Published 24 June 2024 –

According to a survey by QIMA, 47% of businesses worldwide acknowledge being impacted by ESG legislation, either directly or indirectly. The numbers don’t lie — over the next decade, 70% of global economic growth is expected to emanate from the Asia Pacific region, where 90% of emerging SMEs are located. In OECD countries, SMEs represent about 99% of all firms and contribute to more than 50% of GDP.

It’s becoming clear that adapting to these EU standards is not just a regulatory requirement but a strategic move to ensure global market presence and future growth.

Which EU Regulations do Businesses Need to be Aware of?

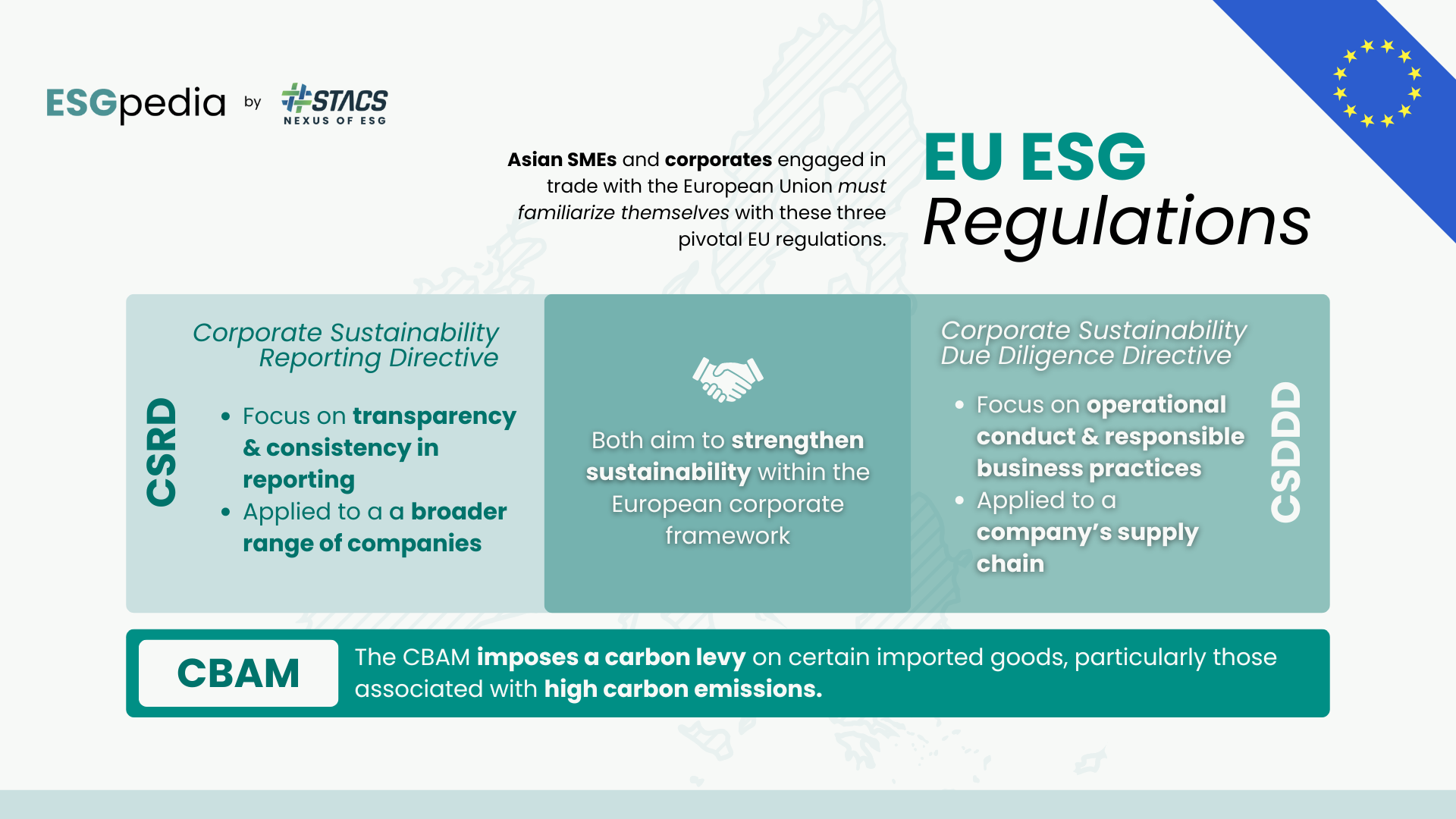

Asian SMEs and corporates engaged in trade with the European Union must familiarize themselves with the following pivotal EU regulations: the Corporate Sustainability Reporting Directive (CSRD), the Corporate Sustainability Due Diligence Directive (CSDDD), and the Carbon Border Adjustment Mechanism (CBAM).

Corporate Sustainability Reporting Directive (CSRD)

A significant update to the 2014 Non-Financial Reporting Directive (NFRD), the CSRD extends its requirements to a broader range of companies, including non-EU entities that meet certain thresholds. It will phase in gradually from 2024 to 2028 and introduces new reporting categories, such as those related to the circular economy. Under the CSRD, companies will need to disclose their impacts using the EU’s new Sustainability Reporting Standards (ESRS). The ESRS are aligned to new European policies and known international standards such as the GRI, to prevent double reporting. With transparency and consistency as its focus, the CSRD has established a clear reporting framework for companies to disclose. Over 10,000 non-EU companies are expected to come under this new regulatory regime.

Corporate Sustainability Due Diligence Directive (CSDDD)

While the CSRD focuses on reporting, the CSDDD imposes due diligence and has a bigger global impact. This directive mandates that companies proactively identify, address, monitor, and report on human rights and environmental risks within their operations and supply chains. Given the critical role of the Asia Pacific region as a major supplier to Europe, it is imperative for business leaders from this area to assess whether they fall under the CSDDD’s jurisdiction and begin preparation if necessary.

Carbon Border Adjustment Mechanism (CBAM)

Set to be implemented in 2026, with reporting starting as early as this year, the CBAM imposes a carbon levy on certain imported goods, particularly those associated with high carbon emissions. This mechanism is designed to encourage cleaner production practices outside the EU and EFTA (European Free Trade Association) countries, affecting how Asian manufacturers of carbon-intensive products approach production and exports to the EU.

How do these EU Regulations affect SMEs?

The ripple effects of these three EU regulations extend globally, significantly influencing Asian SMEs and corporates.

Asian corporates that operate through significant subsidiaries in Europe will be compelled to provide detailed reports on these subsidiaries’ activities in compliance with the CSRD. However, this effect isn’t limited to larger businesses; EU-based companies importing goods from Asia are now demanding greater transparency from their suppliers to comply with the CSDDD and CBAM. Asian SMEs who deal with multinational companies will be expected to deliver.

Interestingly, there’s been a growing trend among businesses, with 55% of them voluntarily prioritizing supplier compliance in sourcing decisions. This underscores the importance of adhering to these standards, even if not legally mandated. And with larger companies pivoting to suppliers who can voluntarily provide detailed sustainability data, maintaining business competitiveness becomes a critical concern.

By complying with these regulations, Asian suppliers can further maintain relationships with their upstream business partners and foster trust, allowing open communication to address challenges and concerns in the future. Failure to do so could not only exclude them from investor portfolios but also cause reputational damage in the long haul.

Are there any benefits for SMEs in complying with these EU regulations?

Complying with EU sustainability regulations such as the CSRD, CSDDD, and CBAM presents significant benefits for Asian SMEs, particularly in terms of enhancing their market attractiveness and building resilience. By aligning with these standards, SMEs can position themselves as attractive partners to sustainability-focused clients in the EU who are directly responding to these directives.

Additionally, as local regulations in the Asia Pacific region become more stringent, early compliance with EU standards offers SMEs a strategic advantage. By aligning their products and services with EU’s sustainability standards, SMEs can financially benefit from reduced carbon tax incurred. Moreover, by proactively adjusting to these international norms, SMEs can allocate sufficient time to develop the necessary resources and systems for future local regulations, ensuring a smoother transition. This forward-thinking approach can not only mitigate the risks associated with evolving regulations but also enhance the business’s operational resilience.

What strategies can SMEs in Asia-Pacific adopt to align with EU ESG regulations?

Asian businesses, especially suppliers to large MNCs and global corporates, can adopt a series of strategic measures to integrate comprehensive ESG reporting practices and sustainability into their operations. These strategies are essential for adhering to regulations like the CBAM, CSDDD, and CSRD, which collectively encourage a holistic approach to sustainability.

First and foremost, SMEs need to enhance their data management capabilities, particularly in tracking carbon emissions. The CBAM emphasizes the importance of accurately gathering and reporting emissions data, which is crucial for compliance with the CSDDD. This detailed emissions tracking enables SMEs to identify potential environmental risks, develop mitigation strategies, and refine operational processes, which are further scrutinized under the CSRD.

Recognizing the challenge of resource constraints commonly faced by SMEs, it is beneficial for corporates and SMEs to utilize centralized repositories for sustainability-specific information. This approach can streamline the effort required for gathering and managing ESG data, reduce duplication, and facilitate easier access to high-quality data.

To do this, SMEs and corporates can leverage digital tools. Platforms like ESGpedia can help SMEs improve their sustainability literacy and ensure that their operations meet CBAM and CSDDD requirements. The CSRD is aligned with the newly implemented ISSB standards, a framework that is readily available in ESGpedia.

With the ESGpedia platform, companies can track ESG certifications and compliance, supporting them in maintaining necessary standards. Additionally, integrated programmes in ESGpedia like the ESBN Green Deal for Business enable SMEs to create and amplify their ESG profiles, as well as get greater insights into their carbon footprint to take actions towards decarbonization, enhancing their visibility and attractiveness to potential partners and customers who prioritize sustainability.

The Future of Sustainable Supply Chain Management

As global supply chain management evolves, complying with EU regulations is transforming from basic due diligence into a profound commitment to social responsibility for Asian SMEs and corporates. With the likelihood of increased regulatory stringency, both globally and locally, these businesses must not only meet current standards but also anticipate and prepare for more demanding future requirements. For Asian businesses, the time to act is now—delaying could mean missing the wave of change that will define the future of global business.

Explore how businesses can decarbonise supply chains in Asia and adhere to sustainability reporting standards.