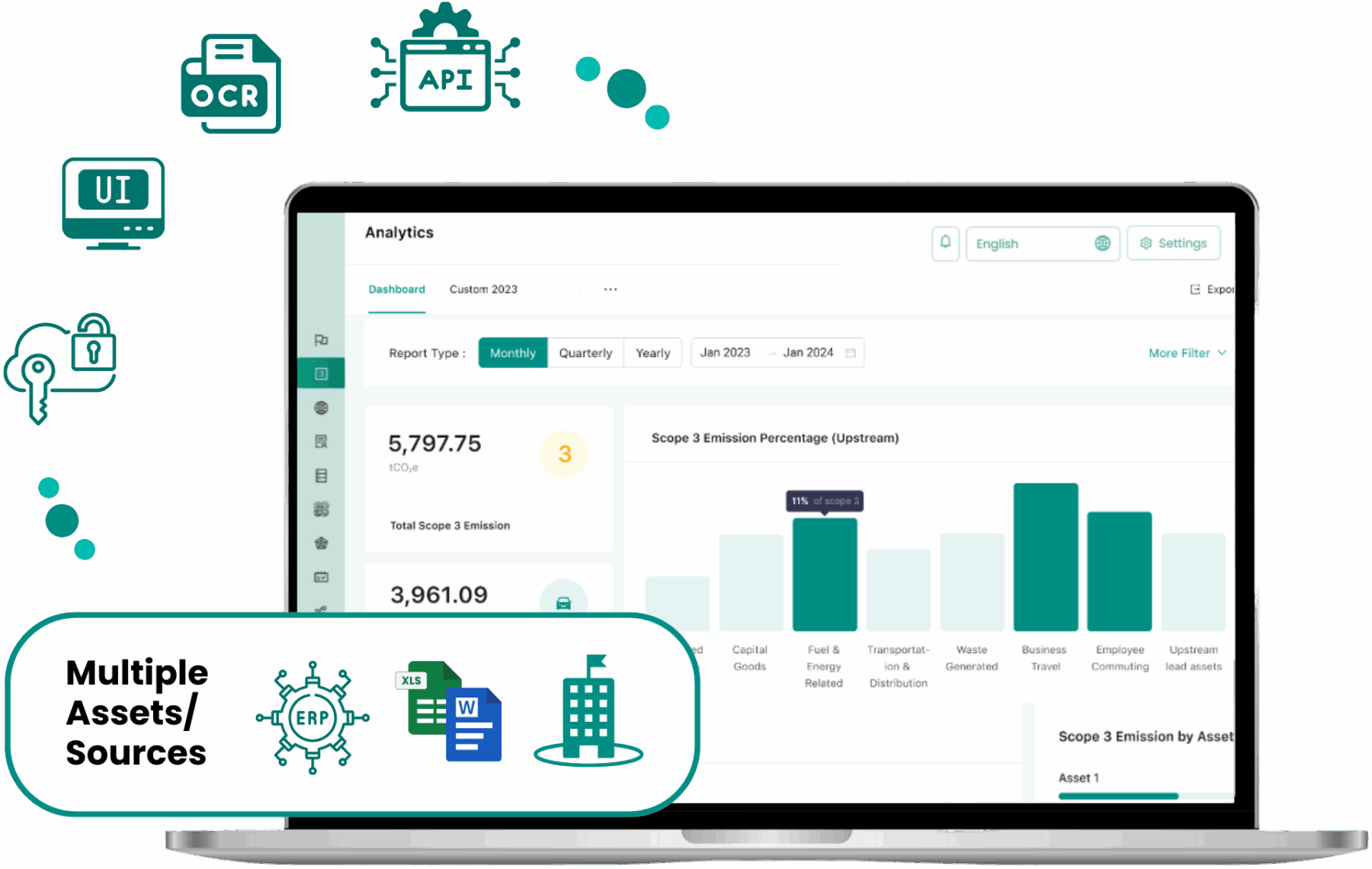

Digital Data Management

to drive business outcomes

- Help organisations streamline ESG and carbon data across entire value chain into multiple ESG outcomes

- Easily collect, aggregate, and verify data across multiple locations/assets/business units and various sources of data with flexible, right-fit user workflows

- Seamlessly integrate data with existing systems via API, Bulk File Uploads, Single-Sign-On (SSO), OCR technology, and more

GHG Carbon Calculator

Calculate your Scope 1, 2, and 3 GHG emissions in accordance to international standards and localised to the Asia Pacific region

- Built for credibility and accuracy, validated under ISO14064 methodology

- Extensive base of >280,000 emission factors hyper-localised to all APAC countries, covering >1000 product categories

- Supports various Scope 3 calculation methods, including transaction-based and life cycle approach

Comprehensive ESG Reporting

- Create comprehensive GHG and ESG reports in accordance with international frameworks such as GRI, TCFD, SASB, and ISSB, and country-specific frameworks, such as SuRe Form, SEDG, and more

- Establish core ESG metrices, scalable to full ESG reporting

- Swiftly generate sustainability reports to showcase to stakeholders

- Get automated calculation of your GHG emissions, with the embedded carbon calculator, in accordance with GHG Protocol and ISO14064 methodologies

- Get awarded the Green, Silver, or Gold ESBN Asia-Pacific Green Deal Badge in recognition of your sustainability efforts

Supplier Engagement and Supply Chain ESG

Advance on your organisation’s sustainability strategy by streamlining and actively engaging your suppliers, from data collection, to monitoring, analysing, and taking action.

- Streamline end-to-end processes and actively engage suppliers from data collection, monitoring, to analysing and taking action

- Set targets for submitting corporates, track progress, and manage suppliers’ data easily with automatic reminders on missing data

- Get end-to-end visibility of ESG data, aggregated from an entire ecosystem, to better manage your supply chain emissions and support Scope 3 reporting

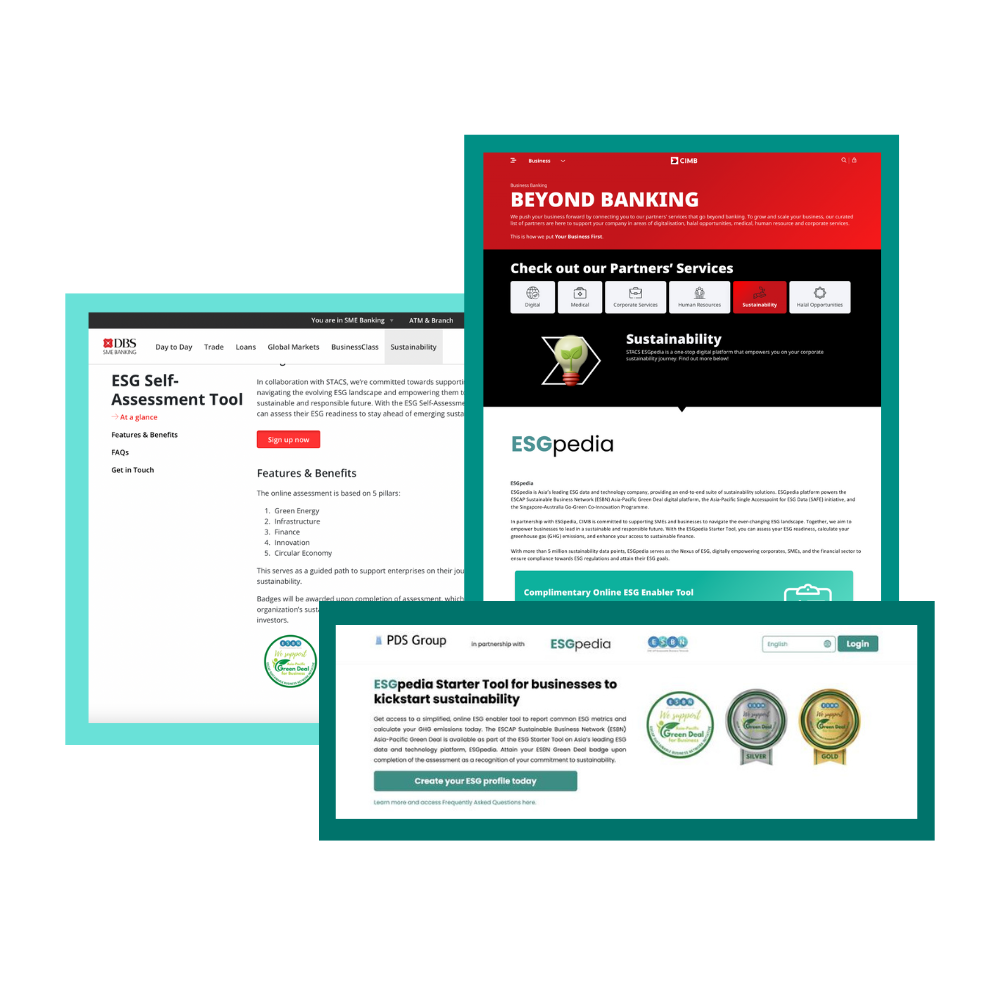

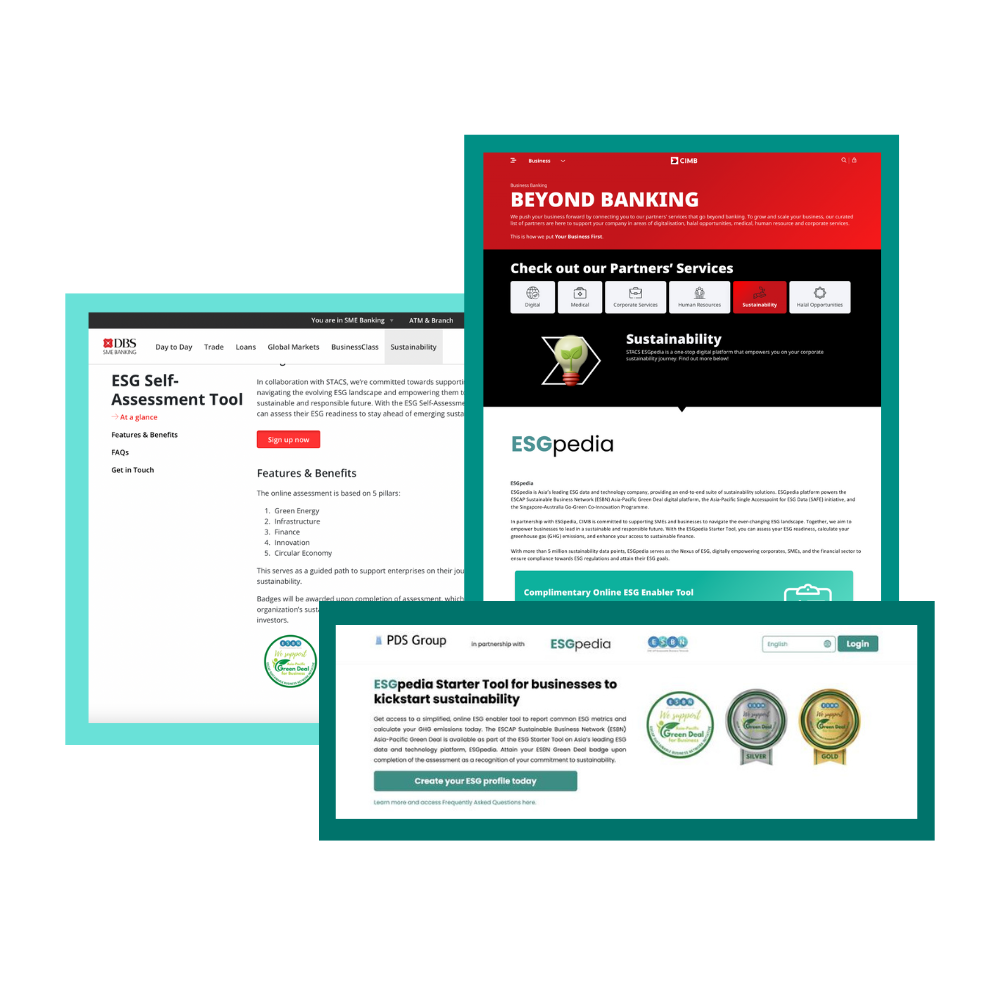

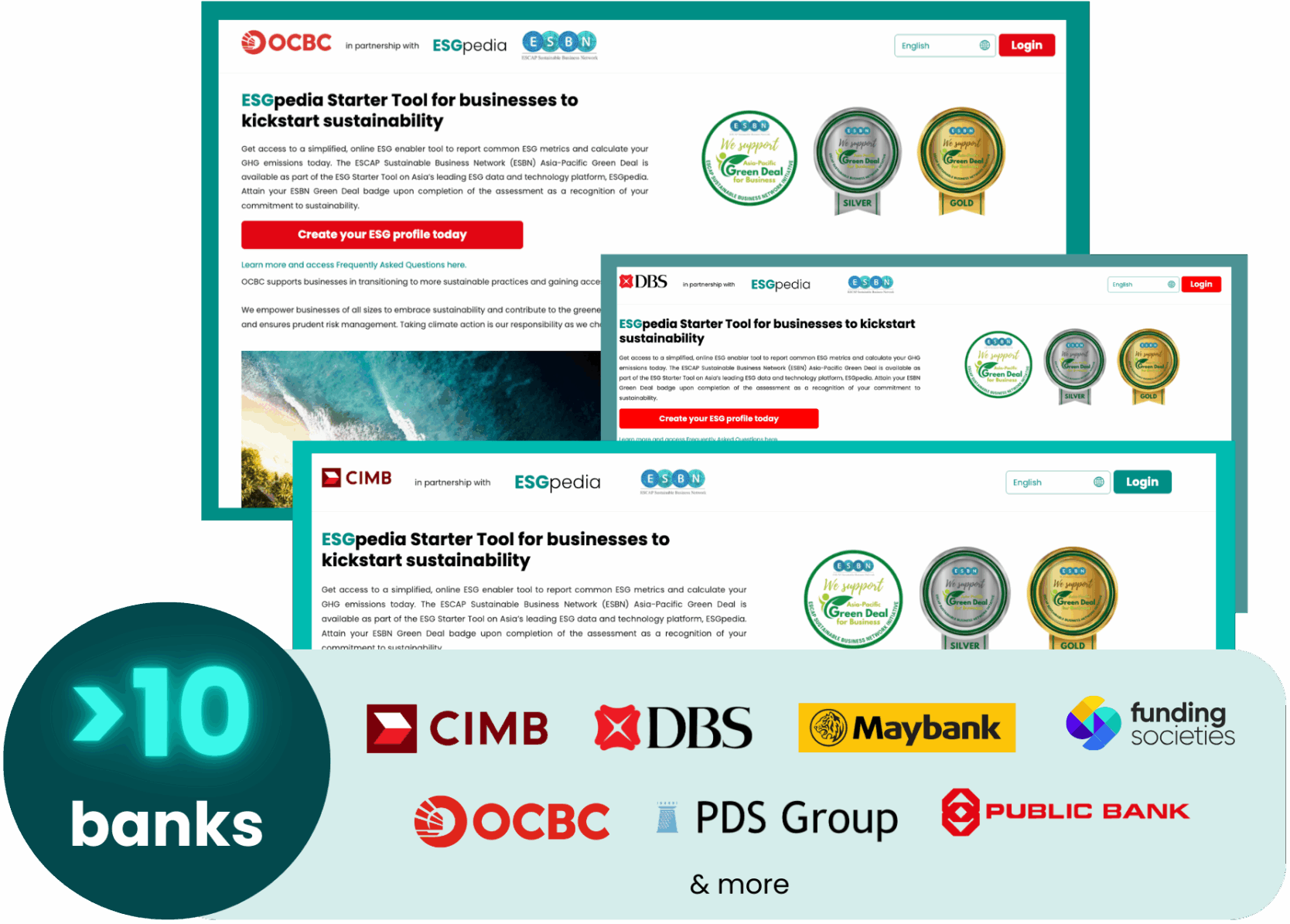

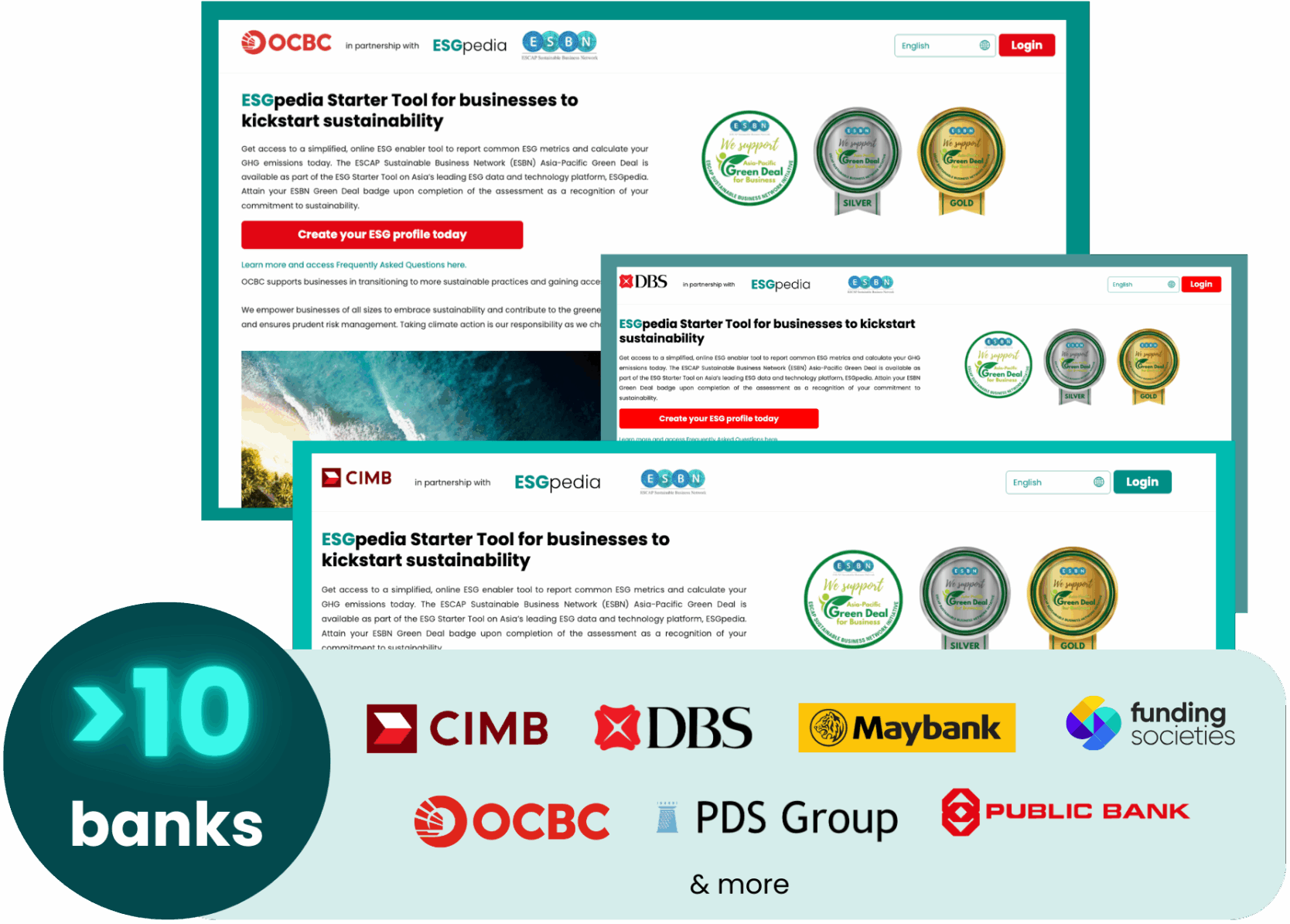

Co-Branded portals to enable portfolio / client / supplier ecosystem engagement

Create co-branded portals with customisable company branding and messaging to engage with ecosystem of portfolio companies, clients, and suppliers

- Advance on your organisation’s sustainability strategy by streamlining and actively engaging your portfolio/client/supplier ecosystem, from data collection, to monitoring, analysing, and taking action

- Showcase your brand logo and messaging, customise your URL, and incentivise your ecosystem by offering benefits such as preferential financing rates or priority in sustainable procurement – all customisable through this co-branded landing page

Sustainable Finance

- Secure preferential rates for sustainability-linked financing from local and regional banks

- Financial institutions can better assess companies’ sustainability standing for financing decisions, manage risks, and monitor their portfolios against ESG Taxonomies

- Help companies advance on their ESG strategies with sustainable financing and credibly showcase their commitment

Marketplace

Take positive actions towards ESG excellence with our marketplace of integrated, actionable ESG strategies & decarbonisation solutions for businesses.

- Sustainability-linked Finance

- Sustainability Certification

- ESG Assurance

- Advisory

- Innovations

- Offset emissions with carbon credits or RECs

- Green Procurement

Dashboard and Data Analytics

- Enjoy a one-stop, enhanced, shareable ESG profile for easier stakeholder management and reporting

- Gain multi-user access and multi-asset reporting, supporting permissioned roles for collaboration between business units

- Manage selective permissioning of confidential information through Data Vault

- Autofill reporting via automapping of data points to frameworks, document data extraction, and API integration

- Sectorial and Geographical Benchmarking

- Regulatory Analysis Assessment Report

Advance on your corporate sustainability journey today

ESGpedia

Starter Tool

- Pre-assessment for companies to understand their ESG requirements

- Scope 1 and 2 GHG Calculator

- ESBN Asia-Pacific Green Deal Program and Badges

- Access to marketplace of integrated ESG solutions

All of ESGpedia Starter Tool, plus

- Corporate Reporting Tool

- Pre-assessment for companies to understand their ESG requirements

- Simplified core ESG metrices

- Generate reports in ISO, ISSB, TCFD, SASB, GRI standard reporting

All of Essentials, plus

- Holistic Scope 3 Calculator

- Supplier Engagement Module

- Dashboard and Data Analytics

- Co-branded Landing Page

- Systems integration for efficient data management

- Multi-user access

- Enhanced, shareable ESG profile

- Data permissioning

- Autofill reporting

*Tiered pricing available

Seeing is believing

Book a 30 minutes demo to see ESGpedia in action. Discover how your company can achieve your sustainability goals and ESG compliance.

Intelligence

Access robust, aggregated, and harmonised global ESG data to empower banks, investors, insurers, and corporates.